Well, bugger me with a rusty bitcoin, if it ain’t the great Robert Kiyosaki, the man who’s made a career out of telling folks where to put their dosh, now doing a spot of selling himself. Turns out the ol’ fox has offloaded some of his Bitcoin (you know, that digital thingamajig everyone’s been hoarding like it’s the end of days) and gold, despite previously claiming they were the bee’s knees.

This news comes as Bitcoin’s price is doing the financial equivalent of the wobbly-legged dance, teetering towards the $64,000 mark. After announcing his move on the Twitter-whatsit (or X, as the young’uns call it these days), Kiyosaki got a right earful from his followers. Seems some folks don’t take kindly to being left holding the bag while the rich bloke skips off with his profits.

AS I POSTED on X earlier. I stopped buying silver at $60. I stopped buying Bitcoin at $6,000. I stopped buying gold at $300. I have sold some Bitcoin and some gold. I hate selling because I hate paying capital gain taxes. Today…. I wait patiently for new bottoms for gold…

– Robert Kiyosaki (@theRealKiyosaki) February 6, 2026

Kiyosaki’s Great Sell-Off and the Doom-Mongering

Amidst the financial kerfuffle, our intrepid investor has been busy explaining his actions. Apparently, he’s been sitting on his hands since silver hit $60, Bitcoin reached $6,000, and gold touched $300. Now, he’s sold a bit of this and that, all while grumbling about the taxman. Still, he’s keeping an eye out for a bargain, the old tightwad.

“Your profit is made when you buy… not when you sell,” he quipped, sounding like a sage from a Discworld tavern. Long-term strategy, indeed. Meanwhile, he’s been having a right old moan about the US economy, what with the national debt climbing higher than a troll on a ladder. The Federal Reserve, politicians, and bankers are all in his firing line, and he’s predicting a spot of bother ahead.

For the past year, Kiyosaki’s been banging on about Bitcoin, gold, and silver like they’re the only things worth owning. Silver shot up to $121 by the end of January 2026, only to come crashing down like a drunk wizard off a broomstick, losing over 45% in a week. The crypto market, not one to be left out of the fun, has shed a cool $750 billion in the same period. Bitcoin itself has taken a 22% nosedive, hovering around $64,500.

Tech Stocks Sneezing, Crypto Catching a Cold

The recent hiccup in US tech stocks, thanks to some AI-related jitters, has sent ripples through the financial pond. Commodities, precious metals, and cryptocurrencies have all taken a beating. In the last 24 hours, the crypto market has lost more than $300 billion, and over the past week, a whopping $750 billion has vanished into thin air.

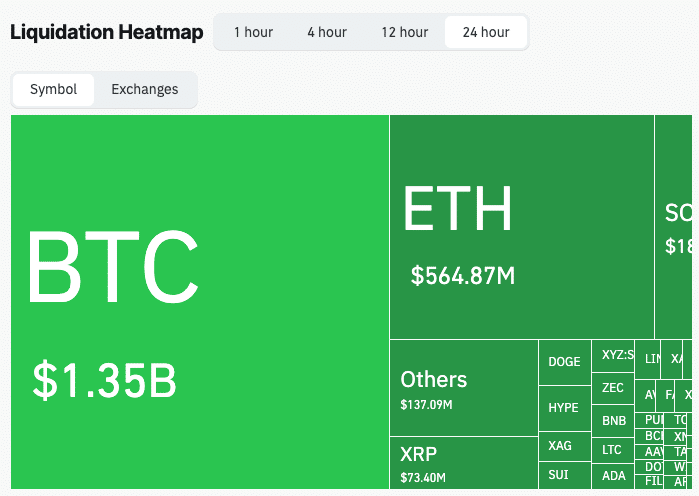

According to Coinglass, liquidations in the crypto market have hit $2.6 billion in the last day. Long positions have been hit hardest, with BTC alone accounting for $1.35 billion of the carnage.

Crypto market liquidations. | Source: Coinglass

So, there you have it. Kiyosaki’s selling, the market’s tumbling, and the taxman’s rubbing his hands with glee. Just another day in the mad, mad world of finance. Now, if you’ll excuse me, I’m off to find a nice, safe place to hide my pennies. Preferably somewhere the taxman can’t find them.

Read More

- Clash of Clans Unleash the Duke Community Event for March 2026: Details, How to Progress, Rewards and more

- Jason Statham’s Action Movie Flop Becomes Instant Netflix Hit In The United States

- Kylie Jenner squirms at ‘awkward’ BAFTA host Alan Cummings’ innuendo-packed joke about ‘getting her gums around a Jammie Dodger’ while dishing out ‘very British snacks’

- Brawl Stars February 2026 Brawl Talk: 100th Brawler, New Game Modes, Buffies, Trophy System, Skins, and more

- Gold Rate Forecast

- Hailey Bieber talks motherhood, baby Jack, and future kids with Justin Bieber

- eFootball 2026 Jürgen Klopp Manager Guide: Best formations, instructions, and tactics

- MLBB x KOF Encore 2026: List of bingo patterns

- Magic Chess: Go Go Season 5 introduces new GOGO MOBA and Go Go Plaza modes, a cooking mini-game, synergies, and more

- Brent Oil Forecast

2026-02-06 14:50