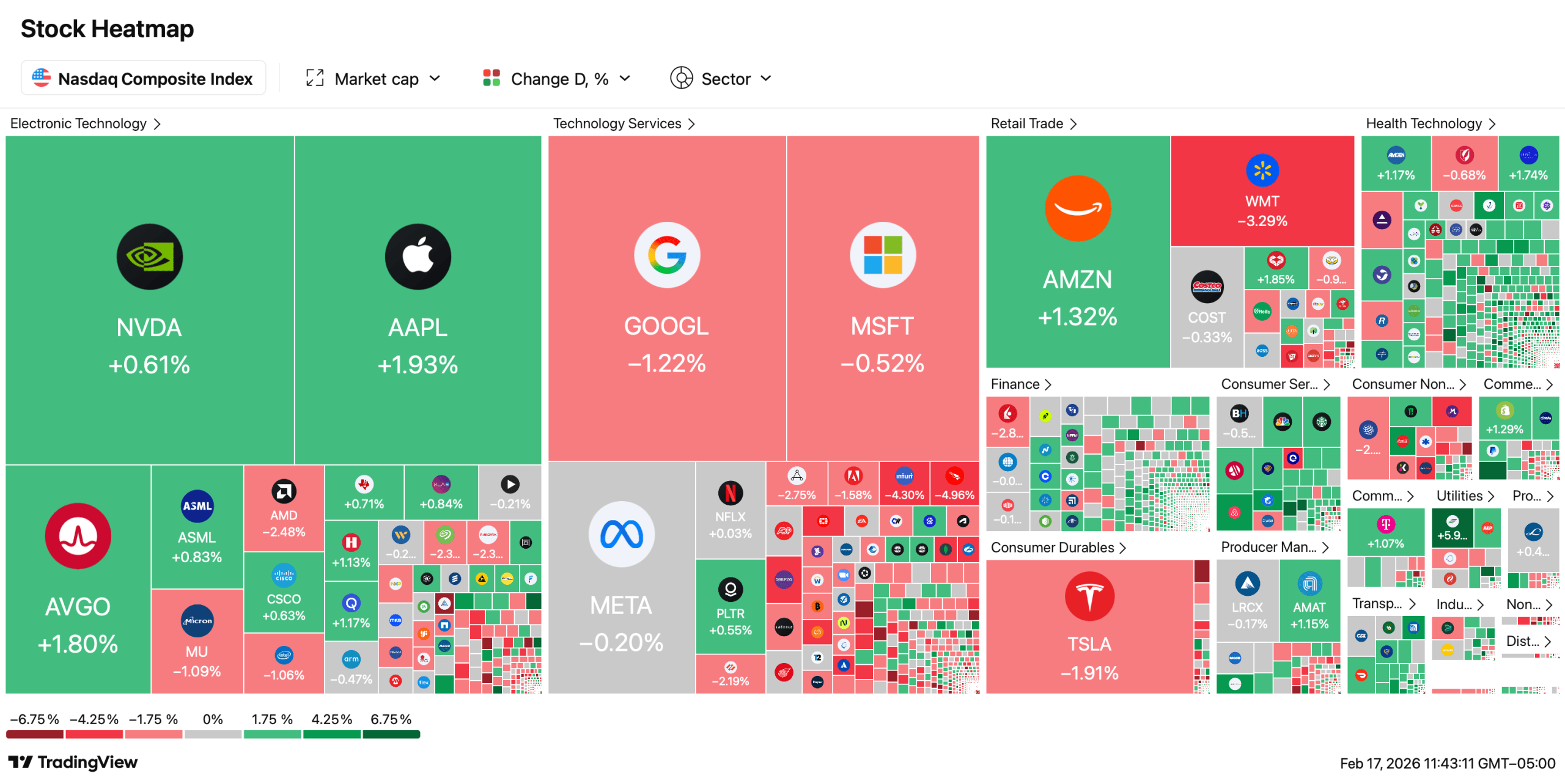

U.S. stocks are trading lower at midday Feb. 17, 2026, as artificial intelligence (AI) jitters weigh on tech giants, pulling down the Nasdaq and S&P 500 while the Dow shows relative resilience.

S&P 500 Tests Support as AI Volatility Pressures Wall Street

U.S. equity markets are trading with a defensive tone on Tuesday, extending last week’s losses as investors continue to weigh the disruptive implications of artificial intelligence (AI). According to Wall Street’s current standings, sentiment remains cautious despite softer inflation data that supports the case for potential Federal Reserve rate cuts later this year.

As of 12 p.m. EST, the S&P 500 trades around 6,836, down roughly 0.5%, while the Nasdaq Composite hovers near 22,546, off about 0.7%. The Dow Jones Industrial Average declines about 0.4%, trading near 49,500. The split performance reinforces a clear theme: technology drags, while other sectors attempt to stabilize the tape.

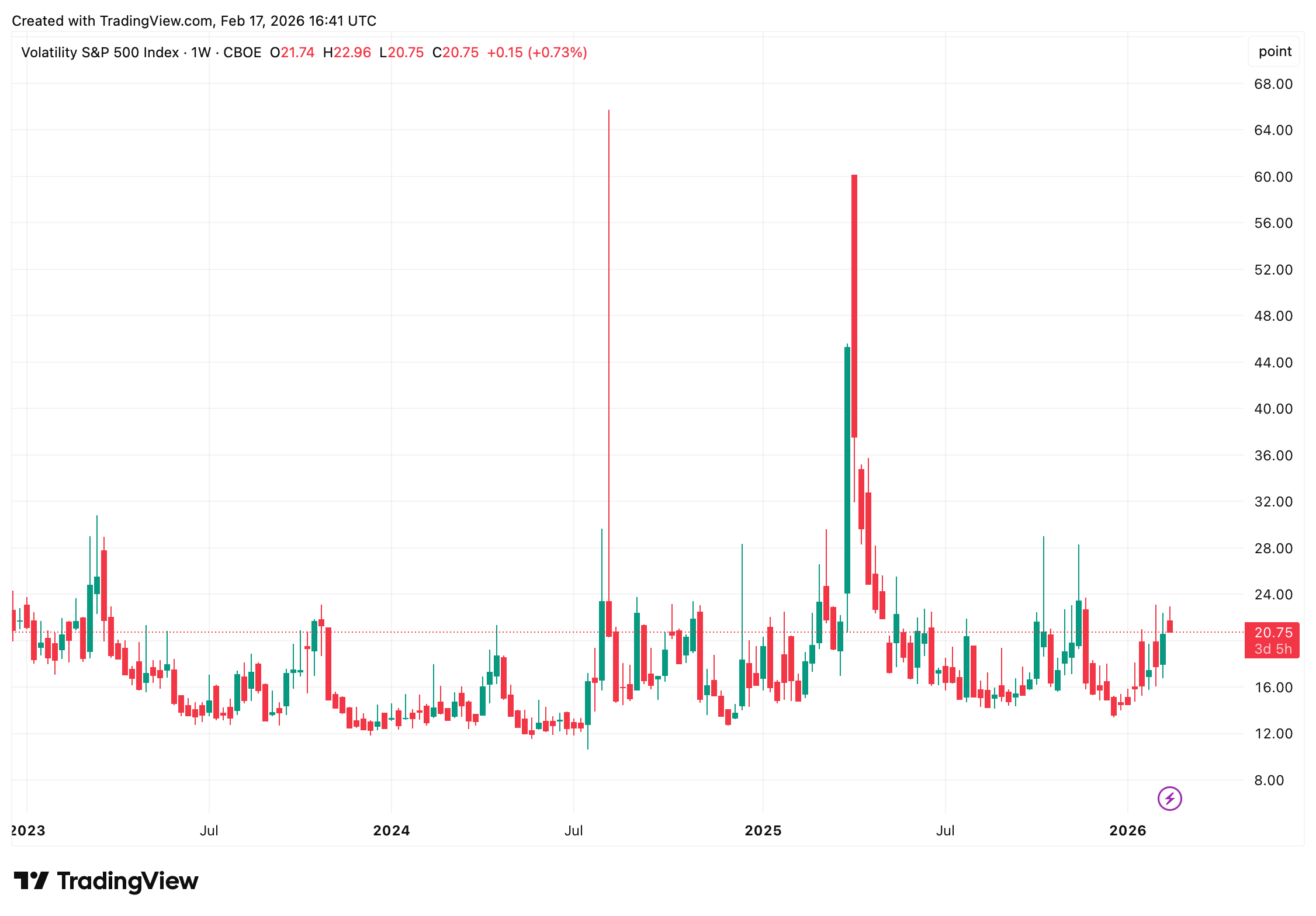

The Nasdaq enters today’s session following five consecutive negative weeks, a stretch not seen since 2022. The S&P 500 now tests its 100-day moving average, with the 6,850 level acting as an immediate technical battleground. If buyers fail to defend that zone, traders anticipate additional near-term pressure on equities.

The volatility index, or VIX, holds near 20, signaling elevated expectations for market swings. It does not indicate outright panic, but it certainly keeps risk managers attentive. In this environment, complacency does not trade at a premium.

Artificial intelligence continues to dominate the narrative. Investors wrestle with AI’s promise of productivity gains while simultaneously fearing disruption to established business models in software, IT services, brokerages and logistics. Nvidia and Microsoft are both trading lower, and broader software exchange-traded funds (ETFs) have also declined.

Sector action confirms a defensive rotation. Utilities advanced, building on last week’s 1.5% gain, while technology and communication services lag. Investors appear to favor predictable cash flows over ambitious capital expenditure tied to AI infrastructure.

Stock-specific moves added texture to the session. Norwegian Cruise Line Holdings jumped 9.1% following reports of an activist stake by Elliott Investment Management, while Fiserv gained 5.8% amid involvement from Jana Partners. Rivian Automotive rallied 26.6% on analyst upgrades, and Coinbase rose 16.5% after earnings and buyback updates. Meanwhile, Genuine Parts and General Mills trade sharply lower today.

Macro data offer a partial counterweight. January’s Consumer Price Index (CPI) logged 2.4% year over year for headline inflation and 2.5% for core, reinforcing hopes that the Fed eventually eases policy. However, flat retail sales and cooling labor indicators temper enthusiasm. Alongside this, a rate cut is not expected to happen at the March meeting.

Bond markets reflect relative stability on Tuesday. The 10-year Treasury yield trades near 4.03%. Commodities show mixed performance: gold trades below $5,000 per ounce, silver declined as well, and West Texas Intermediate crude trades around $63.75 per barrel this afternoon. Bitcoin is changing hands just under $68,000 after pulling back from weekend highs, aligning with the broader risk-off tone.

Geopolitical developments add complexity. U.S.-Iran nuclear talks and partial disruptions in the Strait of Hormuz remain in focus. Energy traders monitor supply dynamics closely, aware that any escalation could quickly ripple through equities.

The holiday-shortened week features several potential catalysts. Investors watch the Empire State Manufacturing Index, Federal Open Market Committee (FOMC) minutes, fourth-quarter GDP estimates, and the PCE price index. Earnings from Palo Alto Networks, Toll Brothers, and Walmart are also commanding attention.

At midday, the market narrative centers on recalibration rather than capitulation. Investors reassess how much AI spending is sustainable and how soon projected efficiencies translate into measurable earnings growth. If inflation continues to cool, equities may find firmer footing. If AI anxiety intensifies, volatility likely remains elevated.

For now, the Dow’s relative resilience provides a subtle counterpoint to tech’s softness. Beneath the headline declines, sector rotation continues to reshape leadership. Wall Street trades cautiously on Tuesday afternoon, balancing innovation-driven optimism with valuation discipline in real time.

FAQ

- Why do U.S. stocks trade lower at midday Feb. 17, 2026?

AI-related concerns and weakness in major tech stocks weigh on the broader market. - How does the Dow compare with the Nasdaq today?

The Dow declines less than the Nasdaq, reflecting relative strength in non-tech sectors. - What economic data are investors monitoring this week?

Markets focus on FOMC minutes, GDP data and the PCE inflation index. - How does inflation influence today’s market tone?

Softer CPI readings support rate-cut expectations but do not fully offset AI-driven volatility.

Read More

- MLBB x KOF Encore 2026: List of bingo patterns

- Overwatch Domina counters

- Honkai: Star Rail Version 4.0 Phase One Character Banners: Who should you pull

- eFootball 2026 Starter Set Gabriel Batistuta pack review

- Brawl Stars Brawlentines Community Event: Brawler Dates, Community goals, Voting, Rewards, and more

- Lana Del Rey and swamp-guide husband Jeremy Dufrene are mobbed by fans as they leave their New York hotel after Fashion Week appearance

- 1xBet declared bankrupt in Dutch court

- eFootball 2026 Jürgen Klopp Manager Guide: Best formations, instructions, and tactics

- Clash of Clans March 2026 update is bringing a new Hero, Village Helper, major changes to Gold Pass, and more

- Gold Rate Forecast

2026-02-17 21:08