Well, butter my biscuit and call me blockchain-cryptocurrency crime just hit a cool $158 billion in 2025, according to the 2026 Crypto Crime Report from TRM Labs. That’s right, folks, the bad guys are out here doing their best impression of a Wall Street bonus season, but with more hoodies and fewer ties.

Apparently, this 145% surge is mostly thanks to Russia, who’s like, “Sanctions? I barely know her!” Their state-linked actors and fancy financial networks are out here making Ocean’s Eleven look like a middle school bake sale. TRM Labs says Russia-connected structures are the MVPs of this crime wave, helping sanctioned entities move money like it’s hot (spoiler: it is).

But hey, silver lining: the share of unlawful activity in total crypto volume dipped to 1.2% from 1.3%. So, you know, baby steps toward legitimacy. Or, as I like to call it, “less crime, more vibe.”

Annual Value Received by Illicit Wallets | Source: TRM Labs report (aka the “Oops, We Did It Again” chart)

Russia’s Sanctions Evasion: The A7 Wallet Cluster Saga

Russia’s sanctions evasion game grew 400% year-over-year, thanks to the A7 wallet cluster and its ruble-linked stablecoin BFF, A7A5. Together, they processed over $110 billion in 2025, because nothing says “financial innovation” like dodging international rules. Platforms like Garantex and Grinex were like, “Hold my vodka,” and got in on the action too.

TRM Labs is like, “Yeah, it’s mostly Russia,” and I’m like, “Shocker.” Meanwhile, Russia’s government decided to let the retail masses buy and sell crypto at the end of 2025, because why not add a little chaos to the mix?

Stablecoins: The Criminal’s New Bestie

Stablecoins are now the hot new accessory for criminals, especially those who need to settle cross-border trades without raising eyebrows. Instead of big, fancy exchanges, they’re using non-custodial services, OTC brokers, and bespoke settlement layers-basically, the crypto equivalent of a burner phone.

Their market cap hit $300 billion in 2025, thanks to friendly regulations like the Genius Act. Because nothing says “genius” like making it easier for bad actors to move money. Solid work, everyone.

China’s Underground Banking: The $103 Billion Question

Chinese-language escrow services and underground banking operations processed over $103 billion in 2025, up from a measly $123 million in 2020. Chainalysis says it’s more like $82 billion for money laundering, but who’s counting? These networks support scams, cybercriminals, and intermediaries in Asia-Pacific, settling in stablecoins before converting to local currencies. It’s like a financial shell game, but with more zeroes.

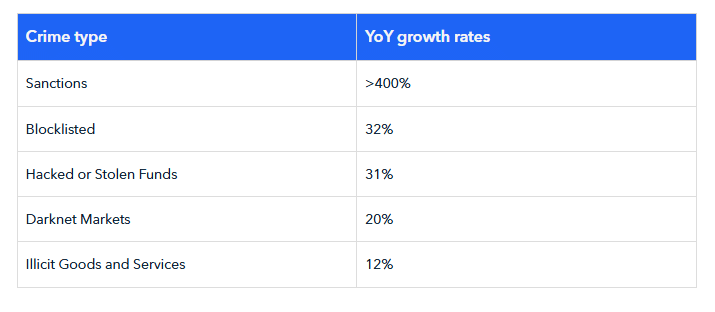

Meanwhile, darknet markets, illicit goods, and hacked funds grew at a slower pace, because apparently even criminals have priorities.

Increase in crypto-related crimes by type in 2025 | Source: TRM Labs report (aka the “Crime-a-Palooza” graph)

TRM Labs says these numbers are probably conservative, because surprise-criminals aren’t great at record-keeping. Regulators and enforcement agencies are in for a wild 2026, trying to tackle state-linked crypto infrastructures instead of just your run-of-the-mill retail scams. Good luck, folks. You’re gonna need it.

Read More

- MLBB x KOF Encore 2026: List of bingo patterns

- Overwatch Domina counters

- eFootball 2026 Jürgen Klopp Manager Guide: Best formations, instructions, and tactics

- 1xBet declared bankrupt in Dutch court

- Brawl Stars Brawlentines Community Event: Brawler Dates, Community goals, Voting, Rewards, and more

- eFootball 2026 Starter Set Gabriel Batistuta pack review

- Honkai: Star Rail Version 4.0 Phase One Character Banners: Who should you pull

- Gold Rate Forecast

- Lana Del Rey and swamp-guide husband Jeremy Dufrene are mobbed by fans as they leave their New York hotel after Fashion Week appearance

- Clash of Clans March 2026 update is bringing a new Hero, Village Helper, major changes to Gold Pass, and more

2026-01-29 02:54