Right then, XRP is dawdling about at $2.14, which, in proper money, is quite a lot, isn’t it? Market cap’s a hefty $124 billion – enough to buy a small country, probably. Trading volume? A mere $2.47 billion. Seems it’s having a bit of a think, consolidating, as they say. Poised for a breakout, maybe? Or just a bit peckish. 🤔

XRP

On the one-hour clockwork, XRP’s doing the financial equivalent of watching paint dry. Bobbling between $2.13 and $2.18, it is. Tried to leap over $2.18 a few times, but the resistance is having none of it. Volume’s dwindling, which either means everyone’s gone for tea, or it’s coiling like a spring. Scalping, you say? Risking your shirt for a few coppers between $2.13 and $2.20? Sounds like a right wheeze, as long as that pesky upper boundary holds firm. 🤪

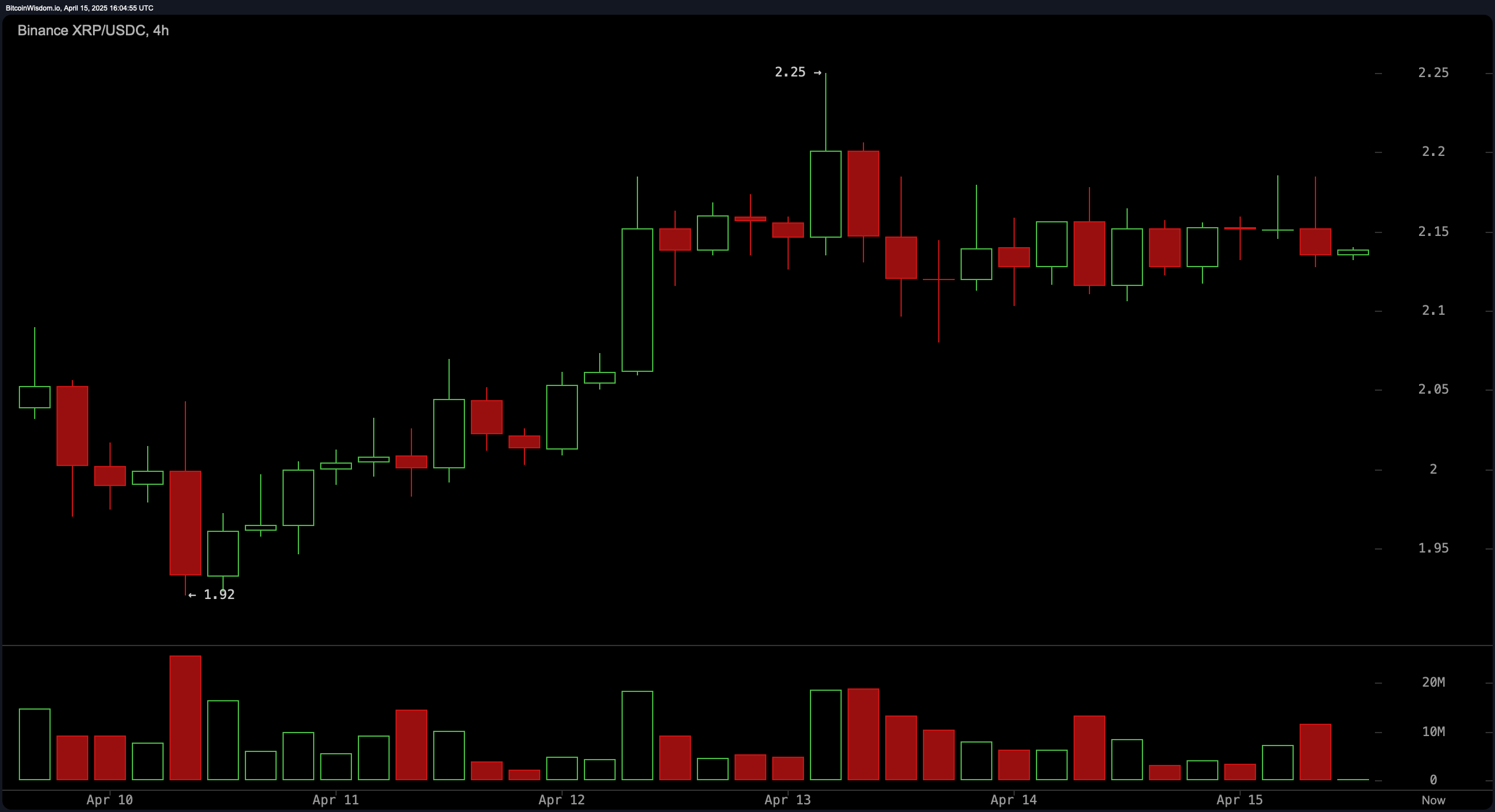

The four-hour chart is showing a bullish breakout towards $2.25, which then promptly collapsed into a consolidation phase. It couldn’t keep up the momentum, bless its little digital heart. Now it’s forming a sideways pattern, a ‘bullish flag’ or ‘pennant’, apparently. Like a tiny digital country waving a flag of surrender, or perhaps just a hankering for a picnic. Support at $1.92, resistance at $2.25. A buy entry, you say, on a ‘decisive move’? Sounds like a gamble to me, but what do I know? 🤷♂️

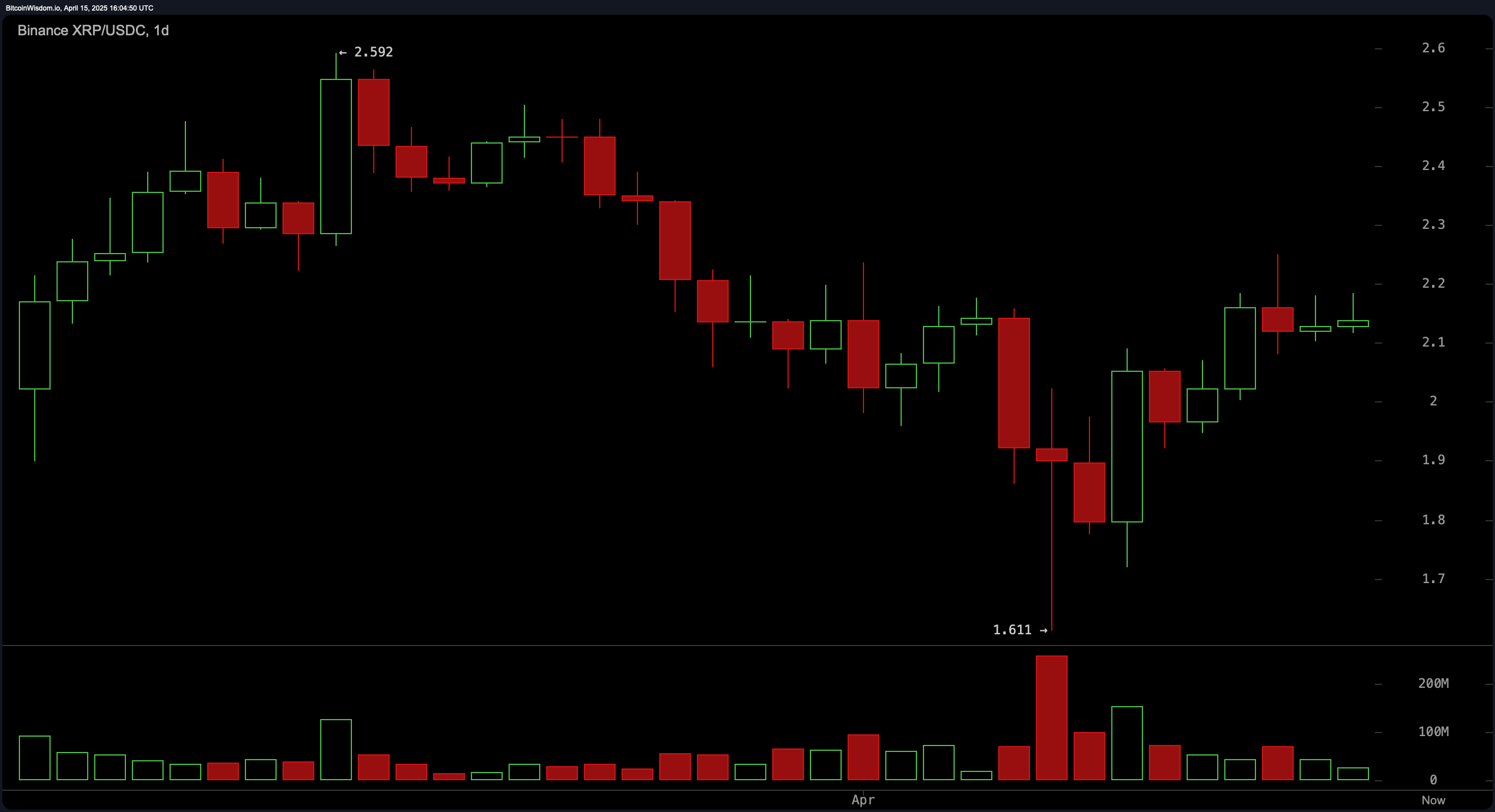

On the daily, XRP’s bounced off the bottom at $1.611 and is now wobbling around $2.10–$2.20. Bullish engulfing and doji candles, whatever those are, near support levels? Sign of a ‘potential short-term reversal.’ Volume surged during the rebound, which is good, I suppose. Resistance near $2.59, and $1.90–$2.00 as a long entry zone. Traders eyeing medium- to long-term positions might exit between $2.30 and $2.50. Seems awfully specific, doesn’t it? Like betting on which raindrop will reach the bottom first. 🌧️

Oscillators, eh? Sounds like something out of a clockwork factory. Relative strength index at 49.74954, Stochastic oscillator at 81.27979, the commodity channel index at 48.11322, the average directional index at 21.79912, and the awesome oscillator shows −0.09439. All indicating a lack of decisive momentum. The momentum indicator is flashing a bearish signal at −0.00622, while the moving average convergence divergence level reads −0.05472, offering a bullish signal. This mixed sentiment supports the view of consolidation with a slight bullish inclination. Clear as mud, right? 😵💫

Moving averages, you say? Shorter-term indicators remain bullish, with the 10-period exponential moving average at $2.08231 and the simple moving average at $2.01954, both signaling positivity. The 20-period EMA at $2.11123 and SMA at $2.07974 also reflect positive signals. However, caution is warranted as the 30-period EMA and SMA at $2.15666 and $2.18777, respectively, indicate bearish signals. This divergence extends to longer-term signals where both 50- and 100-period EMA and SMA suggest bearish sentiment, while the 200-period EMA and SMA at $1.95638 and $1.90439 revert to bullishness, pointing to a strong long-term foundation despite mid-term uncertainty. Blimey, that’s a lot of numbers. I’m off for a pint. 🍺

Bull Verdict:

XRP’s current technical posture reflects a market in consolidation with a bullish undertone, supported by short-term buy signals from the 10- and 20-period moving averages and a rebound from a well-established support zone. If XRP can break through the $2.25 resistance on strong volume, the bullish flag formations on the 4-hour chart may catalyze a run toward $2.40 and beyond, reinforcing the potential for further upside in the near term. So, it might go up. Or it might not. 🤷

Bear Verdict:

Despite some early signs of strength, XRP faces multiple headwinds with mid-range moving averages flashing sell signals and oscillators largely neutral or showing weakness, such as the momentum indicator. Failure to breach the $2.18–$2.25 resistance zone could result in renewed selling pressure, dragging the price back toward the $2.00 level or lower, particularly if volume continues to taper off and bullish continuation patterns fail to confirm. So, it might go down. Or it might just stay put. 😴

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Witch Evolution best decks guide

- Best Hero Card Decks in Clash Royale

2025-04-15 19:57