Ah, Friday the 13th-the day when crypto decides to spice up your weekend plans with a dash of drama and a sprinkle of “what the actual hell?” Today’s menu: Binance playing matchmaker for XRP, Bitcoin Cash living its best Saylor-free life, and Charles Hoskinson on a quest to rid crypto of cynicism, one blockchain at a time. Buckle up, darling.

TL;DR (because who has time for nuance?):

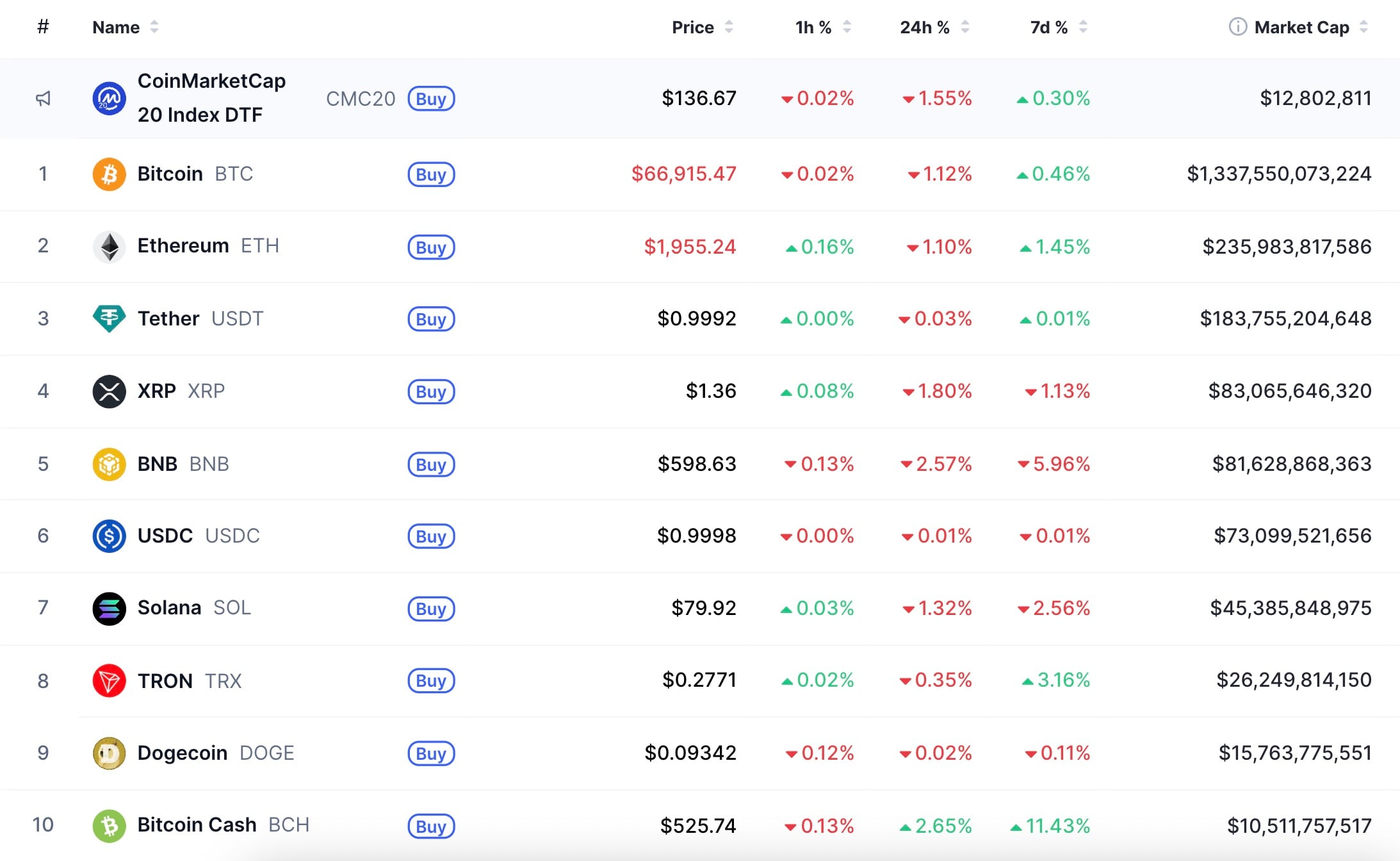

- Binance introduces XRP/U trading pair-because XRP needed another stablecoin fling.

- Bitcoin Cash clings to its top 10 spot like it’s the last seat on the crypto rollercoaster.

- Hoskinson preaches “anti-cynicism” while Cardano’s Midnight chain prepares to launch in March-because privacy and hope are the new black.

Binance’s XRP/U Pair: Because One Stablecoin Isn’t Enough

Binance, the ultimate crypto wingman, has decided XRP needs another stablecoin to dance with. Enter the XRP/U pair, featuring United Stables (U)-a meta-stablecoin backed by USDT, USDC, and USD1. Because why settle for one stablecoin when you can have a whole harem? XRP’s integration into this lineup is all about “stablecoin-agnostic trading,” which sounds fancy but basically means it’s hedging its bets.

Crypto Gossip: Binance’s XRP Flirt, BCH‘s Saylor-Free Life, & Hoskinson’s Anti-Cynic Crusade

Ripple CEO Dubs New CFTC Committee ‘Olympics Crypto Roster’

Meanwhile, Binance remains XRP’s biggest cheerleader, with the XRP/USDT pair raking in $154 million in 24-hour volume. Even the USDC pair is outperforming most exchanges’ main pairs. Korean exchanges Upbit and Bithumb, however, are like, “Hold my soju,” with XRP/KRW volumes of $185 million and $154 million, respectively. Take that, global dominance.

Notice on New Trading Pairs & Trading Bots Services on Binance Spot.

👉

– Binance (@binance) February 13, 2026

United Stables, launched in January 2026, is the BNB Chain’s first native stablecoin with a multiasset reserve structure. Its goal? To standardize settlement and liquidity flows across DeFi, CEXes, and payments rails. Because if there’s one thing crypto needs, it’s more standardization.

Bitcoin Cash: The “Bitcoin Without Saylor” That Nobody Asked For

Bitcoin Cash, the forgotten child of the Bitcoin family, is having a moment. With a $10.55 billion market cap, it’s holding onto its top 10 spot like a toddler clutching a toy. Public figures have dubbed it “Bitcoin without Saylor,” which is either a compliment or a subtle dig at Michael Saylor’s Bitcoin obsession. You decide.

Is this narrative a reaction to Saylor’s dominance in Bitcoin discussions? Or is it a sly way of saying BCH is better without the baggage? Who knows. What we do know is that BCH’s resilience might be tied to its popularity in online casinos and gaming-because nothing says “legit” like being the go-to coin for virtual slot machines.

Others argue that BCH’s mining profitability is the real MVP. But let’s be honest, the truth is probably somewhere in the price chart, while we’re all busy crafting narratives to justify our FOMO.

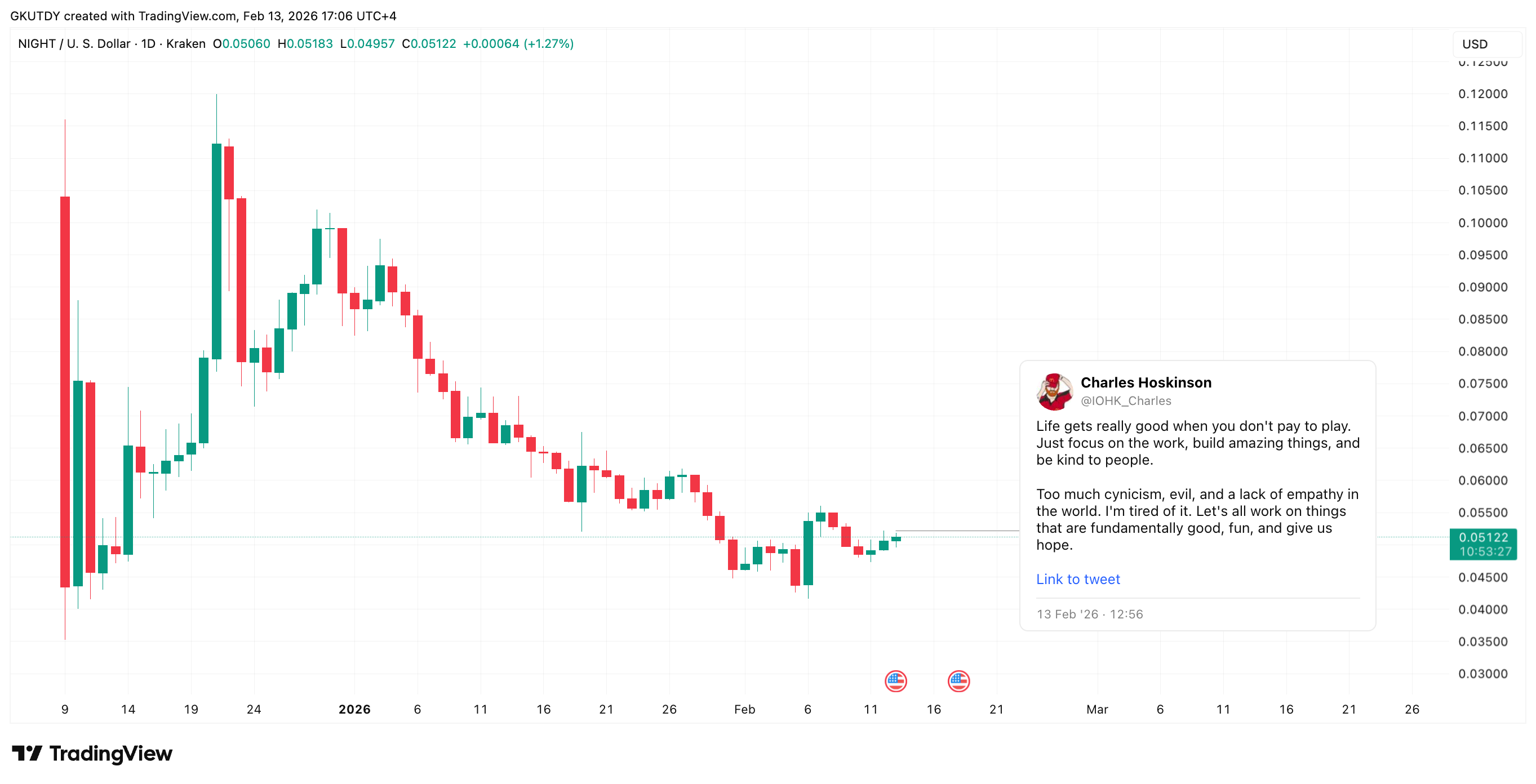

Hoskinson’s Anti-Cynicism Crusade: Saving Crypto One Blockchain at a Time

Charles Hoskinson, the Cardano mastermind, is tired of crypto’s “pay to play” culture and the cynicism that comes with it. His solution? A values-driven framework for development, because apparently, blockchain should be about hope and ethics, not just profits. Cute.

Enter Midnight, Cardano’s privacy-focused blockchain, set to launch in late March 2026. Its architecture ensures transactions are private by default, using zero-knowledge proofs to disclose only necessary information. It’s like a middle ground between privacy and compliance-because why choose when you can have both?

Hoskinson’s “anti-cynicism” approach isn’t just talk; it’s backed by real-world action, like privacy infrastructure, simulation tools, and cross-chain expansion. Whether this leads to capital inflows remains to be seen, but at least he’s trying to make crypto less of a dumpster fire.

Crypto Market Outlook: Levels to Watch or Ignore, Whatever

This week’s price action was a wild ride, thanks to macro data like NFP and CPI. Crypto responded with sell-offs, random pumps, and enough uncertainty to make a horoscope blush. Meanwhile, the CFTC is assembling a 35-person advisory panel-because what crypto needs is more bureaucracy.

Key levels to watch (or ignore, depending on your mood):

-

Bitcoin (BTC): Hovering around $67,069 (nice), with resistance at $72,000 and support at $64,000. Break below that, and we’re looking at $60,000 again. Yawn.

-

XRP: Trading near $1.365, with resistance at $1.50 and support at $1.30-$1.32. Lose that, and $1.10 is back in play. Thrilling.

-

Cardano (ADA): Sitting at $0.2627, with resistance at $0.30 and support at $0.25. A reclaim of $0.30 could signal recovery, but let’s not hold our breath.

Overall, Bitcoin remains the mood ring of the crypto market. As long as it holds above $64,000, altcoins might stabilize. Break below, and it’s every coin for itself. Good luck out there, kids.

Read More

- Clash of Clans Unleash the Duke Community Event for March 2026: Details, How to Progress, Rewards and more

- Gold Rate Forecast

- Star Wars Fans Should Have “Total Faith” In Tradition-Breaking 2027 Movie, Says Star

- KAS PREDICTION. KAS cryptocurrency

- Christopher Nolan’s Highest-Grossing Movies, Ranked by Box Office Earnings

- eFootball 2026 Jürgen Klopp Manager Guide: Best formations, instructions, and tactics

- eFootball 2026 is bringing the v5.3.1 update: What to expect and what’s coming

- Jujutsu Kaisen Season 3 Episode 8 Release Date, Time, Where to Watch

- Jason Statham’s Action Movie Flop Becomes Instant Netflix Hit In The United States

- Jessie Buckley unveils new blonde bombshell look for latest shoot with W Magazine as she reveals Hamnet role has made her ‘braver’

2026-02-13 17:15