Tether ain’t just a stablecoin tycoon now; they’re pickin’ at the Bitcoin network’s innards like a cat with a clock. Seems they’ve decided to chuck propriety out the window and hand the mining keys to the masses, ‘cause why let the big boys hoard the hash when a common man can do it better with a little code and a lot of hubris?

Now, Tether’s gone and done the unthinkable – they’ve flung open the doors to the mining software club. WhatMiners, Avalons, Antminers-oh, the poor souls shackled to their “black box” firmware! No more, partner. Tether’s open-source libraries are like a barn dance for miners: anyone can join, no invite from the elite required. It’s the American dream, if the dream wore a miner hat and smelled faintly of silicon.

But let’s not get carried away. While Tether’s got the block train chuggin’, the tracks are still clogged up like a town in a dust storm. Bitcoin’s base layer? Slow as molasses in January, and twice as sticky. Try shoveling transactions on it, and you’ll end up with a face full of fees and finality delays that’ll make your grandma’s snail look like a racehorse.

So where’s the industry headed? Layer 1’s for the dinosaurs. Layer 2’s for the dreamers. And right now, one dreamer named Bitcoin Hyper ($HYPER) is struttin’ into the spotlight with the swagger of a man who’s just discovered he owns the entire saloon.

Bringing Solana Speeds to Bitcoin’s Base Layer

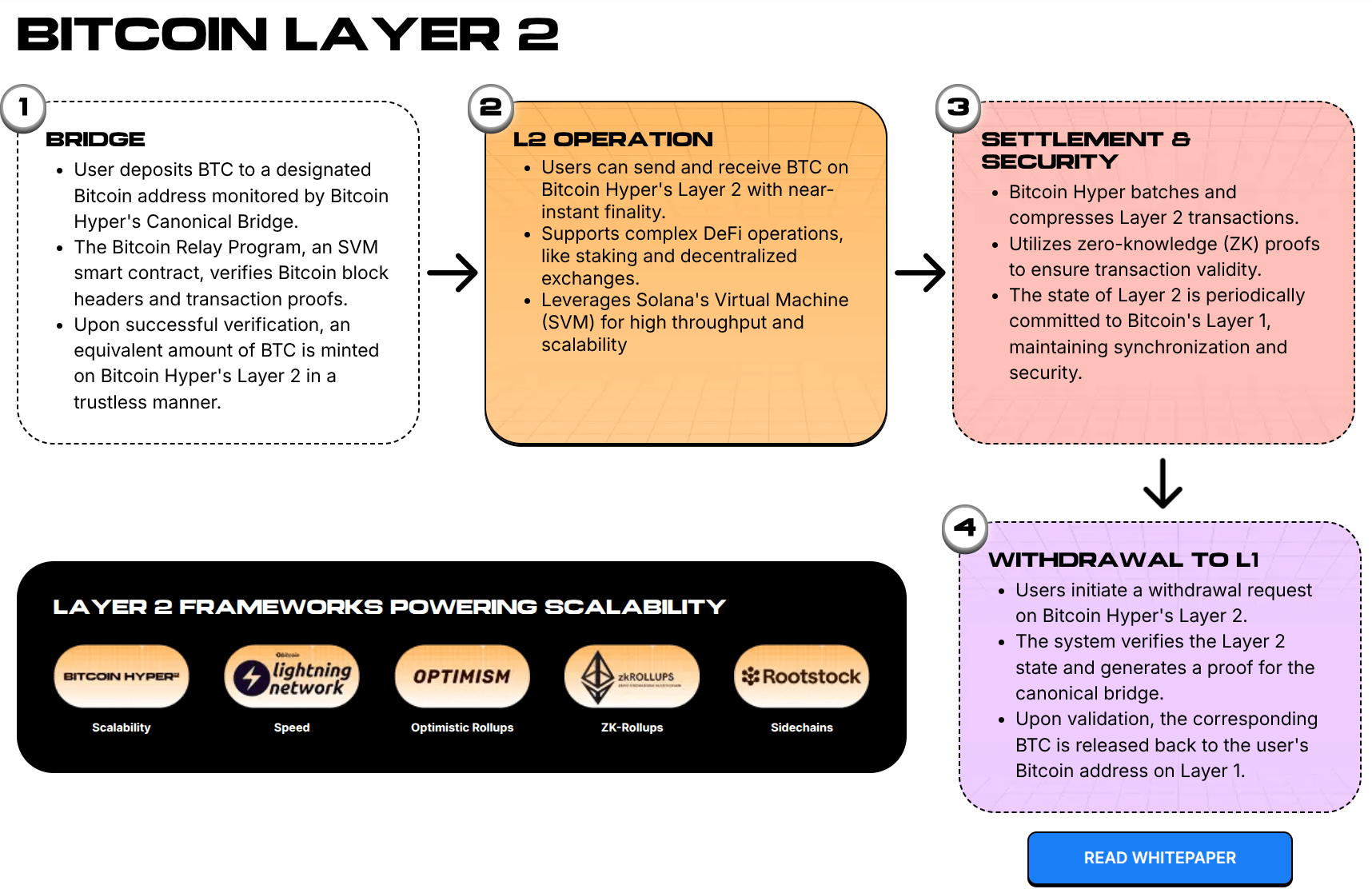

Here’s the rub, partner: Bitcoin’s the most secure asset in the land, but it’s also about as spry as a grumpy old man in a rocking chair. Enter Bitcoin Hyper, the new kid on the block who’s got more swagger than a Texas rancher in a saloon. They’re stitchin’ Solana’s Virtual Machine (SVM) to Bitcoin like a wild west showdown between efficiency and tradition. It’s not a sidechain-it’s a whole new rodeo, where Rust coders can wrangle smart contracts while Bitcoin’s mainnet nods approvingly from the sidelines.

For developers, it’s like finding a gold nugget in a creek bed. They can port those fancy dApps-gaming, lending, NFTs, the works-without leavin’ Bitcoin’s cozy little corral. And that Canonical Bridge? A trustless magician’s trick, turnin’ “digital gold” into spendable coin. It’s the blockchain trilemma solved with a grin and a wink.

But let’s not forget the real star of the show: the whales. They’re takin’ a dip in the $HYPER pool with checks big enough to fund a small town. $500K here, $379K there-it’s the blockchain equivalent of a man buying the whole bar just to prove he’s rich. And while the tokens are priced like a penny loaf of bread ($0.013675), the bigwigs are whisperin’ that the real treasure’s still buried in the ground.

So, saddle up, partner. The future of Bitcoin’s not just in its blocks-it’s in the code, the cash, and the audacity to outpace the old guard. And if you’re smart, you’ll stake your claim before the next gold rush turns the streets to dust.

Read More

- Clash of Clans Unleash the Duke Community Event for March 2026: Details, How to Progress, Rewards and more

- Brawl Stars February 2026 Brawl Talk: 100th Brawler, New Game Modes, Buffies, Trophy System, Skins, and more

- Gold Rate Forecast

- eFootball 2026 Starter Set Gabriel Batistuta pack review

- Magic Chess: Go Go Season 5 introduces new GOGO MOBA and Go Go Plaza modes, a cooking mini-game, synergies, and more

- MLBB x KOF Encore 2026: List of bingo patterns

- eFootball 2026 Jürgen Klopp Manager Guide: Best formations, instructions, and tactics

- Prestige Requiem Sona for Act 2 of LoL’s Demacia season

- Overwatch Domina counters

- Channing Tatum reveals shocking shoulder scar as he shares health update after undergoing surgery

2026-02-03 13:35