Japan’s Liberal Democratic Party swept into office like a bargain hunter at a clearance sale, sending markets into a tizzy and briefly propelling Bitcoin above $72,000. Because nothing says “economic optimism” like a cryptocurrency that behaves like a caffeinated squirrel on a sugar high.

LDP Victory: When Democracy Meets Market Euphoria

The LDP’s win was the financial equivalent of a surprise birthday party-everyone showed up, and the Nikkei 225 even brought a cake, surging past 57,000 for the first time. According to the BBC, analysts are betting on Sanae Takaichi’s pro-business agenda to revive Japan’s economy, which has been about as lively as a retirement home bingo night. This bullish energy spread across Asia faster than gossip at a family reunion, with the Shanghai Composite reclaiming the 4,100 level like it was a long-lost heirloom.

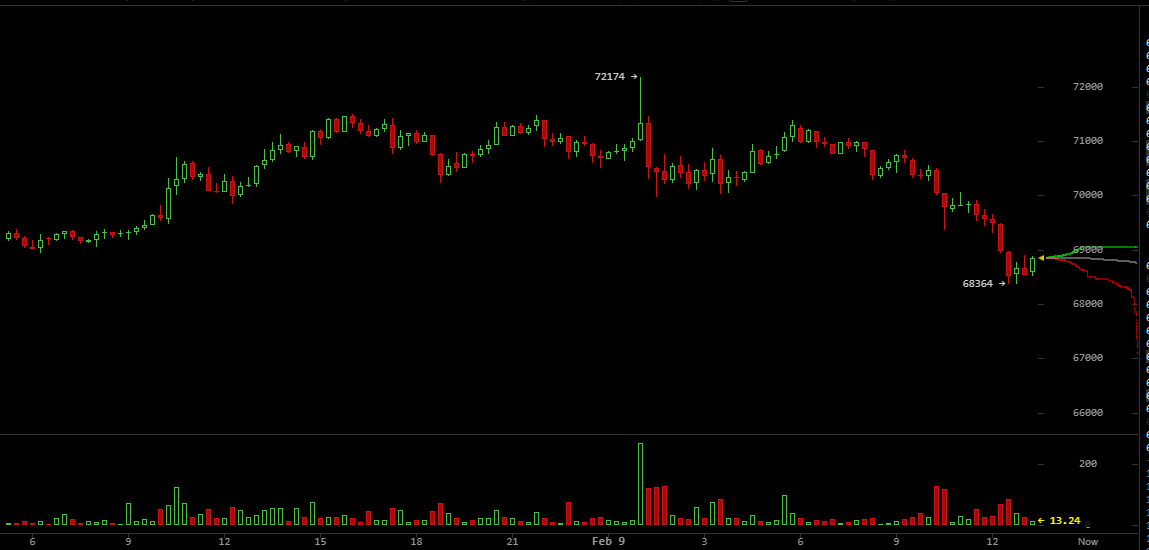

Cryptocurrency, still nursing a hangover from last week’s downturn, joined the party with Bitcoin climbing to $72,174. But like a guest who shows up just to eat all the appetizers and leave, it couldn’t hold its ground, tumbling below $69,000 by 5:23 a.m. EST. This “fakeout” left short sellers feeling like they’d been stood up on a first date, with nearly $82 million in liquidations within 12 hours. Ouch.

Adding insult to injury, South Korea’s Bithumb decided to spice things up by accidentally transferring $40 billion in Bitcoin to users. Yes, you read that right. $40 billion. Not a typo. Not a drill. Just a casual Tuesday in the crypto world. The Financial Supervisory Service (FSS) is now investigating, reminding everyone that “oops” isn’t a valid legal defense. Lee Kang-hee, the FSS chief, has vowed to tighten oversight, because apparently, the sector’s vulnerabilities are as gaping as a plot hole in a soap opera.

Recipients of the windfall are legally required to return the funds, which is about as likely as getting a refund for a bad haircut. Meanwhile, the FSS is eyeing “ghost tokens” and Bitcoin ETFs with the same enthusiasm as a parent chaperoning a middle school dance. Plans to expand authority under the Digital Asset Basic Law are underway, because nothing says “trust us” like more regulations.

China’s Dollar Divorce: Now with Extra Drama

As if Bitcoin didn’t have enough on its plate, China decided to join the fun by instructing banks to cut ties with U.S. Treasuries. Officially, it’s a response to market volatility, but let’s call it what it is: a financial cold war. Beijing is basically saying, “We’re done with your dollar-based shenanigans,” and crypto is caught in the crossfire. As the world’s two largest economies play a game of financial chicken, Bitcoin is the nervous bystander, sweating through its liquidations.

Bitcoin’s dip below $70,000 shaved its market cap to under $1.4 trillion, leaving the crypto economy at a modest $2.4 trillion. Currently stuck in the $68,000 to $70,000 range, optimists are hoping for a rebound to $72,000-$82,000 by the end of February. Pessimists, however, are eyeing a drop to $40,000 within eight months if liquidity stays as tight as a pair of skinny jeans after Thanksgiving dinner. Standard Chartered, ever the buzzkill, predicts a “worst-case” floor of $55,000 if ETF outflows pick up. Because nothing says “fun” like a financial freefall.

FAQ ❓

- How did Japan’s election impact markets? Like a shot of espresso to a sleepy economy, pushing the Nikkei past 57,000 and lifting Asian equities.

- What happened to Bitcoin after the rally? It spiked to $72,174, then tripped over its own shoelaces and fell below $69,000, liquidating $82 million in shorts. Classic Bitcoin.

- Why is South Korea investigating Bithumb? Because someone hit the “send all” button by mistake, transferring $40 billion in Bitcoin. Oops.

- How is China’s policy affecting crypto? Like a game of Jenga, Beijing’s move is adding uncertainty, putting pressure on Bitcoin and its volatile friends.

Read More

- Clash of Clans Unleash the Duke Community Event for March 2026: Details, How to Progress, Rewards and more

- Gold Rate Forecast

- Jason Statham’s Action Movie Flop Becomes Instant Netflix Hit In The United States

- Kylie Jenner squirms at ‘awkward’ BAFTA host Alan Cummings’ innuendo-packed joke about ‘getting her gums around a Jammie Dodger’ while dishing out ‘very British snacks’

- Hailey Bieber talks motherhood, baby Jack, and future kids with Justin Bieber

- eFootball 2026 Jürgen Klopp Manager Guide: Best formations, instructions, and tactics

- KAS PREDICTION. KAS cryptocurrency

- Jujutsu Kaisen Season 3 Episode 8 Release Date, Time, Where to Watch

- How to download and play Overwatch Rush beta

- Brent Oil Forecast

2026-02-09 16:17