and no extra text outside the html tags.

I must produce the final answer in HTML format. I’ll produce the final answer accordingly.

I’ll now produce the final HTML document.

I’ll produce an HTML document with

Ah, the audacious crypto investor! One must be as bold as a lion and as cautious as a cat when treading the treacherous terrain of low-cap altcoins. For while these digital darlings are known to multiply one’s fortune with the zeal of a Midsummer Night’s dream, they are equally fated to lead one to ruin should fortune turn her fickle face away. 😏

One ponders: should one be so bold as to invest in these capricious coins in July, when the so-called altcoin season has begun? After all, in this grand casino of speculation, are we not but mere pawns? 🎰

Opportunities and Perils: The Low-Cap Altcoin Conundrum of Q3 2025

Though the total market cap has soared to new heights in July, capital has flown mainly into the stalwart Bitcoin and its more reputable altcoin kin. Yet, the unwary investor must remember that not all that glitters is gold. 💎

Indeed, TradingView data—that modern oracle of market trends—reveals that while the total crypto market cap inches toward a staggering $4 trillion, the market cap sans the top 100 altcoins lingers at a mere $15.4 billion. One might say the market is a vast ocean, where only the mightiest of waves are worth a second glance. 🌊

Furthermore, CoinMarketCap data proclaims that the top 100 altcoins each boast a market cap of over $700 million. Thus, coins outside this illustrious group are unceremoniously relegated to the realm of mid-cap or low-cap obscurity. Who knew that money, like beauty, lies not in the eye of the beholder but in the depths of the market cap? 😏

This glaring disparity in capital allocation suggests that investors, in their infinite wisdom, remain ever so cautious. They flock to altcoins blessed with high liquidity or those that have captured the fickle affections of institutional players and listed companies. For what is money if not a reflection of trust? 🤑

Yet, another school of thought offers a glimmer of hope. Some sagacious analysts maintain that the current capital inflow is but in its infancy. Ah, the sweet promise of early adoption, where the early bird may indeed catch the worm! 🐍

PHASE 2 IS HAPPENING NOW.

ALTCOINS ARE ABOUT TO EXPLODE.

WE WILL ALL GET RICH SOON!

— Mister Crypto (@misterrcrypto) July 22, 2025

Many analysts echo Mister Crypto’s sentiments. They assert that the market lingers in the throes of phase two, wherein investors, like moths to a flame, favor Ethereum. And yet, as the wheel of fortune turns, capital will eventually flow to large, mid, and low-cap coins alike. It is an opportune moment for the astute investor to pounce, to secure a bargain before the masses descend. 🎩

This ephemeral delay creates a window of opportunity for those with a palate for risk to acquire these coins at a princely price. For is it not said that fortune favors the bold? 🍾

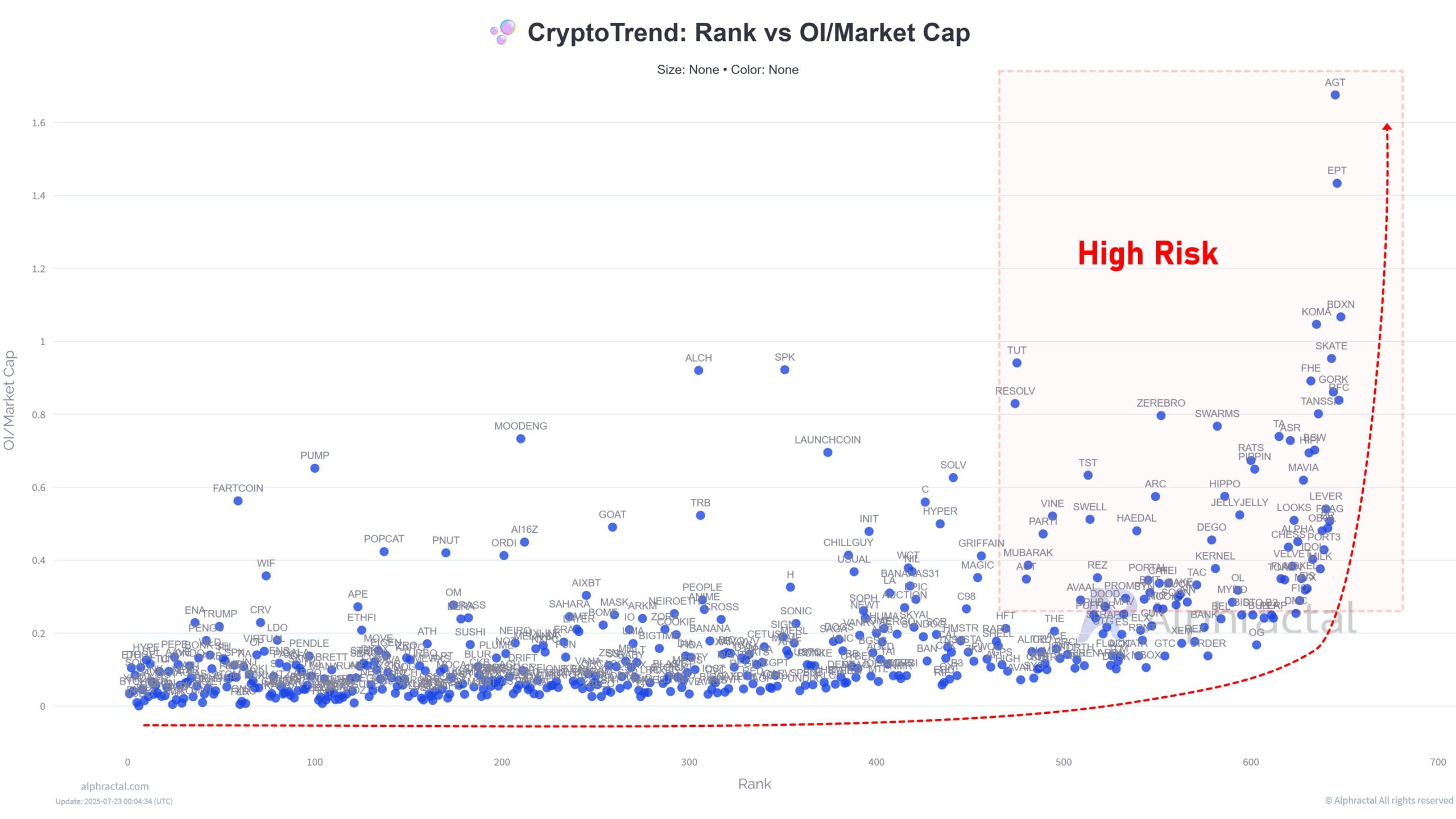

Nevertheless, not all experts share in this buoyant optimism. The venerable João Wedson casts a pall of skepticism on those ultra-low-cap altcoins—particularly those languishing outside the top 300. These coins, typically valued at less than $200 million, are seen as nothing short of a modern-day financial roulette. He cites the Open Interest to Market Cap Ratio as a dire warning signal. Indeed, the math of the market is a merciless mistress. 📉

It appears that data reveals a veritable tempest: open interest for coins beyond the top 300 is alarmingly high relative to their market caps. When open interest significantly overshadows market capitalization, it signals that traders are indulging in a frenetic dance of derivatives rather than committing to the spot markets. The result? A lamentable state of low liquidity and extreme volatility. One might almost pity these coins, caught in a whirlwind of uncertainty. 🎢

“From the Top 300 down, Open Interest becomes disproportionately high compared to Market Cap — a strong risk signal. What does this mean? These altcoins will eventually liquidate 90% of traders, whether they’re long or short. They are also much harder to analyze with consistency,” João Wedson explained.

As the digital town crier on X spreads the electrifying news of altcoin season, one is left to ponder: should investors really be enticed to buy these low-cap altcoins in Q3/2025? The answer, dear reader, lies in one’s own appetite for risk and the whims of one’s investment strategy. After all, in the grand casino of life, fortune is but a fickle friend. 🎲