Ah, Solana, the enfant terrible of the blockchain world, has decided to waltz across the stage while its rivals trip over their own feet. A surge in transactions, you say? But of course, the masses have finally realized where the real party is.

In the grand theater of 2025, fresh on-chain data reveals Solana strutting confidently, leaving its competitors in the dust. Transaction counts? A mere 100 million per day, they scoff, as if it’s nothing. Late January saw peaks of 150 to 165 million-a number so absurdly high it could only be the work of a blockchain with something to prove. Or perhaps, just perhaps, it’s the work of a network that’s finally found its rhythm.

Solana dominated all chains in the number of transactions recorded in 2025.

– Solana Sensei (@SolanaSensei)

While Ethereum, BNB Chain, Base, and Sui are left gasping for air, Solana breezes past, its lead so significant it’s almost comical. An order of magnitude higher, they say. But who’s counting? Clearly not the other chains.

Solana’s Waltz: Users Return to the Dance Floor

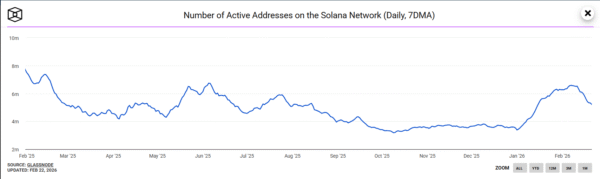

Daily active addresses, once languishing near 3.3 million, have rebounded with the enthusiasm of a crowd at a fire sale. Surging past 6.5 million, they now hover around 5 to 5.5 million. Ah, the fickle nature of the blockchain user-always chasing the next big thing, and this time, it seems, they’ve found it.

Image Source: The Block

And let’s not forget the bots, those tireless workers of the digital realm. But fear not! The parallel growth in transactions and addresses assures us this is no bot-driven farce. Genuine engagement, they call it. Or perhaps just the blockchain equivalent of FOMO.

DEX Volume: When Money Talks, Solana Listens

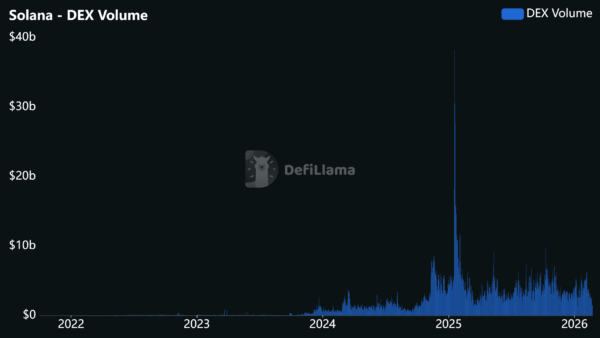

Ah, the sweet sound of $1.456 billion in 24-hour DEX volume. Music to the ears of any blockchain worth its salt. And Solana, ever the gracious host, has kept the party going since 2023. Even a 26% weekly dip can’t dampen the spirits when you’re still miles ahead of where you started.

Image Source: DefiLlama

Fees? A mere $637,000 for the network, with a paltry $58,000 as revenue. But fear not, for the apps built on Solana have raked in $5.86 million in fees and $3.01 million in revenue. Low base-layer fees, they say, keep the users happy. And happy users are spending users.

It’s a brilliant setup, really. Heavy network usage without the hefty price tag. Who needs expensive transactions when you can have a blockchain that’s both fast and frugal?

Liquidity: The Lifeblood of Solana’s Reign

Stablecoins, those stalwart guardians of liquidity, stand at a whopping $15.18 billion on Solana. Total value locked? A cool $6.57 billion. Perpetual futures volume? $404.9 million in 24 hours. Bridged total value locked? $39.75 billion. It’s enough to make a blockchain blush.

Large stablecoin reserves, they say, power trading, derivatives, arbitrage, and fast token rotations. Real capital, real economic use-no empty transfers here. Unless, of course, you count the occasional user sending a meme coin to their friend as a joke. But who’s keeping track?

So, here we are, in the grand spectacle of 2025, watching Solana dominate with the grace of a prima ballerina and the tenacity of a street fighter. Rivals? They’re just part of the audience now, clapping politely as Solana takes its bow. The blockchain world, it seems, has a new star. And what a show it’s putting on.

Read More

- MLBB x KOF Encore 2026: List of bingo patterns

- eFootball 2026 Jürgen Klopp Manager Guide: Best formations, instructions, and tactics

- Overwatch Domina counters

- 1xBet declared bankrupt in Dutch court

- Gold Rate Forecast

- Magic Chess: Go Go Season 5 introduces new GOGO MOBA and Go Go Plaza modes, a cooking mini-game, synergies, and more

- eFootball 2026 Starter Set Gabriel Batistuta pack review

- Clash of Clans March 2026 update is bringing a new Hero, Village Helper, major changes to Gold Pass, and more

- Brawl Stars Brawlentines Community Event: Brawler Dates, Community goals, Voting, Rewards, and more

- eFootball 2026 Show Time Worldwide Selection Contract: Best player to choose and Tier List

2026-02-22 16:30