There it was, Bitcoin, lounging around the $67,000 mark on Thursday, as calm as a cucumber at a tea party, while the CLARITY Act odds on Polymarket were doing the financial equivalent of a rollercoaster loop-de-loop. One minute it’s 90%, the next it’s 55%. Someone clearly forgot to feed the algorithm its morning coffee.

- Bitcoin, ever the stoic, hovered near $67,000 as Polymarket odds for the CLARITY Act did their best impression of a yo-yo, swinging from 90% to 55%. Regulatory uncertainty? More like regulatory spice.

- The CLARITY Act, in all its bureaucratic glory, aims to sort out the SEC and CFTC’s custody battle over crypto. Because nothing says “institutional confidence” like two regulators playing hot potato with the rulebook.

- Technically speaking, BTC is stuck between $65,000 and $70,000, like a tourist trying to decide between two equally underwhelming souvenirs. Bearish momentum is fading, but $70,000-$75,000 remains the Mount Everest of resistance.

Polymarket, the financial world’s favorite crystal ball, had the CLARITY Act’s approval odds at a sky-high 90% earlier in the day, only to nosedive to 55% by press time. It’s like the bill’s future is being written by a soap opera screenwriter.

The CLARITY Act, a legislative masterpiece, is here to save the day by defining who gets to boss around the crypto market-the SEC or the CFTC. Because nothing says “clear rules” like a 100-page bill written in legalese. Token classification? Exchange compliance? It’s like trying to explain the offside rule to a goldfish.

If this bill passes, it could reduce regulatory ambiguity, which is just a fancy way of saying it might stop regulators from playing “Who’s on First?” with crypto. Institutional investors might finally dip their toes in, and long-term capital could flow in like tourists to a duty-free shop.

Bitcoin’s Price Outlook: Less Crash, More Consolidation

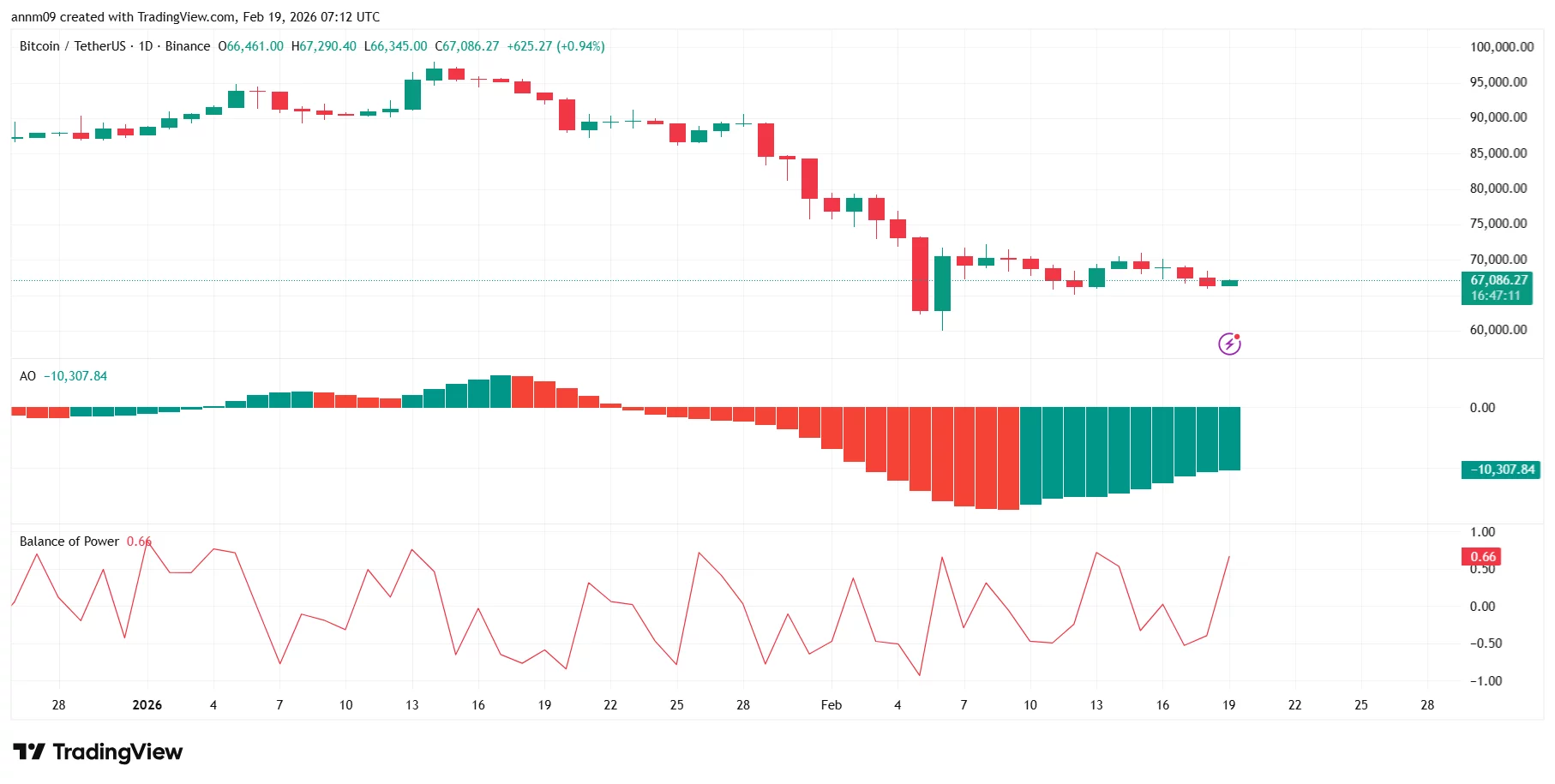

On the daily chart, Bitcoin’s journey has been less “moon mission” and more “bumpy bus ride” since its nosedive from the mid-$90,000s earlier this year. Lower highs, lower lows-it’s like the crypto version of a dieter’s weight chart. But hey, at least it’s stabilized around $60,000. Baby steps.

That massive red candle near $72,000? Oh, that was just Bitcoin’s version of a dramatic fainting spell, dipping into the low-$60,000s before bouncing back. Since then, it’s been chilling between $65,000 and $70,000, like a cat in a sunbeam.

The Awesome Oscillator (AO) is still in the red but spitting out green bars like it’s trying to go eco-friendly. Bearish momentum? Weakening. Balance of Power? Positive. Buyers are knocking on the door, but the bouncer ($70,000 resistance) isn’t having it.

Immediate resistance at $70,000, followed by the fortress of $75,000, where dreams go to die. On the flip side, $65,000 is the safety net, with $60,000 waiting below like a catcher at a baseball game. For now, Bitcoin’s just consolidating, waiting for someone to make the first move. Break above $70,000? Recovery time. Dip below $65,000? Grab the popcorn.

Read More

- MLBB x KOF Encore 2026: List of bingo patterns

- Overwatch Domina counters

- eFootball 2026 Jürgen Klopp Manager Guide: Best formations, instructions, and tactics

- 1xBet declared bankrupt in Dutch court

- eFootball 2026 Starter Set Gabriel Batistuta pack review

- Brawl Stars Brawlentines Community Event: Brawler Dates, Community goals, Voting, Rewards, and more

- Honkai: Star Rail Version 4.0 Phase One Character Banners: Who should you pull

- Gold Rate Forecast

- Lana Del Rey and swamp-guide husband Jeremy Dufrene are mobbed by fans as they leave their New York hotel after Fashion Week appearance

- Clash of Clans March 2026 update is bringing a new Hero, Village Helper, major changes to Gold Pass, and more

2026-02-19 11:11