Picture this: on a Monday not unlike any other (except, of course, it most certainly was), our audacious hero Bitcoin clambered up to the scandalous heights of $108,952—much to the dismay of fiat traditionalists—and suddenly, investors everywhere forgot their spreadsheets, coffee cups still warm, and stampeded toward BTC-backed ETFs like Muscovites to a bread queue. 🥖💸

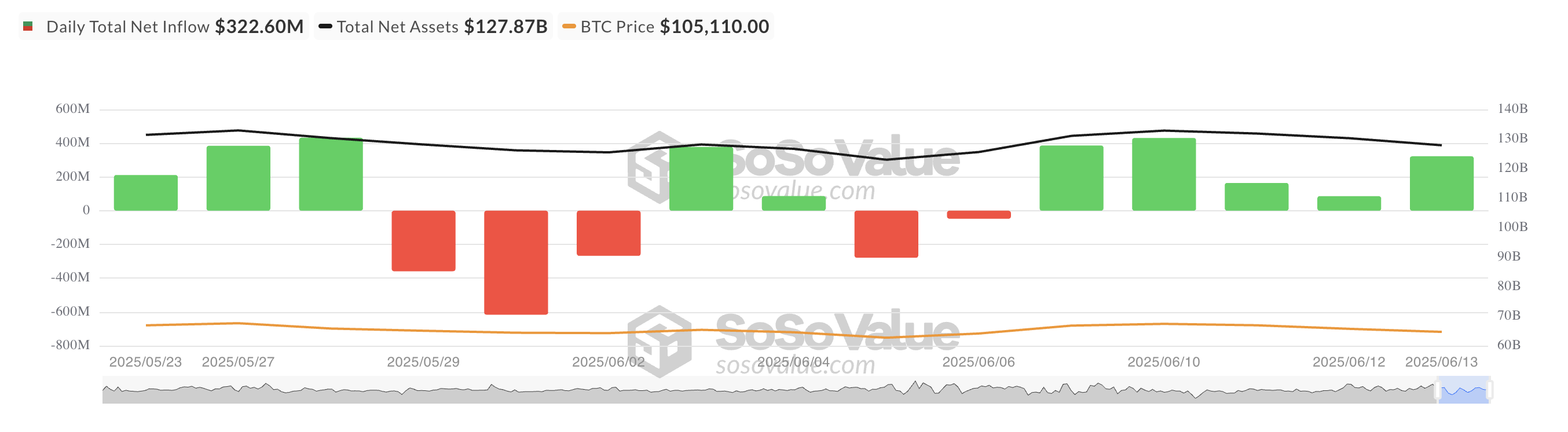

A tidal wave of more than $400 million in net inflows crashed into Bitcoin ETFs, BlackRock’s notorious IBIT leading the procession as if it were Berlioz weaving through bureaucratic chaos—except this time, the only head rolling was a price chart. As for the king coin itself: a dainty 1% gain, a refreshingly sober affair in these delirious times, as leveraged traders grew more skeptical than a Soviet cat eyeing a new brand of fish.

ETF Inflows Surge—Or, How to Make Your Accountant Cry

Bitcoin, with the exuberance of a character freshly resurrected by unknown forces, cartwheeled its way to $109,952. Suddenly, investors grew hungry—no, ravenous—and unleashed a $408.59 million feast upon US-listed spot BTC ETFs. This, my friend, was the largest single-day binge since the grand bacchanalia of June 10. Oh, what tales the brokers will tell!

At the head of the table, BlackRock’s iShares Bitcoin Trust (IBIT) carved the biggest slice, asserting ETF dominance with the air of a bureaucrat holding the only rubber stamp in Moscow. Monday’s offering? About $267 million—enough to make even the greediest banker blush—vaulting IBIT’s total to a stately $50.03 billion. (Rumor has it, Vladimir Ivanovich from accounting hasn’t left his desk since.)

These inflows show institutional investors haven’t flinched at short-term volatility. Who would, anyway? Especially when one can hedge a portfolio with something shinier than gold and less mouthy than a disgruntled official.

BTC Holds Steady While Traders Channel Their Inner Chicken Little

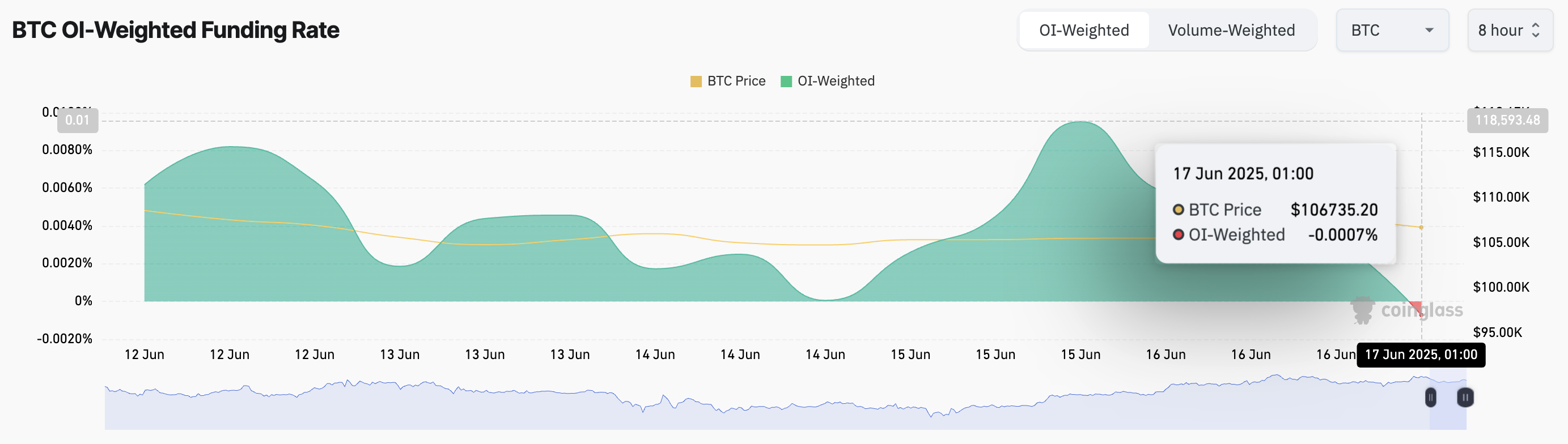

Despite BTC enjoying a modest 1% climb (the financial equivalent of smoking a cigarette on a windswept balcony), ominous signs flash in the derivatives market. Funding rates have donned black armbands: negative again, ringing in at 0.0007%—according to Coinglass, who watches these things with the attention of a suspicious neighbor. 🧐

For those uninitiated in perpetual futures: the funding rate is a regular coin toss of payments between traders, designed to keep prices from running off into the forest like a startled goat. When negative, shorts pay longs, like a tax for pessimism; had Dostoevsky known this, he’d have written about traders instead of Raskolnikov.

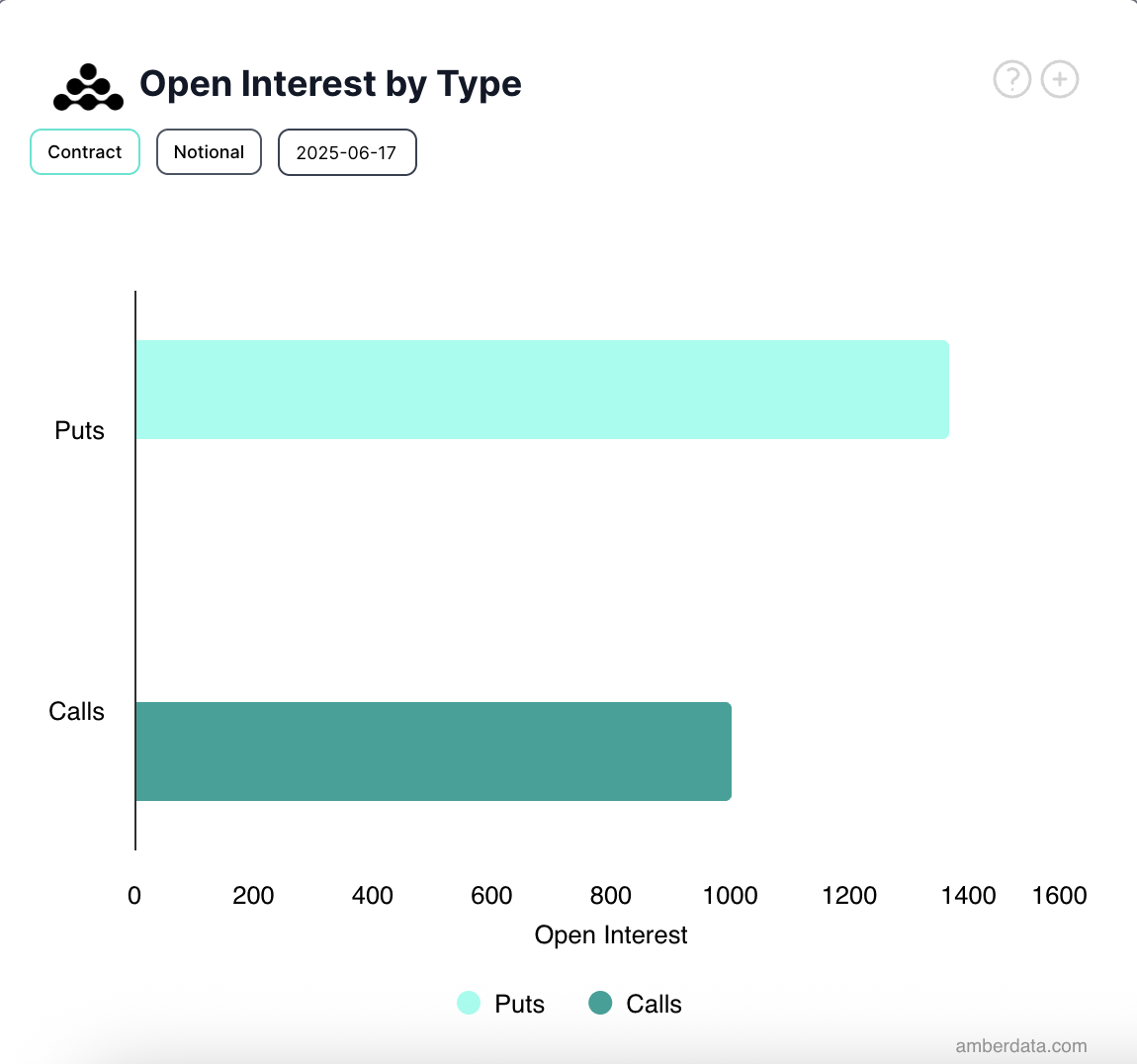

If this malaise continues, the poor coin’s price may slump further, as though suffering from a bad case of early winter blues. Meanwhile, options traders are bustling about defensively, snapping up puts the way Margarita hoarded magic cream—everyone desires protection when the winds grow ominous.

So, while ETF inflows suggest institutions are betting on crypto’s eternal springtime, most traders are hedging their bets and eyeing the exits—even as the band plays a triumphant tune. In the world of finance, as at the Patriarch’s Ponds: the truly strange is yet to come. 🦆💰

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- ATHENA: Blood Twins Hero Tier List

- Clash Royale Furnace Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

2025-06-17 10:36