Hold onto your hats, folks! XRP has shot up to $2.84, marking a 27.9% gain over the week, with its market capitalization climbing to a whopping $167 billion—knocking Tether out of the top three cryptocurrencies. In the past 24 hours, XRP recorded a trading volume of $14.24 billion, with an intraday price range between $2.61 and $2.91.

XRP

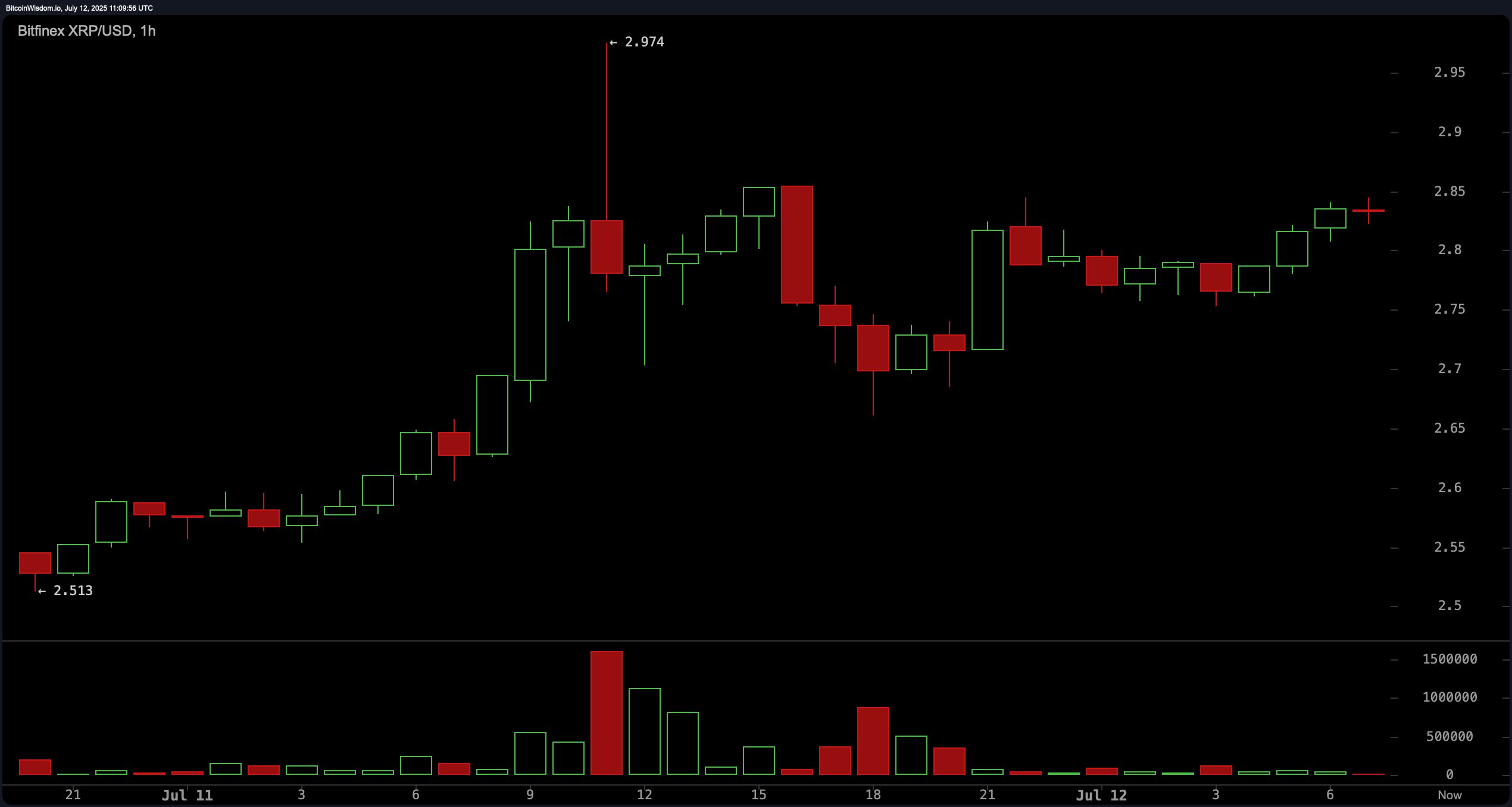

In the 1-hour chart, XRP’s recent price action is giving us a breather after its rapid ascent. After a post-rally pullback that found support around $2.70, the price has started forming higher lows, indicating renewed accumulation and building strength. Lower selling volume, following bearish spikes, suggests sellers are losing momentum. Scalpers may consider long entries around $2.78 to $2.80, though positions above $2.87 are discouraged without a corresponding increase in volume. A tight stop-loss near $2.74 is advisable for short-term plays.

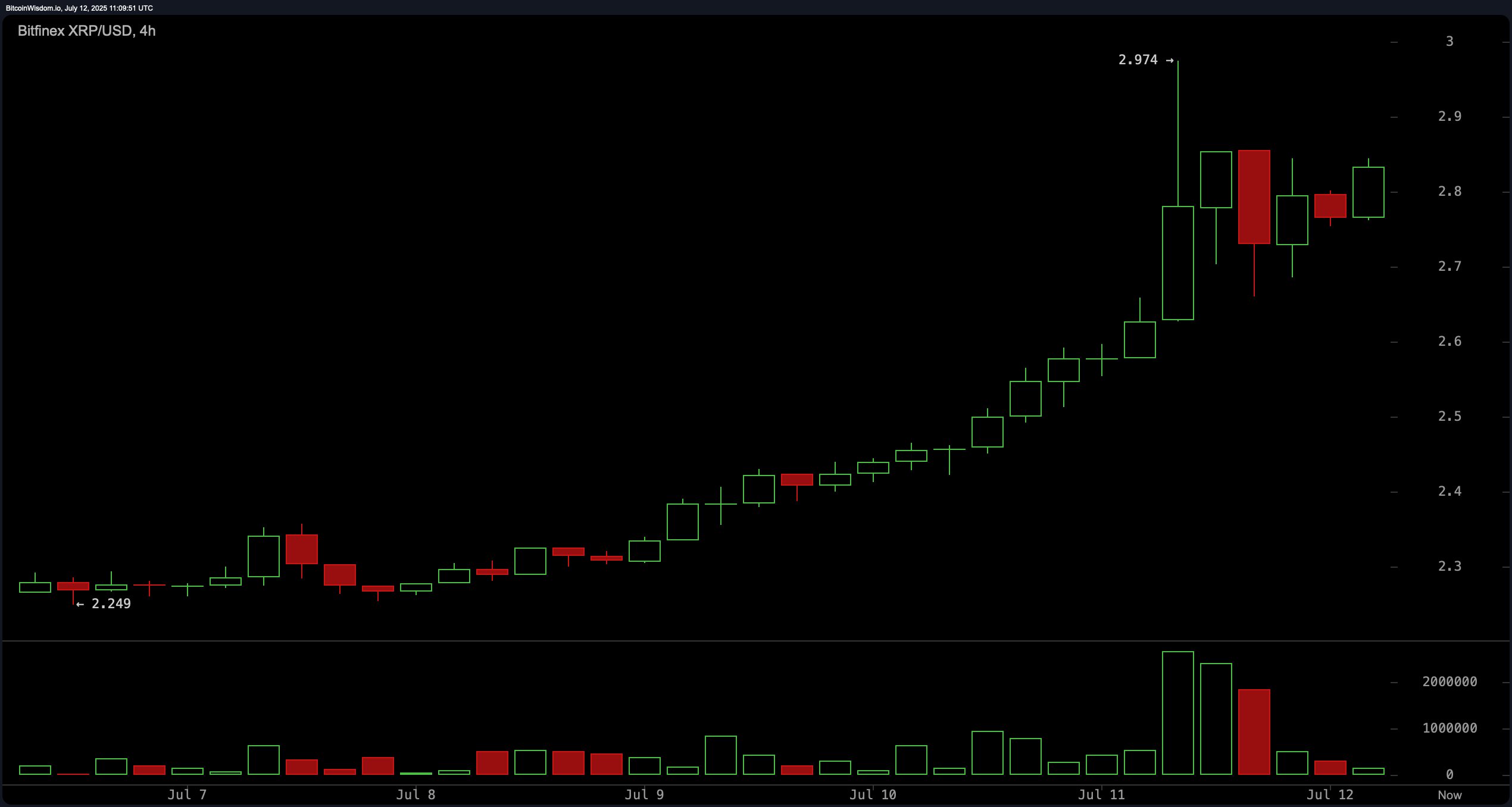

The 4-hour chart offers a view into a consolidation phase after an aggressive spike to $2.974, with XRP now oscillating above the $2.75 support. Lower volume and narrowing price ranges signal that the market is digesting the rally rather than reversing. Profit-taking has emerged, but the lack of broad sell-offs implies that bulls are merely pausing. An upside breakout above $2.90, especially with rising volume, could trigger a move toward the $3.20 to $3.40 range. Traders eyeing entries around $2.70 to $2.75 should be cautious of a stop-loss breach below $2.60.

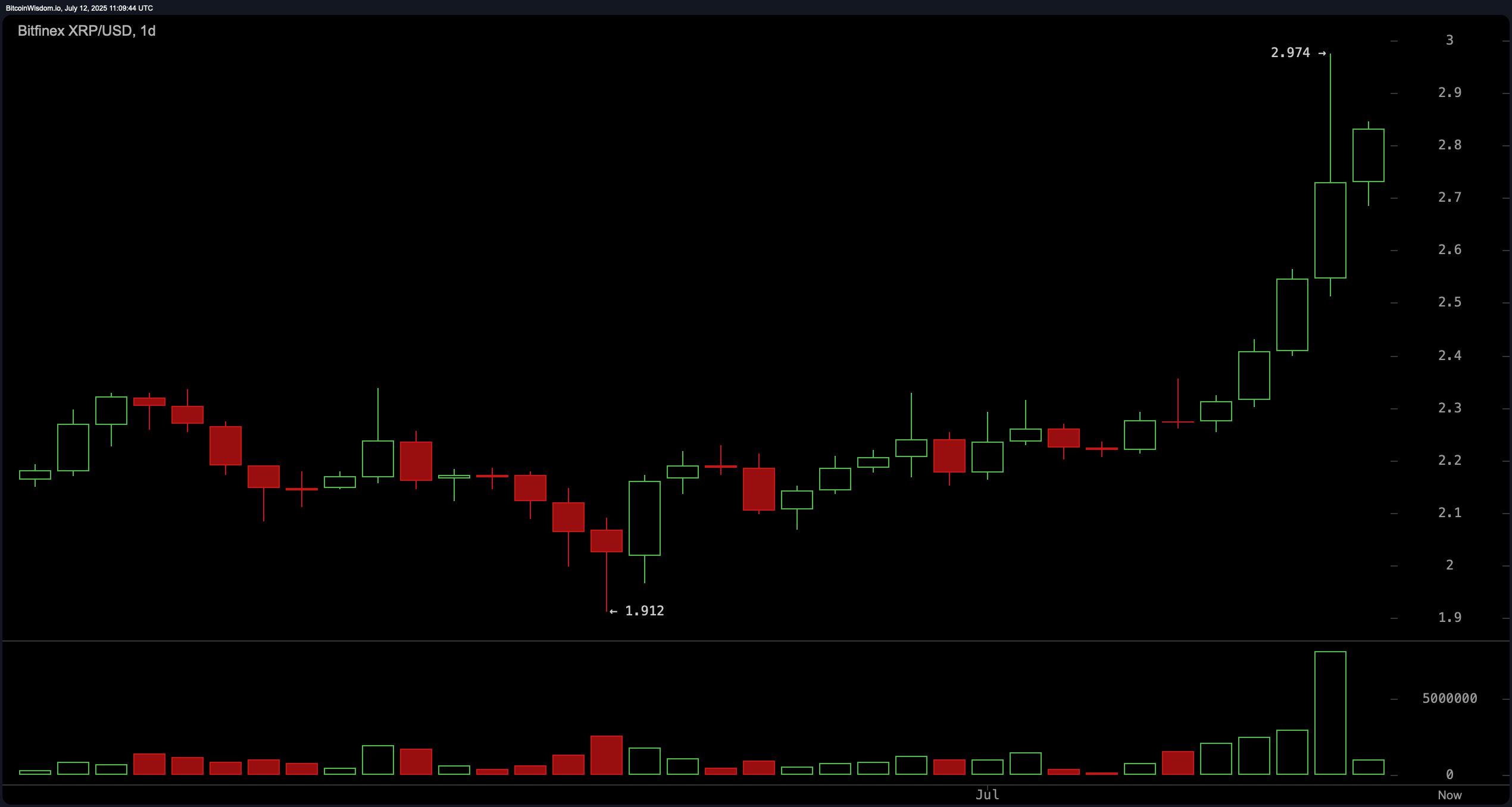

From the daily chart’s macro perspective, XRP has broken out strongly from a previous consolidation range near $2.20 to $2.30. The breakout was accompanied by large green candles and rising volume—hallmarks of institutional interest. With prices peaking near $2.974 and stabilizing in the $2.75 to $2.85 band, a retest of the breakout zone between $2.50 to $2.65 could offer a secondary entry point. However, exceeding $2.90 could attract significant selling pressure, potentially leading to a corrective move. Failure to hold above $2.50 may drag XRP back toward the $2.20 support level.

The oscillator readings provide mixed signals. The relative strength index (RSI) (14) is at 80.83, placing it in overbought territory but yielding a neutral signal. The Stochastic and commodity channel index (CCI) both flag negative signals, suggesting near-term caution. Meanwhile, the average directional index (ADX) at 25.12 and the Awesome oscillator at 0.29 remain neutral. On the bullish side, the momentum indicator at 0.60 and the moving average convergence divergence (MACD) levels at 0.11351 both indicate bullish signals, reinforcing the underlying strength despite short-term fatigue.

Across moving averages, the technical landscape is unambiguously bullish. The exponential moving averages (EMAs) and simple moving averages (SMAs) across multiple timeframes—10, 20, 30, 50, 100, and 200 periods—are all issuing bullish signals. Notably, the 10-period EMA is at $2.47572 and the 10-period SMA at $2.40660, both well below current price levels, reinforcing the ongoing uptrend. Similarly, the 200-period EMA at $2.13315 and SMA at $2.36836 further validate long-term bullish momentum. These aligned moving average signals suggest that XRP remains technically supported for higher levels, provided volume confirms future upward moves.

Bull Verdict:

XRP remains in a structurally bullish formation across all major timeframes, supported by aligned buy signals from all key moving averages and momentum indicators like the Moving Average Convergence Divergence (MACD) and Momentum. If XRP can sustain its footing above $2.75 and break through the $2.90 resistance with volume, a rally toward $3.20 and beyond appears increasingly probable.

Bear Verdict:

Despite the strong rally, several oscillators—including the Stochastic %K and Commodity Channel Index (CCI)—are flashing sell signals, and the Relative Strength Index (RSI) is in overbought territory. If volume continues to decline and XRP fails to hold the $2.75 to $2.60 support range, the risk of a deeper pullback toward $2.50 or even $2.20 cannot be ruled out.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-07-12 16:28