Ah, Ethereum! The grandest of digital dreams, now tumbling down like a clumsy acrobat off the stage, reaching depths unseen since June twenty-third. This week, the crypto market decided to take a deep dive, and oh, how our dear ETH has followed suit!

- Our beloved Ethereum continues its majestic descent!

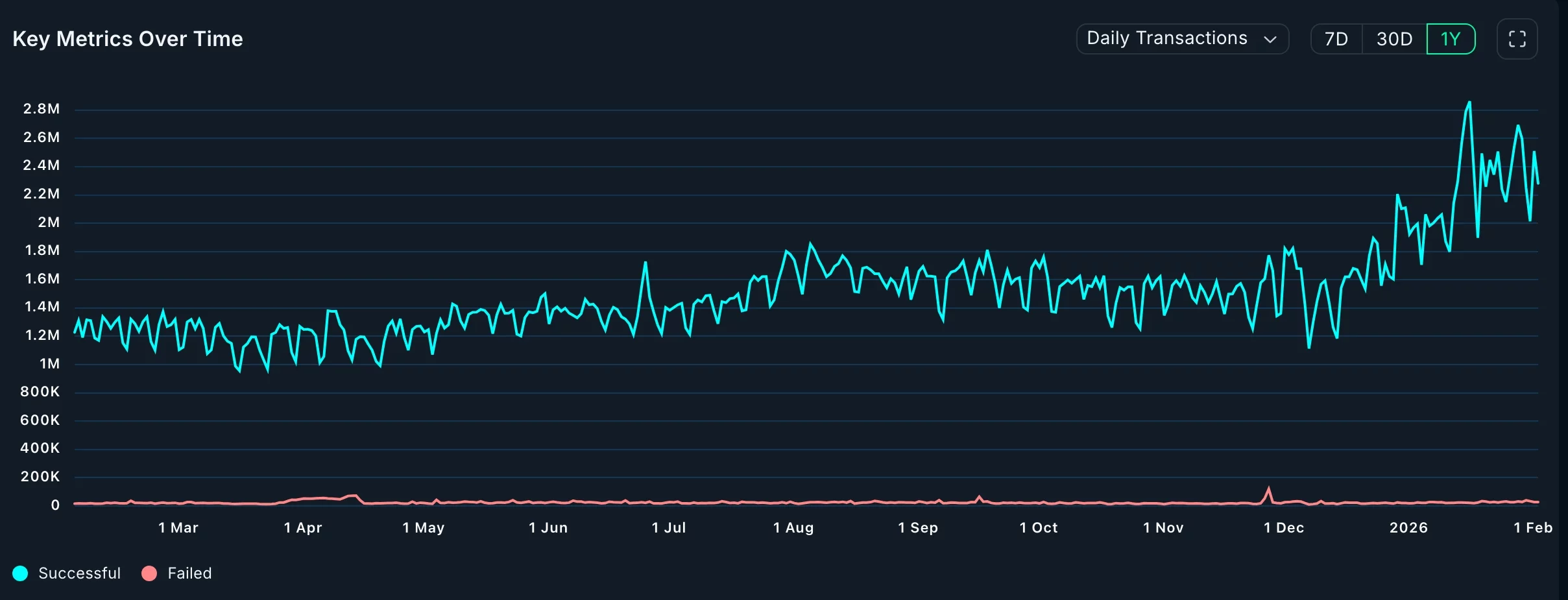

- Yet, in a twist worthy of a soap opera, transactions and active users are soaring as if on a caffeine high-up by 45%!

- But hold your horses; technical whispers suggest there’s still more downward spiraling to come.

Picture this: Ethereum (ETH) crashing down to a pitiful $2,180-over 54% lower than its peak from last August! A staggering fall that has reduced its once-mighty market value to just over $274 billion. Such drama!

It seems our dear Ethereum is having an identity crisis despite the tech world throwing confetti at its feet. Companies like Fidelity, JPMorgan, and Janus Henderson, the big players, are all embracing its network for their tokenized assets. Yet, here it lies, face down in the mud.

But wait! Data from the noble scribes at Nansen reveals the network is firing on all cylinders. Active addresses have surged by a staggering 45% in the last month, now boasting over 15 million! Who would’ve thought?

And if that wasn’t enough, transactions have spiked by 40%, climbing to more than 68 million-an all-time high, as if it were trying to win an Olympic gold medal!

This enthusiasm has inflated chain fees to over $15 million, a hearty rise of 40% in just thirty days, even while transaction fees have been on the decline. Oh, the irony!

Ethereum’s decentralized exchange network (or DEX, for those in the know) is also on the rise, climbing to a whopping $52.8 billion in January from December’s $49 billion. Uniswap, Curve Finance, Fluid, and Balancer are leading the charge-who knew numbers could be so thrilling?

Importantly, Ethereum has wiggled its way into the real-world asset tokenization industry, with its distributed asset value swelling by 15% in the last month to over $14.4 billion. And let’s not forget its stablecoin market cap, now over $165 billion. A true rags-to-riches tale!

Ethereum Price Technical Analysis

Now, let us gaze into the crystal ball of technical analysis! The daily charts reveal ETH has been on a downward spiral, forming a bearish flag pattern, which sounds much fancier than it truly is-a vertical line with an ascending channel. Quite the artistic endeavor, wouldn’t you say?

ETH has skidded below the 61.8% Fibonacci Retracement level at $2,753, like a child sliding down a playground slide. It has also dipped below the 50-day moving average and the Supertrend indicator. Oh, the shame!

Currently, ETH is forming a bearish pennant, a common sight in the circus of technical analysis. It has slipped below the Supertrend indicator-oh, the horror!

Hence, the most likely prediction for Ethereum’s price trajectory remains gloomy, with the next key support level lurking ominously at $2,000. Grab your popcorn!

Read More

- eFootball 2026 Jürgen Klopp Manager Guide: Best formations, instructions, and tactics

- Clash of Clans Unleash the Duke Community Event for March 2026: Details, How to Progress, Rewards and more

- MLBB x KOF Encore 2026: List of bingo patterns

- Brawl Stars February 2026 Brawl Talk: 100th Brawler, New Game Modes, Buffies, Trophy System, Skins, and more

- Gold Rate Forecast

- eFootball 2026 Starter Set Gabriel Batistuta pack review

- Magic Chess: Go Go Season 5 introduces new GOGO MOBA and Go Go Plaza modes, a cooking mini-game, synergies, and more

- ‘The Mandalorian and Grogu’ Trailer Finally Shows What the Movie Is Selling — But is Anyone Buying?

- Overwatch Domina counters

- Free Fire Beat Carnival event goes live with DJ Alok collab, rewards, themed battlefield changes, and more

2026-02-03 22:33