Now, I never did put much stock in fortune-telling-be it tea leaves, tarot cards, or folks wavin’ candlesticks over their dogecoin charts. But sure as riverboats float, this FLOKI critter is dancin’ along some sort of invisible fence they call an “ascending channel.” Supposedly, this bucking bronco’s been known to bust out from such corrals in the past. The local hand-wringers-they call ‘em analysts these days-are peering over their spectacles, bracing for either glory or a pratfall worthy of a traveling medicine show. 🤠

Super Cycle Structure and Channel Pattern Support Outlook

Now, there’s a fella by the handle of Alpha Drop (@airdropalpha40)-I suspect he’s half man, half tumbleweed-who figures FLOKI/USD is snuggling up into what he calls the “early stages of a second super cycle.” I don’t recollect where the first one rode off to, but there’s chatter of fancy things like Fibonacci levels and prices that rebound every time they get too close to the business end of the channel. Seems FLOKI just can’t resist playin’ with danger at the bottom support and bouncing up with all the gumption of a frog in a frying pan.

Our chart has what they call a “rounded bottom.” In my day, that was a compliment reserved for the town baker’s wife-not something you wanted to see on a trading chart. But here, it means the sellers are tuckered out and there’s a smidge of hope buyers might start poking their noses into the trough. Right now, FLOKI’s pacing ’round the middle of that channel, staring up at resistance like Tom Sawyer eyeing a fresh fence to paint. Should it break free from there, why, we’re told it could shoot for the rafters and keep this so-called “super cycle” dream alive. 🚀

There’s even an up arrow on the chart, like a polite instruction for where the price ought to be headed. If it obeys, traders will slap each other on the back; if not, well, there’s always next time. Just don’t let your hopes dip below that lower support line, or it’s straight to the riverbed for you.

Short-Term Volatility and Volume Dynamics Remain Elevated

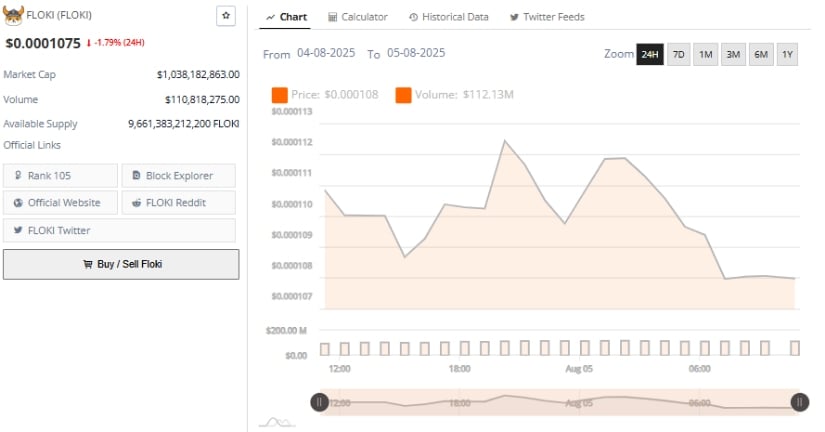

As for today’s hullabaloo, the 24-hour chart looks more jumpy than a jackrabbit at a fireworks display. FLOKI woke up priced at $0.0001108, tried to climb outta bed twice, then lost all ambition and slid down to $0.0001075 before suppertime-dropping 1.79%. That’s about as much progress as a New Year’s resolution by January 4th. 💤

The volume tally hit $112.13 million, so at least someone’s having fun tossing coins around. Whenever the price crept up, traders stampeded for the exits-classic “pump and fade” they say, which is polite code for “epic letdown.” By nightfall, both price and excitement had run out, waiting on another spark-or perhaps just a miracle.

Now, this FLOKI contraption is valued at a cool $1.038 billion, sneaking into the 105th slot among the universe of pretend money. There’s a heap of tokens-a mountain of ‘em, actually, over 9.66 trillion-so any volume spike sends it careening like a mule on moonshine. Can’t get back above $0.0001110? That’s bad news, son. Get ready to meet support levels you never knew existed.

Momentum Indicators Signal Short-Term Weakness

Now, at the time I tip my hat and put pen to paper here, FLOKI/USDT is lounging around $0.00010681, taking a 4.04% daily beating. It’s wandered down from a vaunted $0.00015777 and is now loitering near support between $0.000105 and $0.000100-an area of more drama than a Mississippi steamboat poker game.

The MACD-a device more mysterious than a magician’s hat-has taken a sour turn, its line crossing below the signal like two drunks missing the same streetcar. The histogram’s in the red, so the bulls have evidently gone fishing. Unless they sober up quick, the trend’s liable to keep slippin’ backward.

As for the RSI-sitting at 46.21, just below its own moving average of 52.12-it’s not really low enough for panic but ain’t inspiring much hope, either. Savvy traders might wait for these signals to quit bickering before betting the farm.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- Best Arena 9 Decks in Clast Royale

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-08-06 02:43