Well, bless my stars and stripes, the derivatives desks have been busier than a one-legged man in a butt-kicking contest, propping up XRP this week. Futures and options are callin’ the shots while the spot price sits quieter than a church mouse at $2.90. 🤠📈

XRP Derivatives Are Lit Like a Fireworks Show on the Fourth of July 🎆

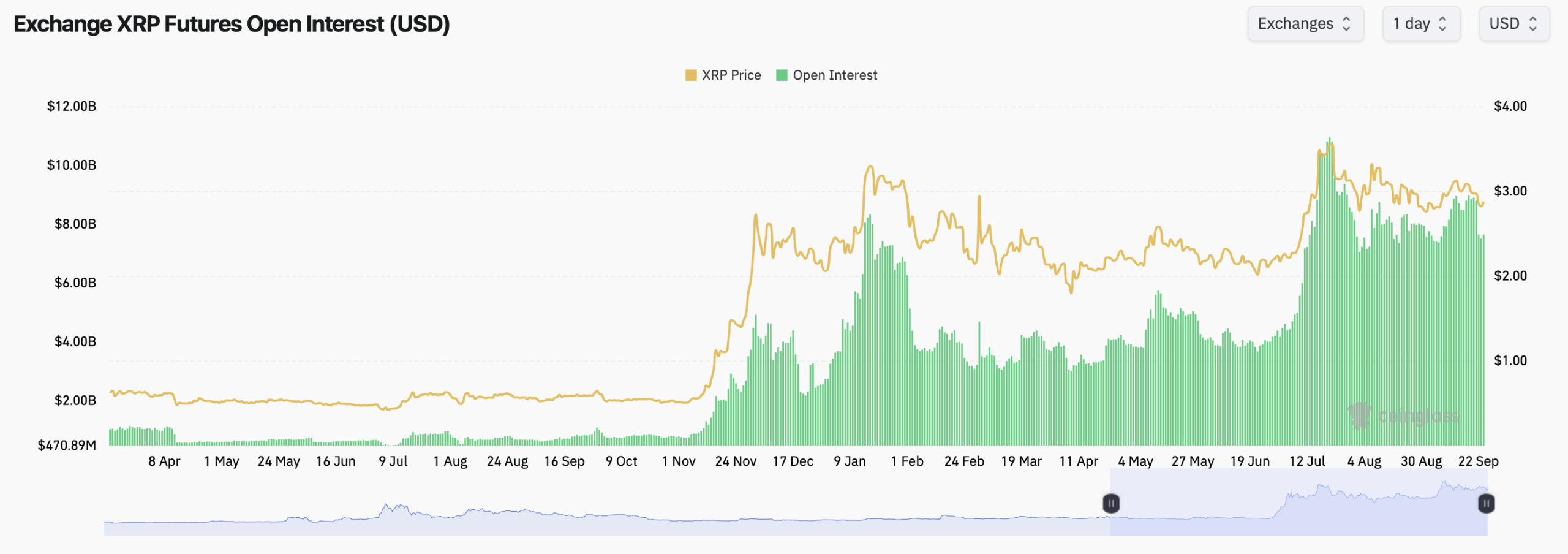

Let’s talk futures, shall we? Total open interest (OI) is sittin’ pretty at $7.64 billion across them venues, which is about 2.66 billion XRP notionally. Them folks over at Coinglass.com say Bitget’s got the biggest slice of the pie, with CME, Binance, and Bybit right behind, each holdin’ over $1 billion in OI. That’s more money than a politician’s promises! 💼💸

Hourly changes are as exciting as a sermon on a Sunday morning-leverage looks steady, not overcooked. But the venue mix? Now that’s where the action is. CME’s $1.24 billion OI shows the big boys are still in the game, while Binance and Bybit are keepin’ things spicy. 🌶️

Kucoin, Gate, OKX, WhiteBIT, BingX, and MEXC are bringin’ up the rear, thickenin’ the liquidity like gravy on a Sunday roast. Funding and basis? Well-behaved as a choirboy. On the options side, it’s all about positioning, not panic. No need to clutch your pearls just yet, folks. 🧘♂️

Over at Deribit, XRP options OI is sittin’ at 45,275 contracts, with 35,925 calls and 9,350 puts. That’s a put/call ratio of 0.26-less doom and gloom than a Twain novel. Notional value? About $130.7 million. Calls and puts traded even-steven in the last 24 hours, leavin’ the put/call volume at 0.94. Balanced like a tightrope walker with a sense of humor. 🤹♂️

Strike heat’s clustered between $3 and $4.10, with the bulkiest bars at $3.10, $3.90, and $4.10. Dealers are bettin’ on round numbers and dreamin’ of $4. Puts are hangin’ around $3-$3.30, lookin’ more like hedges than a funeral march. 🎢

Expiration risk? Front-loaded like a politician’s promises. The Sept. 26 stack’s the big kahuna, with in-the-money calls north of 20,000 contracts. Smaller stacks in late October and December mean near-dated headlines could shake things up faster than a cat on a hot tin roof. 🐱🔥

Implied volatility’s tellin’ a calmer tale. The term structure slopes downward from the mid-60s this week to the high-50s by year-end. Traders think the chop’s gonna cool off, even as OI builds. Translation: payoffs, not panic, are runnin’ the show. Cool as a cucumber, I say. 🥒

Flow color’s split like a four-way intersection-a quarter each for calls bought, calls sold, puts bought, and puts sold, with a slight lean toward put selling. Classic carry behavior-collect that premium while XRP grinds away, waitin’ for the bat signal. 🦇

Spot’s tap-dancin’ between $2.75 and $3.10. A daily close above $3.05-$3.10 could send options chasin’ toward $3.30-$3.50. Lose $2.75, and hedges’ll drive us into the mid-$2.60s faster than a hound after a rabbit. For now, the derivatives structure’s lookin’ constructive, the breadth across futures venues is healthy, and patience is payin’ off. Just like waitin’ for a good joke’s punchline. 😄

Key watch items this week: spot around $3, funding drift, CME share shifts, and those Sept. 26 expiries. Any surprises there, and the tape’ll flip faster than a pancake on a griddle. 🥞

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- Best Arena 9 Decks in Clast Royale

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-09-24 19:13