Well, well, well! U.S. crypto ETFs kicked off February with a bang, returning capital to bitcoin faster than a comedian retelling a punchline! Meanwhile, ether and XRP are over there struggling like they just forgot their lines on stage. And what’s this? Solana, the quiet one in the corner, is stretching its legs with another day of inflows. Who knew it had it in it?

February Opens With a Bitcoin ETF Surge While Ether and XRP Slip Like a Slippery Banana Peel!

February opened with a sharp change in tone for crypto exchange-traded funds (ETFs), led by a powerful resurgence in bitcoin demand. After a not-so-funny end to January, investors rotated back into BTC exposure-because who doesn’t love a good comeback story? Meanwhile, other assets were playing the part of the confused sidekick.

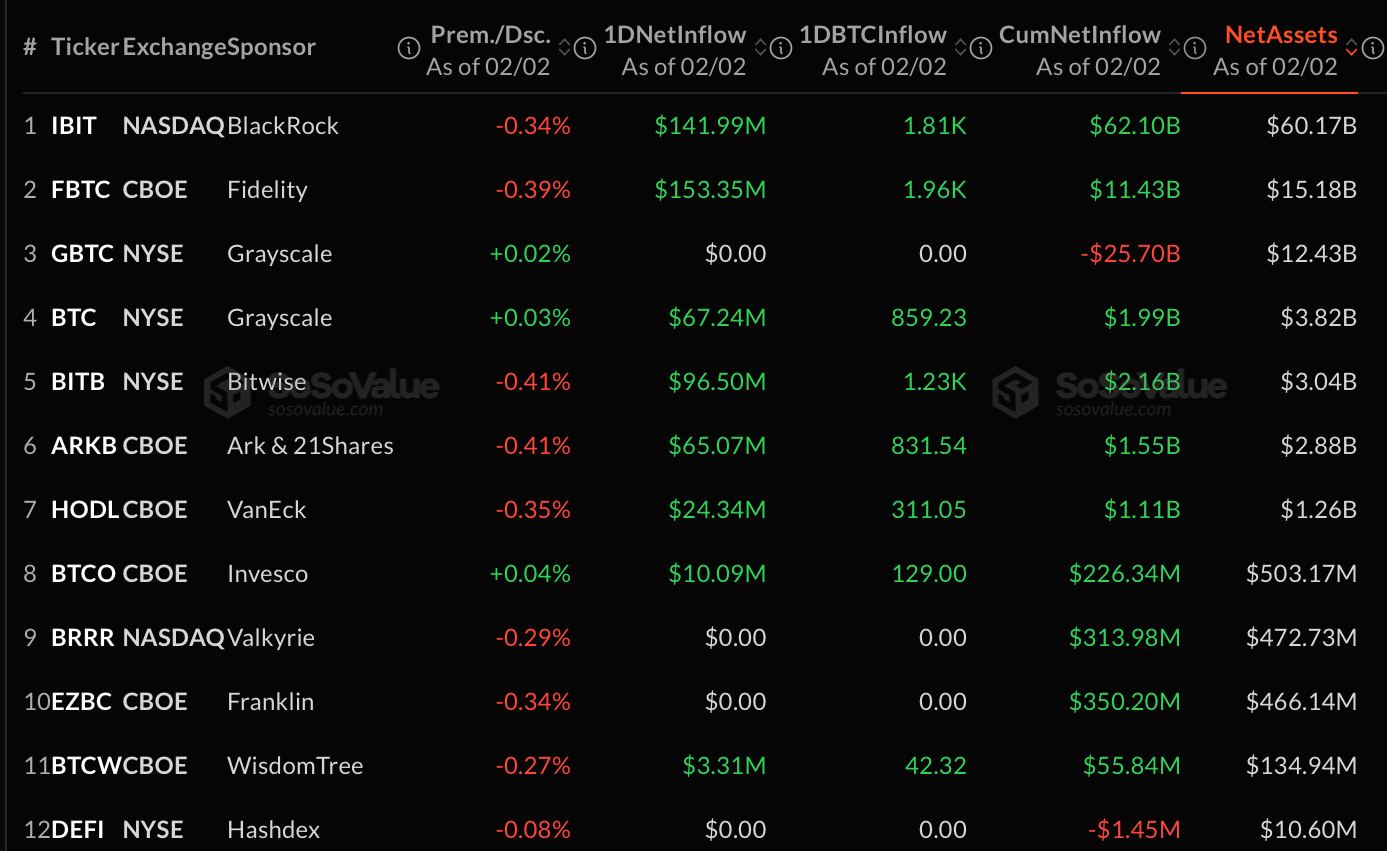

Bitcoin spot ETFs recorded a robust $561.89 million net inflow, spread across eight funds-so many funds, it’s like a family reunion! Fidelity’s FBTC led the charge with $153.35 million, closely followed by Blackrock’s IBIT at $141.99 million. Bitwise’s BITB and Grayscale’s Bitcoin Mini Trust added meaningful support with inflows of $96.50 million and $67.24 million, respectively. Talk about a money-making machine!

Ark & 21Shares’ ARKB brought in $65.07 million, while Vaneck’s HODL added $24.34 million-name a more iconic duo! Smaller yet notable contributions came from Invesco’s BTCO ($10.09 million) and WisdomTree’s BTCW ($3.31 million). Trading activity surged alongside the inflows, with total value traded reaching $7.68 billion-a number so high, it might just pay for that ticket to the moon!

Solana spot ETFs continued their gradual recovery, posting a $5.58 million net inflow. Bitwise’s BSOL accounted for the majority with $3.44 million, while Fidelity’s FSOL added $2.14 million. Trading volume totaled $51.18 million-enough to buy a small island, or at least a decent pizza-and net assets edged higher to $882.94 million, suggesting renewed but still cautious confidence-like a cat on a hot tin roof!

Ether spot ETFs finished the day slightly in the red, despite pockets of strength-like someone trying to lift weights but only managing to lift their spirits. Fidelity’s FETH attracted $66.62 million, while Vaneck’s ETHV and Bitwise’s ETHW added $7.64 million and $4.99 million, respectively. However, a sizable $82.11 million outflow from Blackrock’s ETHA overwhelmed those gains, resulting in a $2.86 million net outflow overall. Trading volume reached $2.70 billion-an amount that could make anyone dizzy!-with total net assets sliding to $13.69 billion.

XRP spot ETFs also closed marginally lower. Bitwise’s XRP saw a $544.40K inflow, but a $949.09K exit from 21Shares’ TOXR tipped the balance to a $404.69K net outflow. Total value traded stood at $39.39 million-just enough for a fancy dinner-and net assets remained steady at $1.11 billion.

//www.binance.com/en/price/bitcoin”>bitcoin

, reflected in broad-based inflows and elevated trading activity. Elsewhere, ether and

XRP

continued to face selective pressure, while

solana

quietly extended its rebound-like the underdog of the story! The divergence underscored a market still rotating carefully, rather than moving in unison like a bad dance troupe.

FAQ📊

- Why did bitcoin ETFs surge at the start of February?

Investors rotated back into bitcoin after January’s selloff, driving strong inflows across major BTC funds-because you know what they say, “If at first you don’t succeed, try, try again!” - How much capital flowed into bitcoin ETFs?

Bitcoin spot ETFs saw about $562 million in net inflows-one of the strongest days this year! That’s like winning the lottery without even buying a ticket! - Why did ether and XRP ETFs lag behind?

Large outflows from key funds offset smaller inflows, keeping ether and XRP slightly in the red-like a tomato that forgot its sunscreen! - Which altcoin ETFs showed strength?

Solana ETFs extended their recovery with steady inflows, signaling cautious renewed confidence-like a shy kid finally asking someone to dance!

Read More

- Gold Rate Forecast

- Heartopia Book Writing Guide: How to write and publish books

- Robots That React: Teaching Machines to Hear and Act

- Mobile Legends: Bang Bang (MLBB) February 2026 Hilda’s “Guardian Battalion” Starlight Pass Details

- UFL soft launch first impression: The competition eFootball and FC Mobile needed

- 1st Poster Revealed Noah Centineo’s John Rambo Prequel Movie

- Here’s the First Glimpse at the KPop Demon Hunters Toys from Mattel and Hasbro

- UFL – Football Game 2026 makes its debut on the small screen, soft launches on Android in select regions

- Katie Price’s husband Lee Andrews explains why he filters his pictures after images of what he really looks like baffled fans – as his ex continues to mock his matching proposals

- Arknights: Endfield Weapons Tier List

2026-02-03 17:59