Key Highlights:

- VIRTUAL has gained 89.89% in May, currently trading at $2.39 with MCap of $1.56B

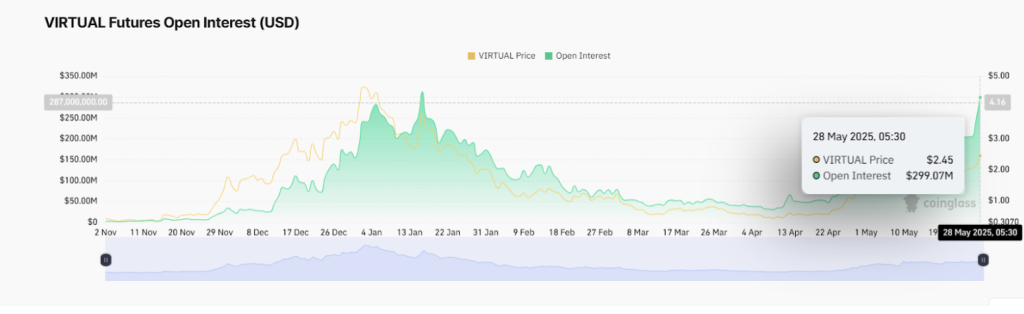

- Futures Open Interest surged from $35M in April to $239M by May 9; now at $299M.

- Daily trading volume hit $2.14B on May 9, currently at $1.38B.

- Momentum remains strong. Trend is bullish, but traders should watch for signs of exhaustion near resistance.

- Price has surpassed the $2.20 breakout zone, signalling a strong continuation setup.

The Virtuals Protocol (VIRTUAL) is picking up speed again, surging past $2.20 in a fresh surge of a parabolic trend. Traders are keeping an eager watch, hoping to reach $3 as the technical indicators take charge, while the growth in ecosystem usage continues at a steady pace.

VIRTUAL/USD Price Analysis: Second Parabolic Rally in Progress

As a crypto investor, I’ve witnessed an impressive surge in the value of my investment in VIRTUAL. In April alone, it soared by an astounding 275%, climbing from $0.60 to $2.25. This rise was not without structure, as it formed three distinct bases before a vertical breakout. More recently, since hitting a low of $1.68 in May, VIRTUAL has been shaping another parabolic arc.

- Base 1: $1.95–$2.00 — initial consolidation.

- Base 2: $2.20 — breakout and continuation level.

1) The present pricing pattern resembles the initial upward curve, nearing resistance points. From April to May, we’ve seen a ‘U’-like recovery that indicates robust underlying structure and purchase during market downturns.

Key Levels:

- Support Levels:

- $2.20 — Base 2 breakout zone.

- $1.95–$2.00 — Base 1 zone.

- $1.68 — retracement low from early May.

- Resistance Levels:

- $2.80 — local structure top.

- $3.00 — psychological breakout barrier.

- $3.50 — macro continuation level.

- $3.87–$4.00 — long-term ATH zone from January.

Growth Catalyst

Key Levels:

Support Levels: The price ranges from approximately $1.95 to $2.00 (first level), with a slightly higher point at $2.20 (second level). A lower boundary is set at $1.68 (retracement low).

Resistance Levels: Resistance can be encountered at around $2.80 (based on local structure), $3.00 (psychological barrier) and $3.50 (extending to the macro level continuation).

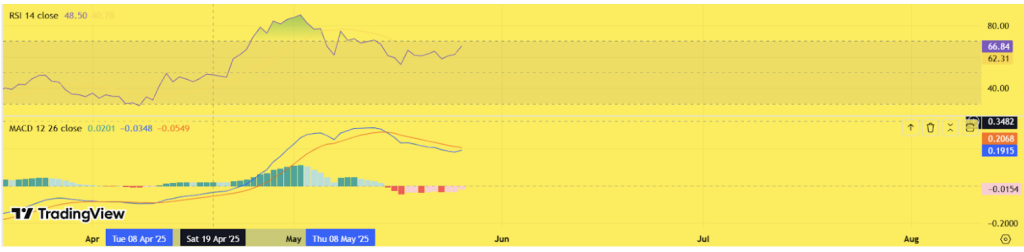

- RSI: 66.84 — showing strong bullish momentum nearing overbought levels.

- MACD: Flattening with a potential bullish crossover by early June, suggesting renewed upside strength.

Keep tabs on the current pricing, market capitalization, and technical fluctuations of Virtuals Protocol at Coinpedia Markets. Access live data, graphs, and in-depth analysis for the VIRTUAL token.

On-Chain Metrics: Speculative Strength Holds

Futures Open Interest:

The amount of open interest for futures contracts significantly increased, starting from approximately $35.2 million on April 11 (when the price was around $0.45), to a peak of $239.56 million by May 9 ($2.09). As of May 28, the open interest stands at about $299.07 million with a price of $2.39. This figure is slightly below its highest point in January, which was $312.53 million when VIRTUAL was trading at around $3.81. This trend suggests an increase in leveraged positions and speculative confidence.

Trading Volume:

On May 9, the volume reached a high point of $2.14 billion. By May 24, it had decreased to $1.11 billion. However, as of May 28, it has recovered to $1.38 billion, indicating increased interest and sufficient liquidity for further progress.

Growth Catalysts Fueling the Rally

- Genesis Launchpad (April 17): Introduced a new token distribution mechanism, triggering fresh user interest and participation.

- Binance.US Listing (April 29): Significantly expanded trading access and improved liquidity through a top-tier exchange.

- Narrative Momentum: Branding as an AI-agent prediction protocol has attracted speculative attention from trend-focused traders.

- Influencer Engagement: Prominent crypto analysts highlighting VIRTUAL’s outperformance against ETH and SOL have boosted its visibility.VIRTUAL Price Prediction: Can Bulls Reach $3.00?

VIRTUAL Price Prediction: Can Bulls Reach $3 ?

VIRTUAL is currently in a confirmed upward trajectory, boosted by high participation and significant trading activity. If the price manages to stay above $2.20 and breaks through $2.80 with momentum, reaching $3.00 seems plausible. The ongoing recovery pattern mirrors the overall market trend.

Short-Term Forecast (May 29 – June 5):

- Possible short-term pullbacks to $2.35–$2.40.

- A revisit to $2.20 remains healthy within the arc structure.

- Breakout above $2.80 could send VIRTUAL to $3.00.

Mid-Term Outlook (June 5 – June 14):

- If $3.00 breaks with volume, next resistance is $3.50.

- Beyond that, $3.87–$4.00 becomes the macro breakout target.

As long as the value stays at or above $2.20, the parabolic shape will continue to be accurate. If it drops below this point, it might cause the curve to fracture.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-05-28 17:15