Markets

A Most Unfortunate Turn of Events:

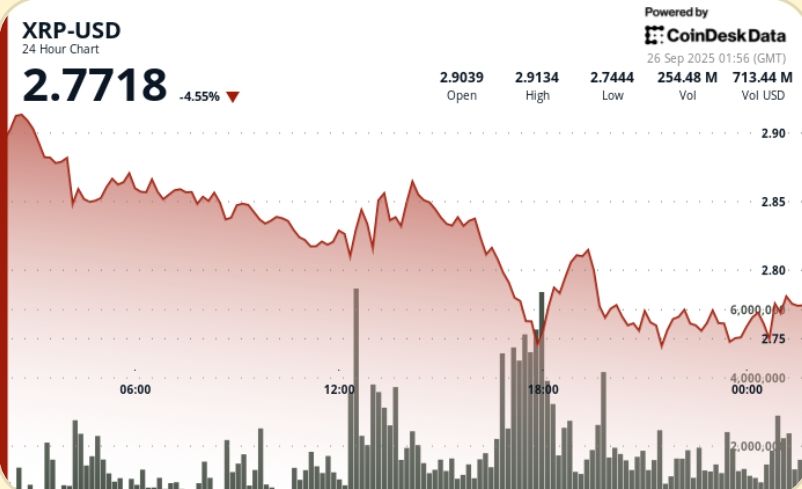

- XRP, the digital flibbertigibbet, took a most ungracious tumble from $2.92 to $2.75 – dashed hopes and all, thanks to some frightfully serious institutional selling.

- The market value, bless its fluctuating heart, shrank by rather more than $18 billion over the week. One shudders to think! A breach of the $3.00 mark, quite dreadful.

- Traders are now holding their breath, pondering whether $2.75 can possibly hold, or if XRP is destined for a further descent towards the $2.70 vicinity. Oh, the suspense!

XRP’s attempt to soar above $2.90, a rather bold endeavor, was summarily squashed by a sudden outbreak of selling on September 25th. A positively enormous volume spike – $277 million, no less! – rather rudely pushed the price back down to $2.75. 😒

This little mishap wiped out a staggering $18 billion in market value over the past week, and confirmed that $2.80 is, for the moment, quite insurmountable. Traders, naturally, are bracing themselves for a potential test of the $2.70 support. One wouldn’t want to be caught unprepared, what!

A Bit of Background, If One Must

• XRP slipped a rather disheartening 5.83% between September 25th and 26th, falling from $2.92 to $2.75 due to, you guessed it, those frightfully determined institutional sellers.

• A sharp rejection at $2.80 caused a volume spike of 276.77 million – more than 2.5 times the daily average. Excessive, one might say! 🙄

• Despite the glimmer of hope offered by SEC approval of a U.S. XRP ETF, optimism seems to have been dampened by Mr. Powell’s gloomy predictions and those ever-climbing Treasury yields.

• In the last week, XRP’s market value has contracted by $18.94 billion, a decline of 10.22%, and taken a most unceremonious dip below the $3.00 psychological threshold.

$0.18 (6.3 %) between the rather lofty $2.92 high and the somewhat less impressive $2.74 low.

• Resistance: $2.80 initially, and then the $2.81-$2.82 clusters.

• Support: $2.75, for the moment, but $2.70 looms.

• Volume: A staggering 276.77M at 17:00, versus a modest 108.42M daily average.

• Pattern: A high-volume rejection suggests distribution. Short-term indecision reigns, naturally.

What the Clever People Are Observing

• Whether $2.75 can withstand the onslaught of the Asian session, or if it will crumble towards $2.70.

• The eternal question: ETF optimism versus real money outflows. It’s a ‘sell-the-news’ sort of situation, you see. 🧐

• Whale activity is being monitored after a substantial $800M in transfers over the past week. Prudent, I should think.

• And finally, the macro-economic overhang: Mr. Powell’s stern warnings, rising yields, and the dashed hopes for a swift Fed cut.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- Country star who vanished from the spotlight 25 years ago resurfaces with viral Jessie James Decker duet

- ‘SNL’ host Finn Wolfhard has a ‘Stranger Things’ reunion and spoofs ‘Heated Rivalry’

- M7 Pass Event Guide: All you need to know

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- JJK’s Worst Character Already Created 2026’s Most Viral Anime Moment, & McDonald’s Is Cashing In

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

2025-09-26 05:55