Shrinking reserves, negative funding, and ETFs more loyal than a Discworld watchman-all signs point to XRP’s bottom being as solid as a dwarf’s anvil.

Well, knock me down with a feather and call me surprised! XRP has decided to stop its nosedive and bounce back like a rubber chicken at a wizard’s convention. After hitting a 15-month low earlier in February, the price surged 50% to a high of $1.67 from the Feb. 6 low of $1.12. That’s right, folks, the buyers have finally remembered where they left their wallets. Though it’s still trading 60% below its multi-year peak of $3.66, several on-chain and derivatives indicators suggest this dip might be as shallow as a troll’s philosophy.

Negative Funding Rates: When Shorts Get Squeezed Like a Lemon in a Dwarf Bar

Exchange data shows XRP balances have been shrinking faster than a wizard’s patience. According to Glassnode, exchange-held supply fell to 12.9 billion XRP this week, levels last seen in May 2021. Seems like holders are moving their tokens into cold storage, or perhaps just hiding them from their spouses. Lower balances often mean less selling intent, unless they’re just waiting for the next price spike to dump it all-classic human behavior.

Image Source: Glassnode

Binance’s XRP reserve has dropped to around 2.57 billion XRP, with both the 50-day and 100-day simple moving averages trending downward. Despite prices hovering near recent lows, reserves are still shrinking. CryptoQuant’s PelinayPA notes this could set the stage for a short squeeze, assuming the sellers take a nap and the buyers finally wake up.

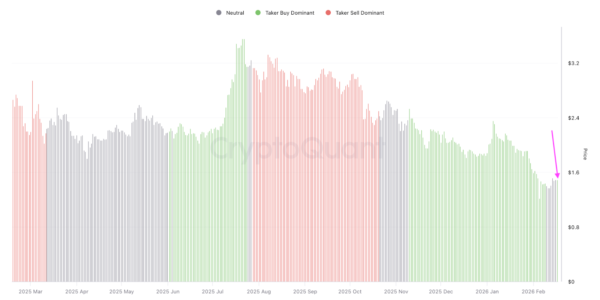

Funding rates have been more negative than a sour dwarf after a bad pint. Binance funding fell to -0.028% when XRP touched $1.12, its lowest since April 2025. Negative funding and falling prices? Sounds like the shorts are as crowded as a pub on Hogswatch Eve. History shows extreme negative funding can precede a rally, so maybe it’s time to dust off those moon boots.

Open Interest Collapses Like a Badly Built Bridge in Ankh-Morpork

Futures open interest has collapsed faster than a poorly constructed bridge in Ankh-Morpork. CoinGlass data shows XRP open interest declining to $2.53 billion, down 55% from $4.55 billion in early January. Falling open interest during a correction usually means deleveraging, not new shorts. Less leverage could mean a cleaner recovery, assuming the spot market doesn’t decide to take a nap.

Several technical and derivatives signals now align around the $1.12 low:

- Negative funding rates so extreme, even a troll would call it a bad bet.

- Open interest contraction suggesting liquidations and resets-a financial reset button, if you will.

- Exchange reserves declining even as prices stabilize-holders are either hodling or hiding.

- Historical patterns showing similar conditions preceded rebounds sharper than a witch’s wit.

Spot market data also hints at renewed buyer activity. The 90-day spot taker cumulative volume delta (CVD) has turned positive, indicating buyers are finally stepping up. Until recently, it was as neutral as a librarian’s expression, but now it’s showing stronger buy-to-sell volume. Sustained positive readings could mean buyers are accumulating, setting the stage for a price acceleration-or another dip, because why not?

Image Source: CryptoQuant

ETFs: The Only Thing Attracting More Capital Than a Free Beer Night at the Mended Drum

Spot XRP exchange-traded funds have been attracting capital like a magnet attracts paperclips-or a bar attracts dwarfs. Since their launch in November 2025, these products have recorded inflows on 53 of 59 trading days. That’s dedication, or perhaps just a lack of better options.

Image Source: SoSoValue

SoSoValue data shows spot XRP ETFs added $4.5 million on Friday, pushing cumulative inflows to $1.23 billion and total net assets under management above $1.01 billion. Even as global crypto investment products posted four consecutive weeks of outflows totaling $173 million, XRP ETPs led weekly inflows with $33.4 million for the week ending Feb. 13. Institutional interest seems as steady as a troll’s appetite for rocks.

If spot buying continues and leverage stays subdued, XRP could build a base above recent lows. Whether it holds depends on the broader market, but current metrics suggest $1.12 might be a turning point-or just another pit stop on the rollercoaster. Either way, grab your popcorn and enjoy the ride!

Read More

- MLBB x KOF Encore 2026: List of bingo patterns

- Overwatch Domina counters

- eFootball 2026 Jürgen Klopp Manager Guide: Best formations, instructions, and tactics

- 1xBet declared bankrupt in Dutch court

- eFootball 2026 Starter Set Gabriel Batistuta pack review

- Honkai: Star Rail Version 4.0 Phase One Character Banners: Who should you pull

- Brawl Stars Brawlentines Community Event: Brawler Dates, Community goals, Voting, Rewards, and more

- Lana Del Rey and swamp-guide husband Jeremy Dufrene are mobbed by fans as they leave their New York hotel after Fashion Week appearance

- Gold Rate Forecast

- Clash of Clans March 2026 update is bringing a new Hero, Village Helper, major changes to Gold Pass, and more

2026-02-18 19:34