Ah, crypto. A realm of fortunes made and lost before breakfast. It seems the little panic of October – a minor indigestion, shall we say – is finally subsiding. Grayscale, those high priests of financial prognostication, declare the purging of excessive enthusiasm (or, as the common folk call it, “leverage”) is complete. A miracle, or merely a temporary lull before the next inevitable bout of speculative frenzy? Only time, and perhaps a mischievous demon, will tell.

The Leverage Craziness: A Post-Mortem

The whispers in the financial ether have shifted. No longer are we obsessed with the panicked scrambling to cover debts accrued on the crypto markets. Grayscale, in a pronouncement delivered with the solemnity of a Kremlin decree via the platform known as X (honestly, X? Such a drab name), suggests the great deleveraging of October is but a fading memory. Stabilization, they say. Fundamentals, they murmur. One wonders if somewhere in the Grayscale offices, a small, knowing smile is playing on someone’s lips. 🧐

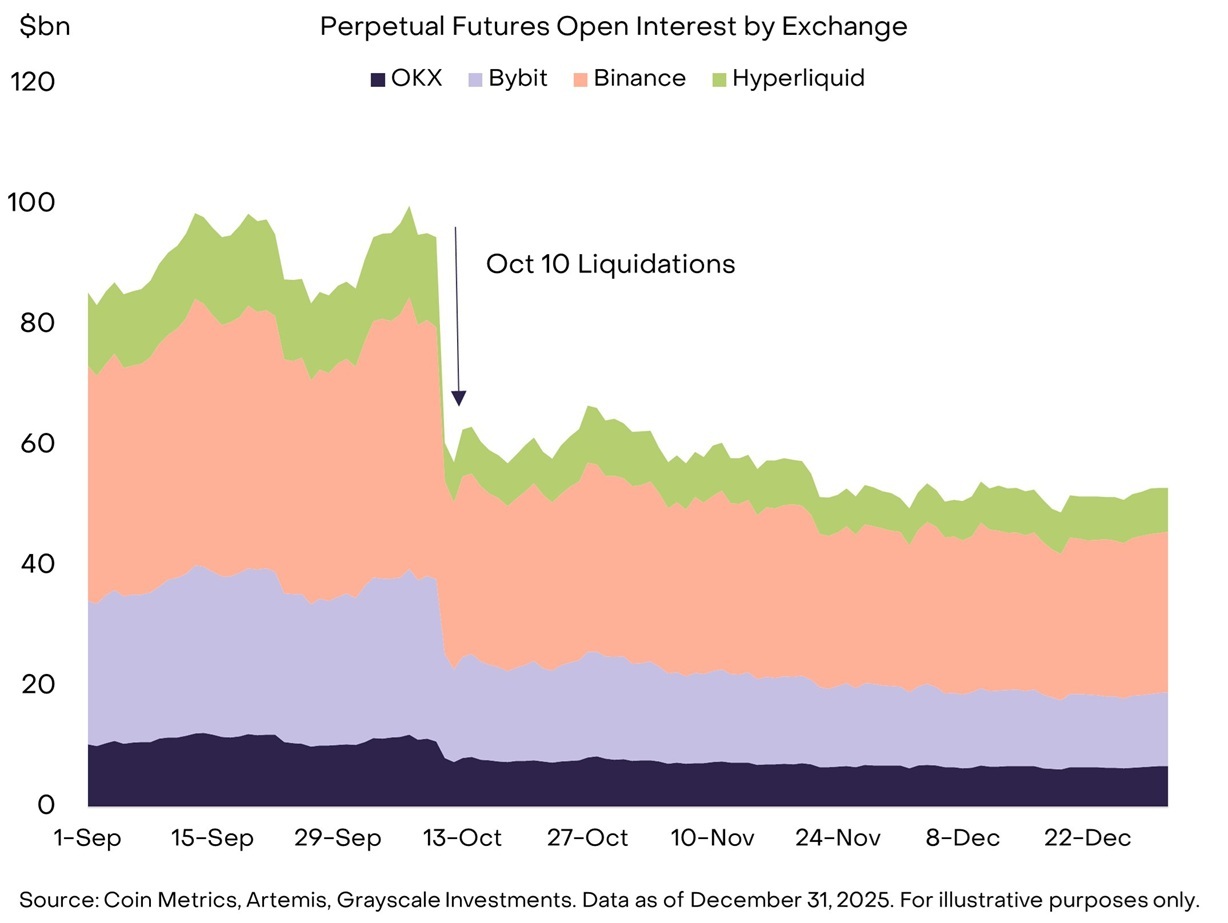

Let us remember October. A time of sharp intakes of breath and the regrettable severing of many digital appendages. The open interest across those bustling exchanges – OKX, Bybit, Binance, and that curious little haunt, Hyperliquid – plummeted from a rather vulgar $90-$100 billion to a mere $55 billion. A collapse! A disaster! Or, as some would say, a healthy correction. But fear not, for it didn’t continue. It merely… paused. Binance and Bybit, naturally, remained the main players, while OKX and Hyperliquid contented themselves with smaller, but strangely persistent, shares.

And thus, Grayscale declared:

“As a result, we no longer believe that post-October 10 deleveraging has been a meaningful driver of valuations in recent weeks.”

A boldly understated statement, wouldn’t you agree? They assure us, with a measured tone, that the “Crypto futures markets experienced a sharp deleveraging event,” but, crucially, “open interest stabilized.” As if stabilizing is the natural order of things in this chaotic universe. 🙄

This stabilization, you see, has led to a grand assessment of December. Futures open interest edged upwards, while options… well, they expired. A rather depressing fate for options, wouldn’t you say? But the essence is this: leverage remained constant, not building to another unsustainable peak. The price of bitcoin dithered, volatility was subdued, and volumes were light. A tranquil scene, almost… suspicious. A conspiracy of calmness, perhaps? It all suggests a period of consolidation, a collective holding of breath.

Grayscale also notes, with a touch of weary acceptance, that the long-term bitcoin holders aren’t frantically dumping their holdings. A good sign? Perhaps. Though, knowing human nature, they’re probably just waiting for the next opportunity to unleash another wave of irrational exuberance. With tax season past, regulations looming, and tokenization and protocol development ever-accelerating (buzzwords, the lot of them!), Grayscale believes future valuations will depend on… fundamentals and policy decisions. Fancy that. 🧐

FAQ ⏰

- What sort of mischief did crypto futures get up to in October 2025?

A rather rude awakening involving a significant reduction in open interest. Not a pretty sight. - Which exchanges bore the brunt of this unpleasantness?

Binance and Bybit, as always, found themselves in the thick of it. - Why is Grayscale suddenly less concerned about leverage?

Because it decided to stop worrying and love the stabilization. A surprisingly pragmatic decision. - What does all this stabilization actually mean?

It suggests a period of respite, a chance to collect one’s thoughts, before the next unpredictable act in this ongoing drama.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- How to find the Roaming Oak Tree in Heartopia

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- ATHENA: Blood Twins Hero Tier List

- M7 Pass Event Guide: All you need to know

- Sunday City: Life RolePlay redeem codes and how to use them (November 2025)

2026-01-17 03:58