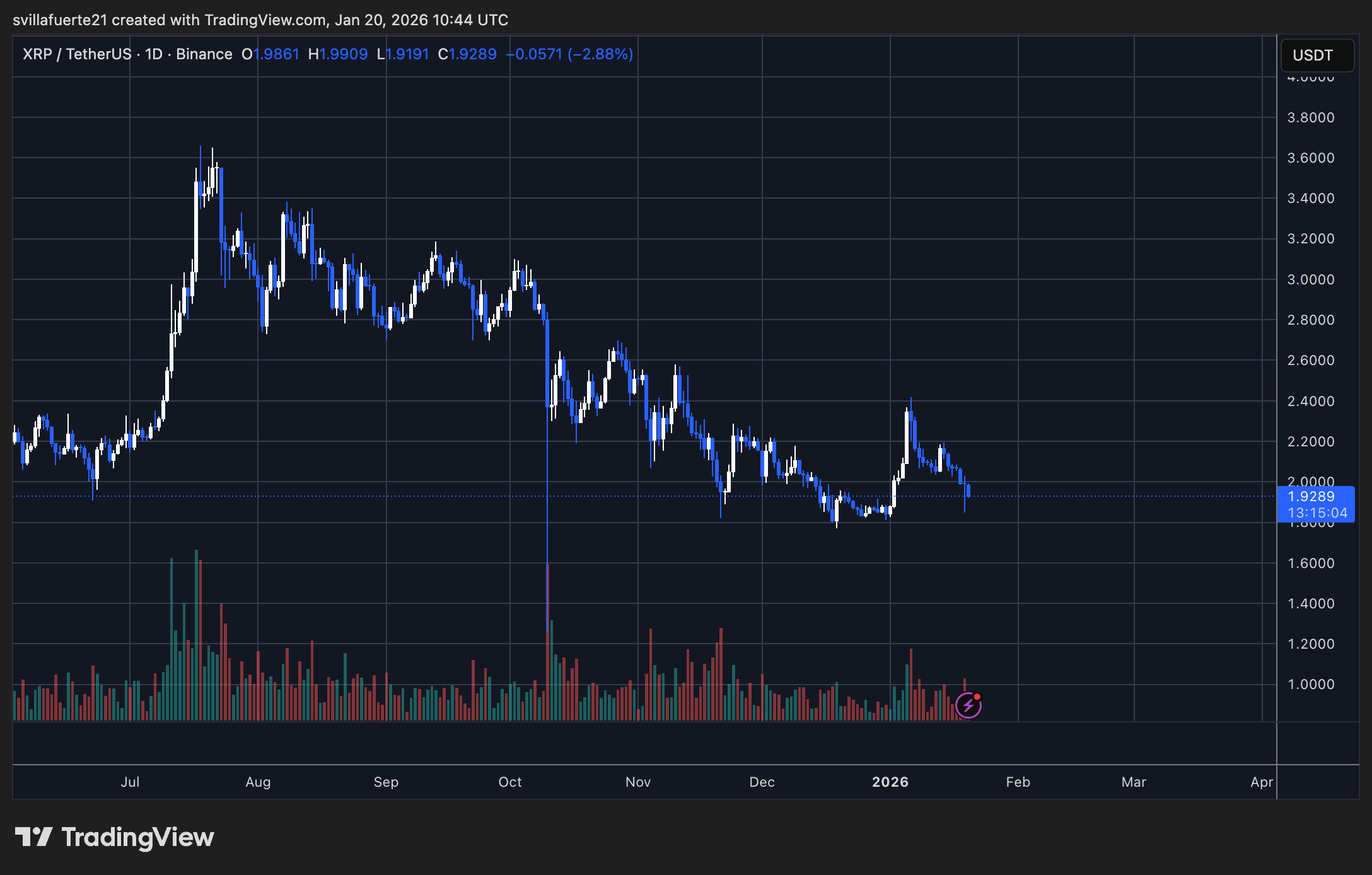

XRP, that most fickle of digital companions, has once again abandoned the $2 mark, dragging its crypto brethren into a state of genteel despair. One might almost mistake the market’s latest tantrum for a drawing-room comedy of errors, were it not for the faint scent of panic wafting through the charts. Binance derivatives data, ever the starchy British butler, reports no immediate liquidation catastrophes-a small mercy for those who forgot to pack their umbrellas for this downpour of volatility.

Open interest, that barometer of speculative fervor, now swells to $566.48 million on Binance, a sum so modest it could fit in the pocket of a particularly well-dressed hedge fund manager. The 30-day average, a mere $528.84 million, now seems almost quaint. Fresh positions, it seems, are being added with the enthusiasm of a man ordering a second round at a funeral-present, but not eager. Traders, one imagines, are sipping their leverage with the caution of someone who once mistook a cappuccino for a poison.

The 30-day Z-Score, that austere financial soothsayer, hints at a future where XRP might yet break free from its current purgatory. But for now, the price remains as fragile as a soufflé in a hurricane. Whether it ascends or plummets depends on whether liquidity returns like a long-lost heir or fear festers like an untended wound.

CryptoQuant’s Arab Chain, ever the archivist of chaos, notes that XRP’s open interest volatility has reached its highest since November-a figure so lofty it might qualify as a minor scandal in crypto society. The 30-day standard deviation ($65.7 million) suggests the market is stirring like a tea party guest who’s just discovered the sugar bowl is empty. All this turbulence, yet the Z-Score remains a demure 0.57, as if the market has been primed by a Victorian schoolmistress to behave itself.

And so, we find ourselves in a peculiar limbo: risk is rising, but leverage remains as restrained as a debutante at her first ball. Momentum simmers, but no one dares tip the scales. It is a dance of cautious optimism, where every step is calculated and every glance at the chart is a silent prayer.

XRP’s descent toward $1.90 is less a fall and more a polite decline, as if the coin were apologizing for its earlier flirtations with $2. Lower highs and lower lows paint a portrait of a market in a state of mild self-reproach. Sellers, those relentless gatekeepers, ensure that every rebound is met with a swift reminder of gravity’s persistence.

The $2.00 level, once a beacon of hope, now looms like a bad memory. Bulls, if they exist, are hiding behind the $1.85-$1.90 support zone, whispering incantations to ward off the bears. Volume, erratic as a drunkard’s gait, offers no clear path forward. The market, in its infinite wisdom, has chosen consolidation over clarity-a decision as baffling as it is inescapable.

And so, dear reader, we await the next act in this farcical opera. Will XRP reclaim its dignity above $2, or will it succumb to the whims of a crowd that clearly hasn’t read the script? The answer, as always, lies in the hands of those who dare to speculate-and perhaps a few well-placed prayers to the crypto gods.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Best Arena 9 Decks in Clast Royale

- Country star who vanished from the spotlight 25 years ago resurfaces with viral Jessie James Decker duet

- World Eternal Online promo codes and how to use them (September 2025)

- JJK’s Worst Character Already Created 2026’s Most Viral Anime Moment, & McDonald’s Is Cashing In

- ‘SNL’ host Finn Wolfhard has a ‘Stranger Things’ reunion and spoofs ‘Heated Rivalry’

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- M7 Pass Event Guide: All you need to know

- Kingdoms of Desire turns the Three Kingdoms era into an idle RPG power fantasy, now globally available

2026-01-20 22:27