Ah, the traders of Polymarket, Myriad, and Kalshi-those modern-day soothsayers-are tossing their kopecks into the ring, wagering on Bitcoin’s whimsical dance in 2026. With $84 million in volume, they paint a portrait of cautious optimism, though their hedges suggest they’re clutching their wallets tighter than a miser’s purse.

Six-Figure Bitcoin Dreams: A Slow Waltz, Not a Frenzy

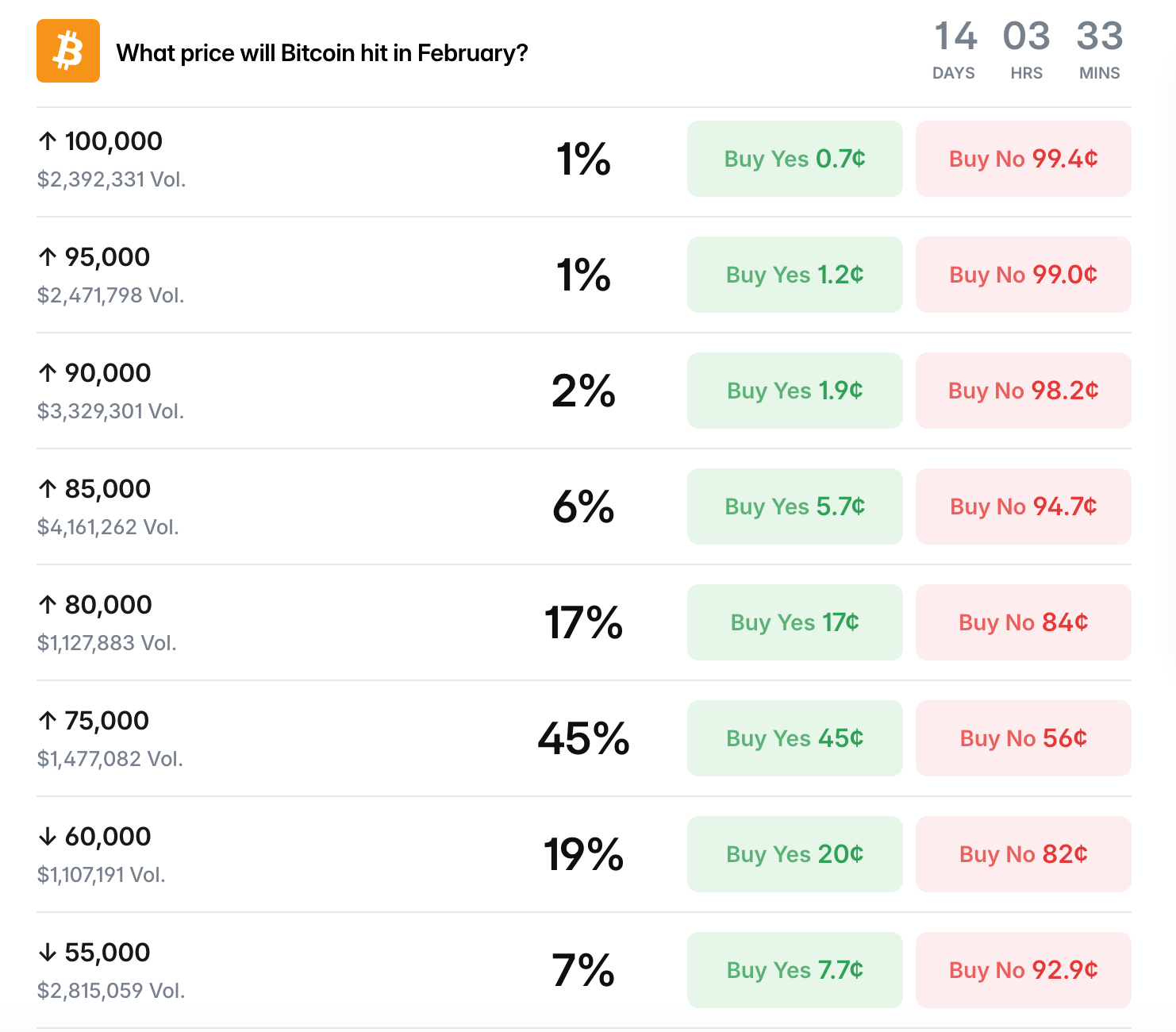

On Polymarket, a contract asks: “What price will Bitcoin hit in February 2026?” A question as fraught as a Gogol protagonist’s existential crisis. The market, with its $61 million volume, resolves with the precision of a bureaucrat’s stamp-“Yes” if Binance’s BTC/USDT candle high touches a listed level. Ah, the poetry of finance!

Current odds? $75,000 per Bitcoin has a 45% chance, while $80,000 lingers at 17%. Beyond that, confidence crumbles like a poorly baked pirozhki. Six-figure targets? Priced at 1% or less-a distant mirage in the desert of speculation.

Volume clusters around psychological milestones-$85,000 for the optimists, $55,000 and $50,000 for the pessimists. Ah, the duality of man! Traders prepare for both triumph and catastrophe, like a peasant stocking up for winter.

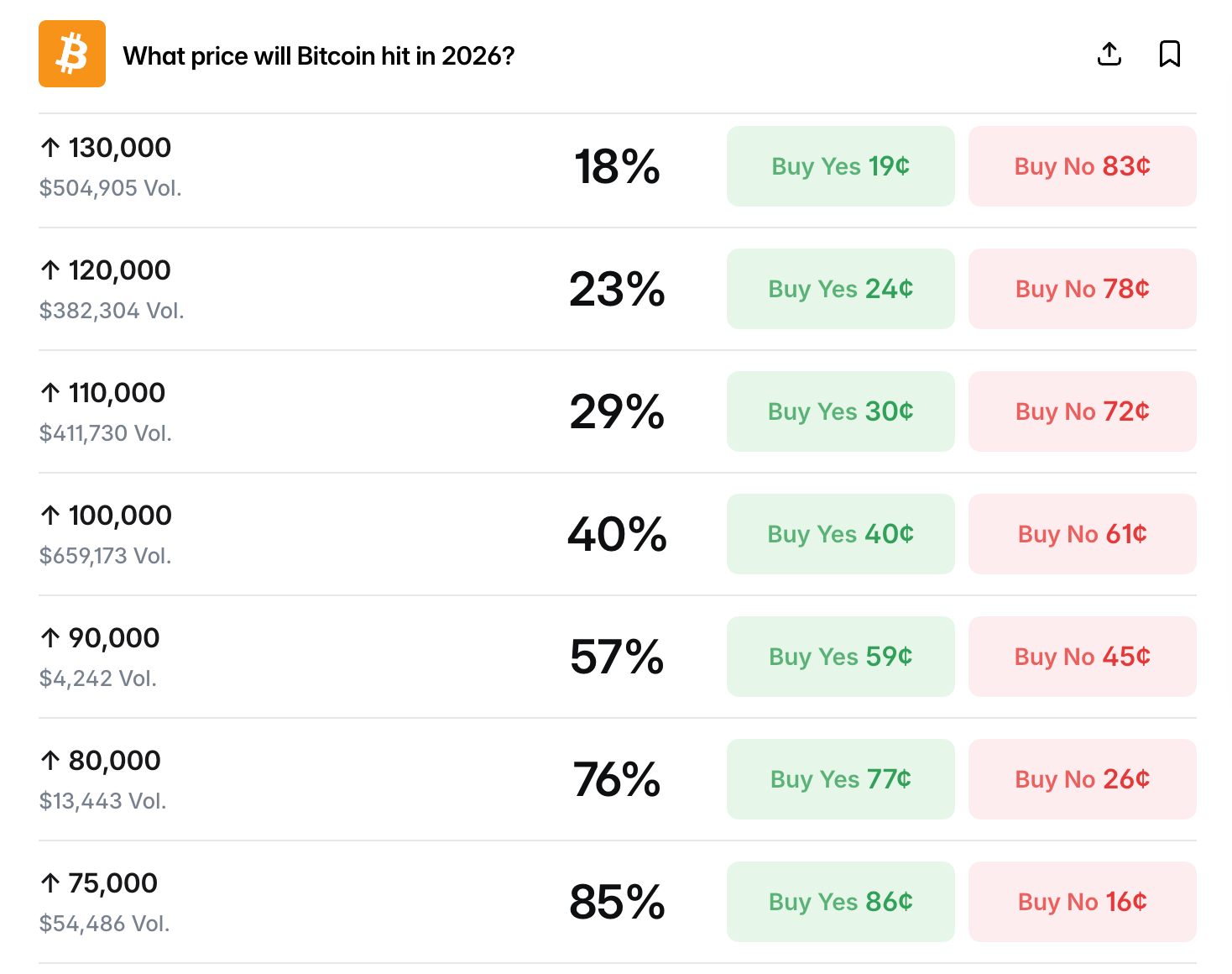

Another Polymarket contract asks: “What price will Bitcoin hit before 2027?” Here, the crowd assigns a 40% chance of $100,000 in 2026. Long-shot targets like $250,000? Hovering at 5%-a fantastical delusion, like believing in a nose that runs away.

Volume appears at extremes, including $15,000. Ah, the hedgers! Buying insurance against tail risk, like a superstitious villager warding off evil spirits.

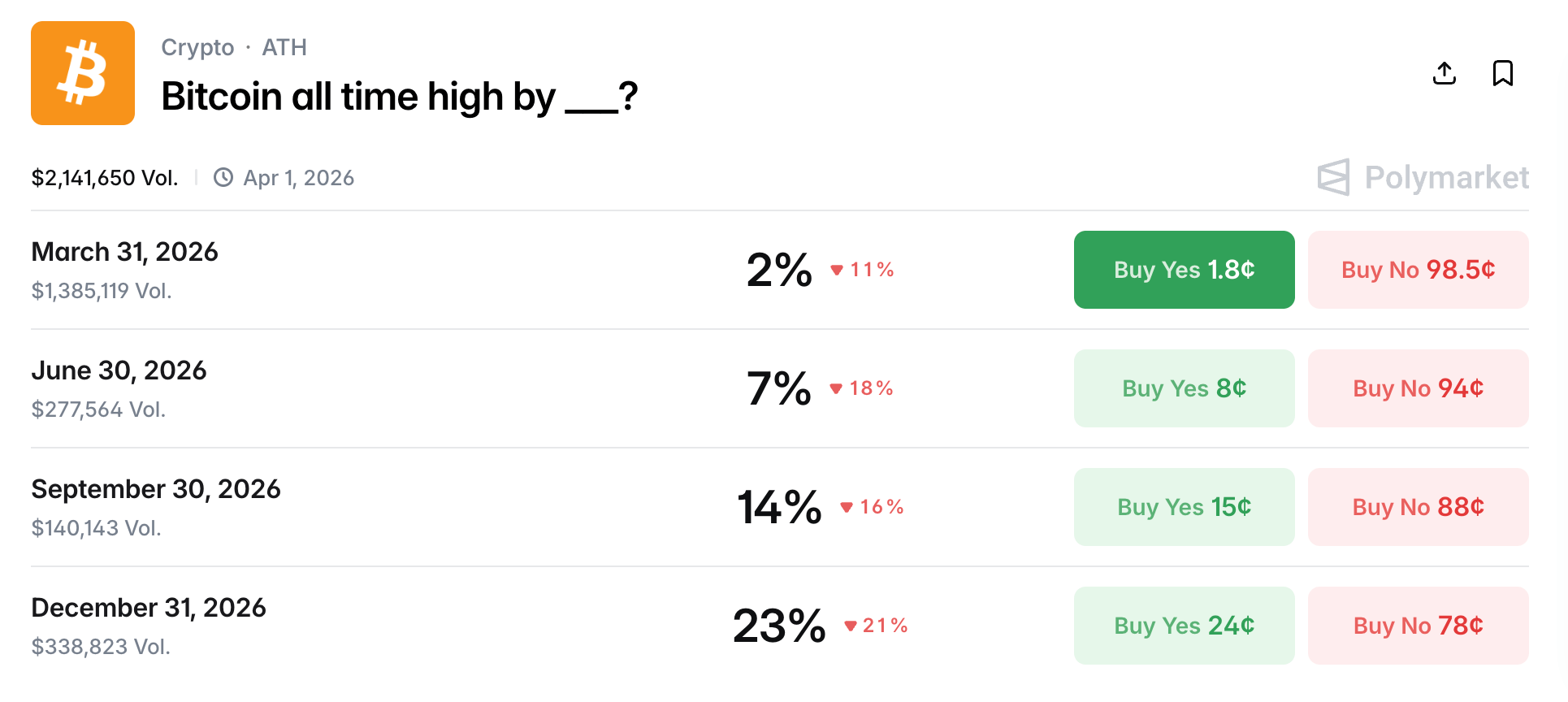

A timeline contract asks: “Will Bitcoin set a new all-time high by various deadlines in 2026?” Odds are low in the near term-2% by March, 7% by June. By Dec. 31, they rise to 23%. A steady climb, like a bureaucrat ascending the ranks of the civil service.

Liquidity concentrates in earlier deadlines, reflecting short-term positioning. Ah, the impatience of traders! Yet longer-dated optimism builds slowly, like a pot of borscht simmering on the stove.

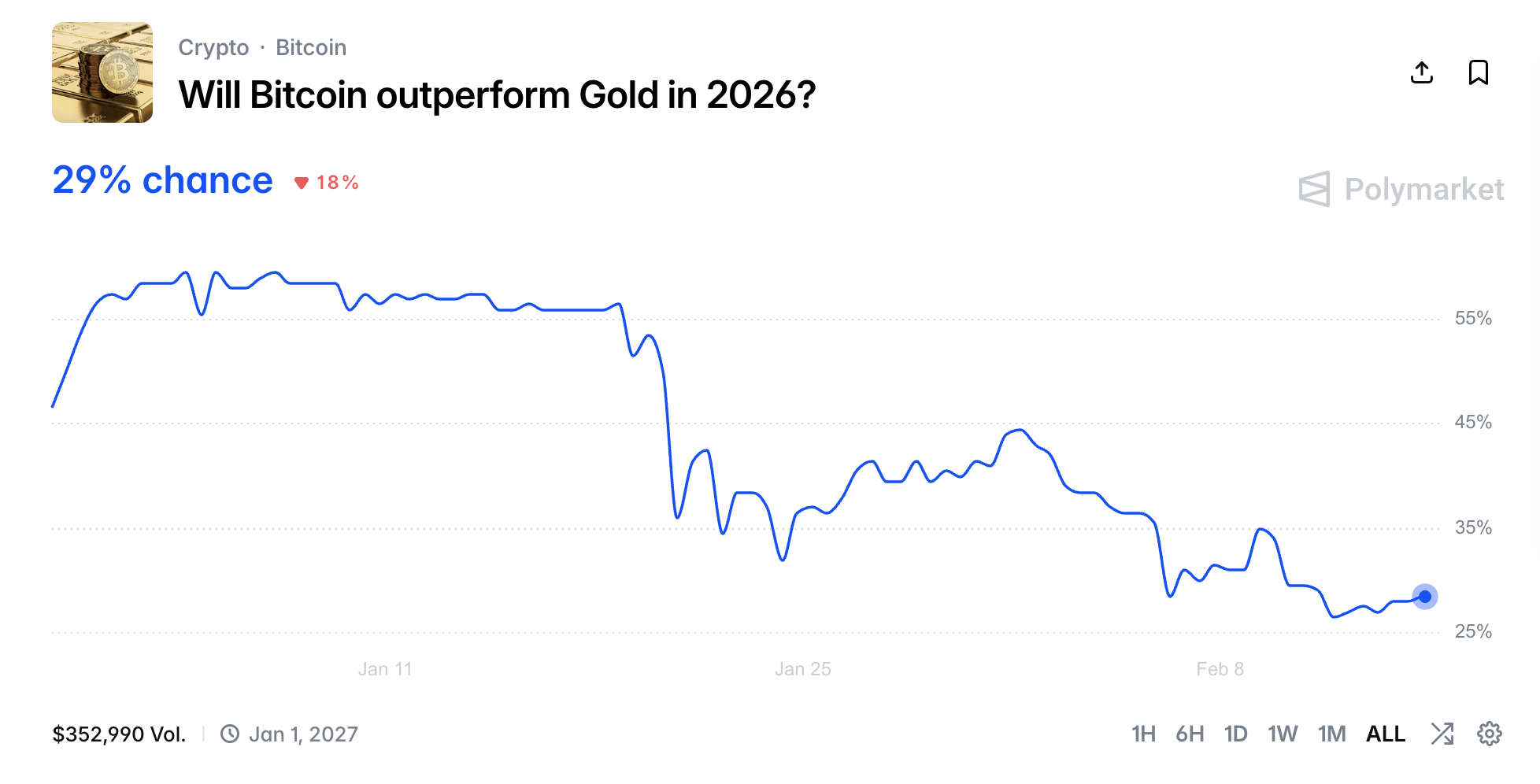

Polymarket also hosts a contract asking: “Will Bitcoin outperform gold in 2026?” Bitcoin has a 29% chance, leaving gold favored at 72%. Ah, the caution! Traders weigh volatility and macro conditions, viewing gold as a steadier performer-a reliable old friend in uncertain times.

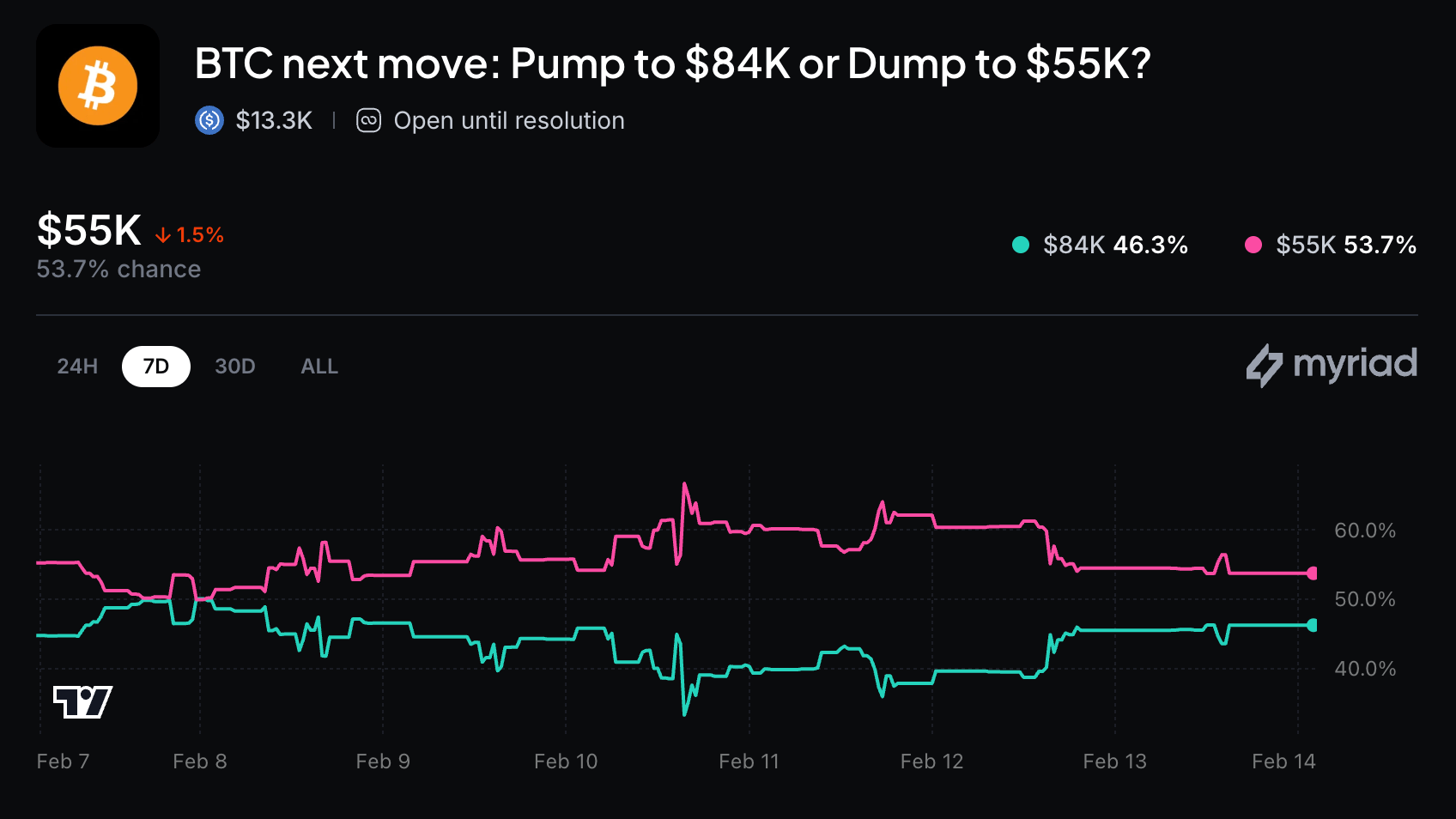

On Myriad, a binary market asks: “Will Bitcoin hit $84,000 or $55,000 first?” Current odds give $55,000 a 54% edge, with $84,000 at 46%. Volume is light, like a whisper in a vast steppe, meaning probabilities could shift abruptly.

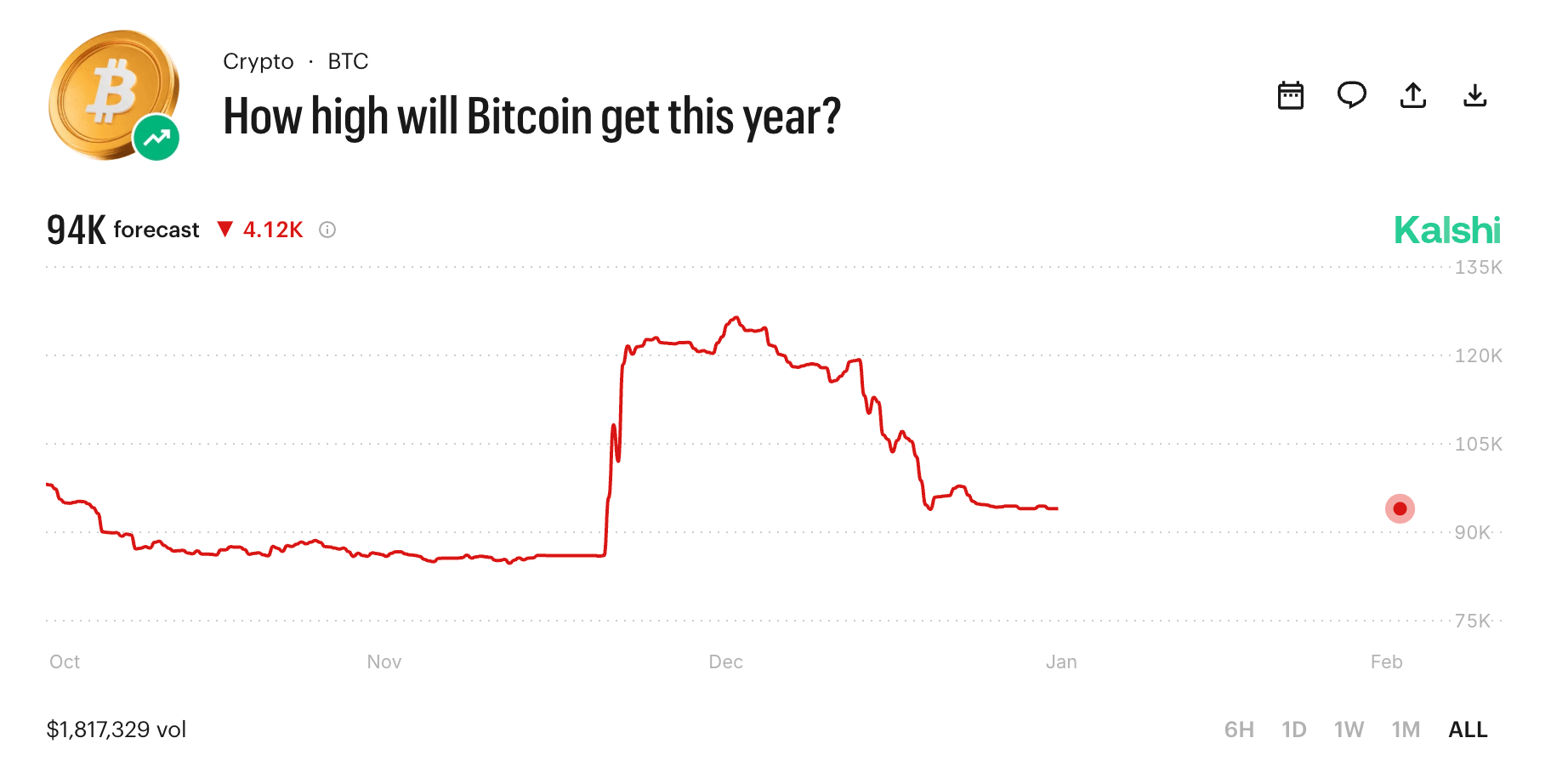

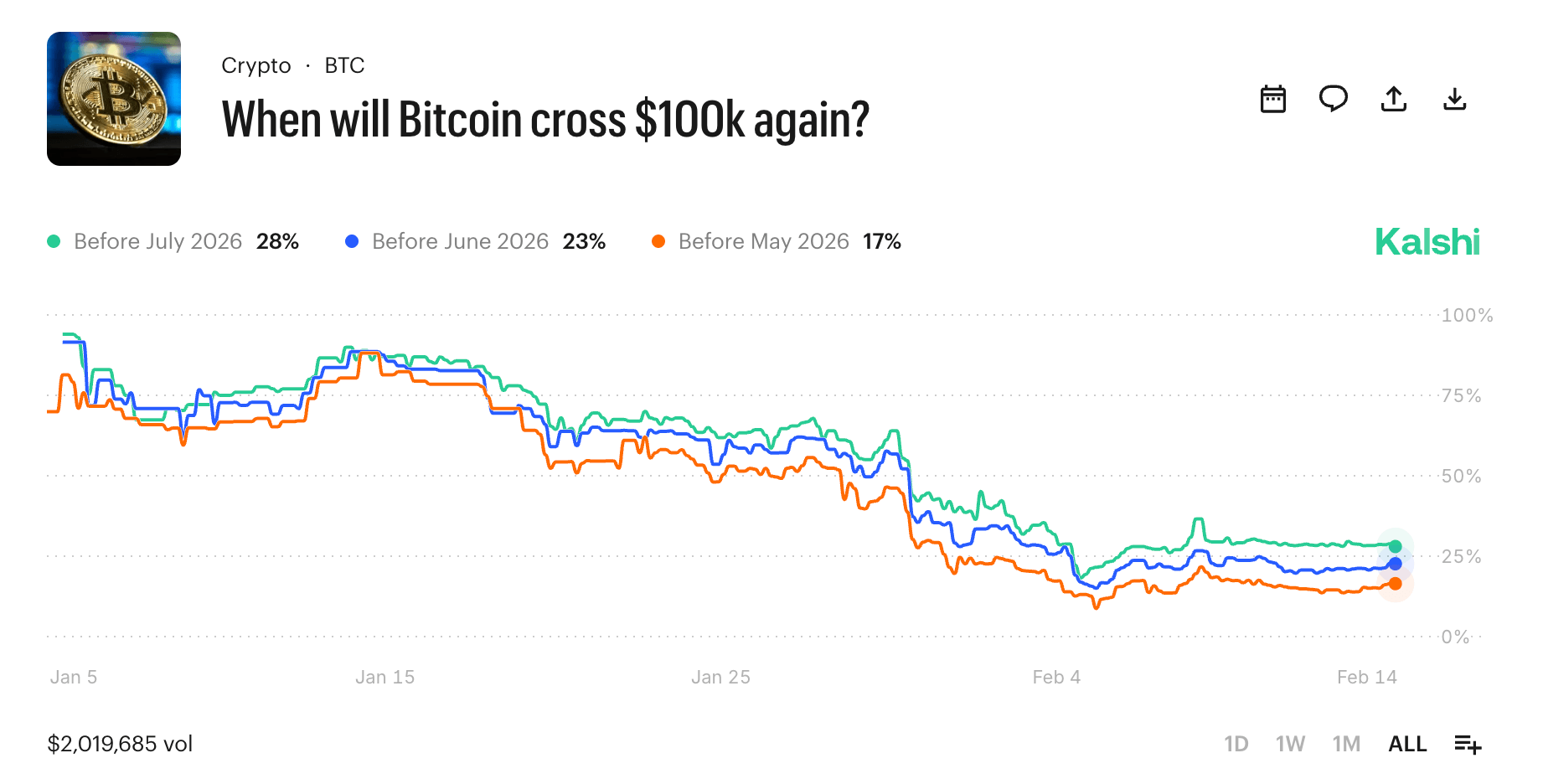

Kalshi offers annual threshold markets for 2026, assigning a 39% chance Bitcoin trades above $99,999.99. A separate contract tracks when Bitcoin might cross $100,000, showing a time-based curve. Ah, the gradualism! Confidence builds as the calendar advances, like a character in a Gogol novel finally finding their purpose.

Across all contracts, the theme is restraint. No moonshot fantasies, no doom and gloom-just moderate appreciation potential with meaningful downside risk. Ah, the wisdom of the crowd! Prediction markets, those sentiment snapshots, reveal a risk-reward profile as nuanced as a Gogol character’s inner turmoil.

Millions of dollars are committed, yet the future remains in flux-a dance of probabilities, hedges, and hopes. Will Bitcoin soar or stumble? Only time will tell, and even then, perhaps not.

FAQ ❓

- What do Polymarket traders expect for Bitcoin in February 2026?

The highest implied probability is near $75,000, with sharply lower odds above $80,000-a modest dream, like a peasant’s fantasy of owning a cow. - What are the chances Bitcoin hits $100K in 2026?

Kalshi markets imply a 39% chance-a coin toss, but with higher stakes than a game of durak. - Do traders expect a new all-time high soon?

Near-term odds are low, with higher probabilities in late 2026-a slow burn, like a Gogol novel’s plot. - Is Bitcoin favored to outperform gold in 2026?

No, gold has a clear edge-a steady hand in a world of volatility, like a reliable bureaucrat in a chaotic office.

Read More

- MLBB x KOF Encore 2026: List of bingo patterns

- Honkai: Star Rail Version 4.0 Phase One Character Banners: Who should you pull

- eFootball 2026 Starter Set Gabriel Batistuta pack review

- Overwatch Domina counters

- Top 10 Super Bowl Commercials of 2026: Ranked and Reviewed

- Lana Del Rey and swamp-guide husband Jeremy Dufrene are mobbed by fans as they leave their New York hotel after Fashion Week appearance

- Gold Rate Forecast

- ‘Reacher’s Pile of Source Material Presents a Strange Problem

- Meme Coins Drama: February Week 2 You Won’t Believe

- Married At First Sight’s worst-kept secret revealed! Brook Crompton exposed as bride at centre of explosive ex-lover scandal and pregnancy bombshell

2026-02-15 11:08