The crypto bazaar today trembles with drama, as bitcoin options expiry and ethereum options expiry bring nearly $3 billion of contracts to their final act on the Deribit stage, as if the town’s council suddenly remembered it was bored and decided to entertain itself with numbers.

This grand expiry carries the gravitas of 9% of total open interest, a key spectacle for those who chase short-term price action like a cat chases a sunbeam and occasionally trips over its own tail.

Bitcoin Options Expiry Reveals $2.5 Billion

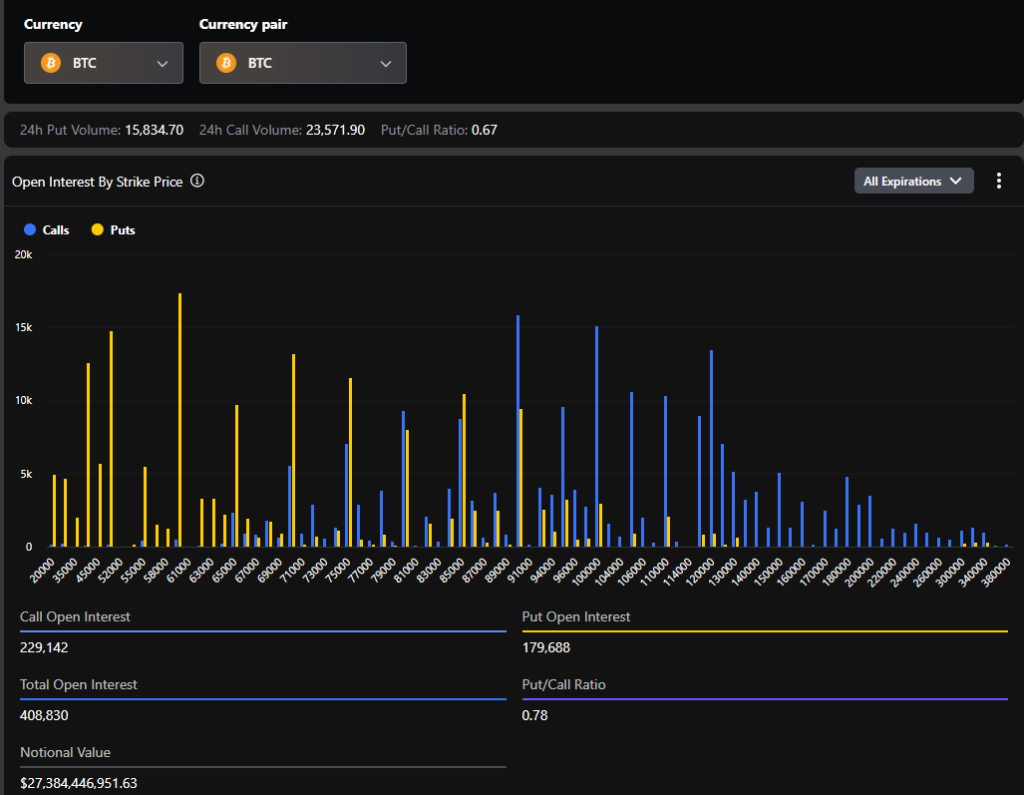

According to Deribit’s latest data, the bitcoin options expiry counted about 38,000 contracts with a total value of nearly $2.5 billion, which sounds impressive until you realize it’s basically a collection of premium coffee orders for a market that prefers drama to caffeine.

The put-call ratio sits at 0.71, signaling a balanced mood among traders who can’t decide whether to cry in their ledger or toast with a champagne of digests. The BTC max pain level is at $74,000, while Bitcoin traded near $66,872, which is to say: the price is playing hide-and-seek with a number it pretends to respect.

The Bitcoin option expiry chart shows rising caution in the market, especially as Bitcoin continues to struggle to move back above the $70,000 level, as if the price is politely refusing to be photographed without makeup.

Ethereum Options Expiry Adds Pressure With $410 Million

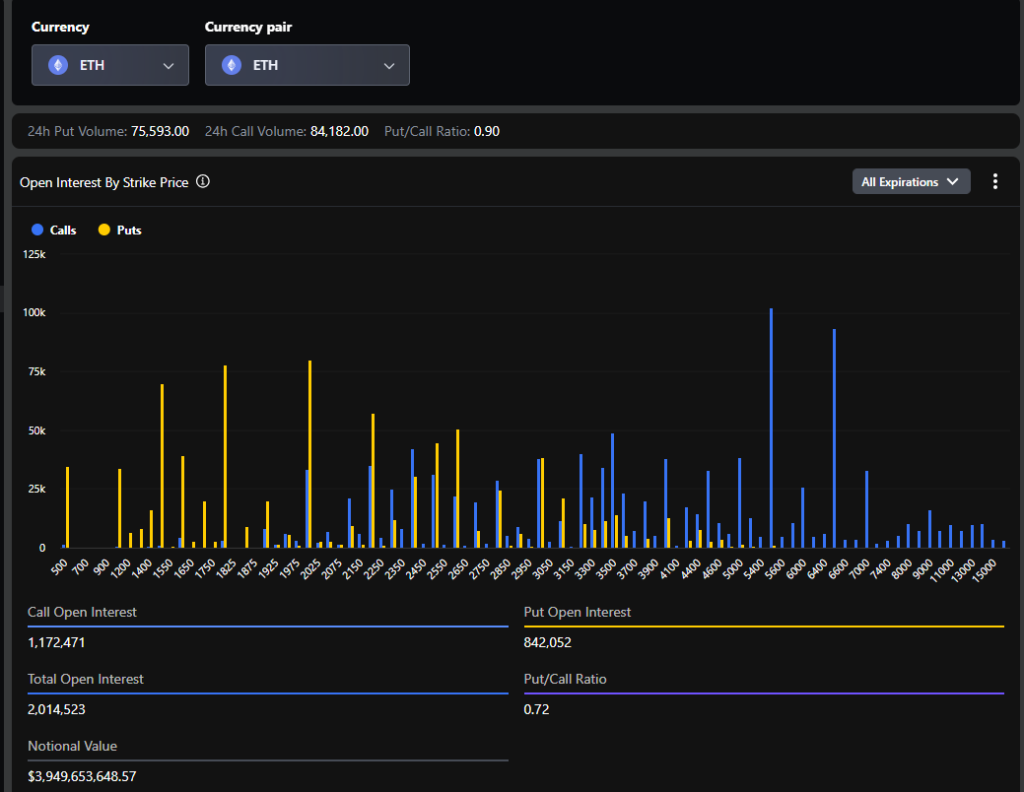

Alongside Bitcoin, the ethereum options expiry covered about 215,000 contracts worth roughly $410 million. Yet the ETH “max pain” level sits around $2,100, while the current price lingers near $1,950, as if Ethereum is playing a stubborn game of price tag with a stubborn audience.

The put-call ratio is close to 0.82, which shows many traders are still protecting against further downside, perhaps in a bid to avoid the scandal of an unanticipated dip on a Tuesday afternoon.

How the Crypto Market Will React

This week’s expiry is larger than last week’s event, when a notable bitcoin options expiry saw about $2.1 billion worth of BTC contracts settle. During that expiry, Bitcoin’s price moved by around 2%, showing only a modest short-term impact, like a polite knock on a door that no one actually answers.

Historically, expiries of this size can subtly influence short-term price moves, but markets often stabilize once positions are settled, as if the actors have finished their theatrical flourish and return to their ordinary provinces.

Now, with Bitcoin trading near $66,891 and Ethereum around $1,985, the market could see short bursts of volatility again as open interest unwinds, like a crowd dispersing after a noisy play, leaving only the receipts and a lingering ash of speculation.

Read More

- MLBB x KOF Encore 2026: List of bingo patterns

- Gold Rate Forecast

- Married At First Sight’s worst-kept secret revealed! Brook Crompton exposed as bride at centre of explosive ex-lover scandal and pregnancy bombshell

- Top 10 Super Bowl Commercials of 2026: Ranked and Reviewed

- Why Andy Samberg Thought His 2026 Super Bowl Debut Was Perfect After “Avoiding It For A While”

- ‘Reacher’s Pile of Source Material Presents a Strange Problem

- How Everybody Loves Raymond’s ‘Bad Moon Rising’ Changed Sitcoms 25 Years Ago

- Genshin Impact Zibai Build Guide: Kits, best Team comps, weapons and artifacts explained

- Meme Coins Drama: February Week 2 You Won’t Believe

- Brent Oil Forecast

2026-02-13 14:47