So, Chainlink decided to take a little nap and sold off, kinda like when you realize your ex was actually terrible all along. 💤 Bitcoin and the other crypto kids followed suit—who knew they had feelings? Anyway, LINK plummeted to $13.70 on Monday, which is basically the financial version of hitting rock bottom since May 8. That’s 23.75% below its peak. Ouch. But don’t worry, here come the reasons why LINK might just pull a Lazarus and climb back up.

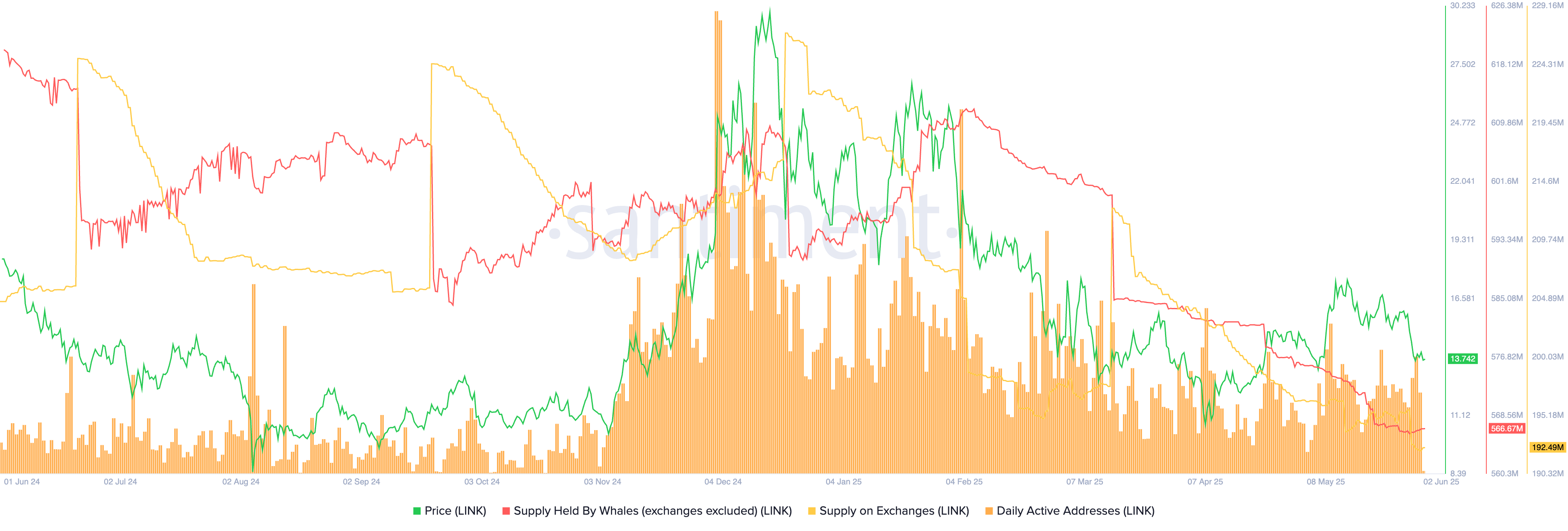

The big news? Less LINK sitting on exchanges, more in the hands of the cool kids who actually believe in the long game. Data from Santiment shows that exchange-held tokens have dropped from 226 million to 192 million since November 2023. That’s like shedding baggage before boarding the bullish plane—good vibes only. ✈️

And those good vibes are backed by some serious bells and whistles—JPMorgan, ANZ Bank, UBS, Coinbase, Solv Protocol, and Swift are all cozying up with Chainlink. They’re thinking, “Wow, this stuff might be useful for real-world assets,” or maybe they just liked the logo. Either way, Chainlink’s Cross-Chain Interoperability Protocol is out here making friends and influencing blockchains, which is technically what it was designed to do. It’s like the diplomatic envoy of the crypto world.

Chainlink totally dominates the oracle scene, managing over $43 billion in assets across DeFi playgrounds. Its runner-up, Chronicle, is chilling at $7.4 billion—basically a pocket change. 😎

Whales Are Chill Again

Turns out, the whales—those giant holders—have paused their shopping spree. Whale-held supply just nudged up from 565.9 million to 566.67 million tokens. It’s like they finally looked at the market and said, “Hey, maybe now’s a good time to buy more?” This could mean the end of the March-selling madness, where whales piled up nearly 612 million coins. If they keep piling in, we’re probably looking at a bullish party up ahead. 🎉

Meanwhile, activity on the network is picking up—daily addresses are getting busier, cracking open the door for a bullish breakout. Or, at least, that’s the hope.

The Technical Soap Opera: Harmonics and Patterns

On the chart, things are looking spicy. There’s a harmonic pattern forming—like a good plot twist—called the XABCD formation. Basically, LINK is lining up for a major breakout if this pattern plays out. Here’s the quick rundown:

- The XA leg was the March-July 2024 saga.

- The AB correction drama unfolded July to November.

- The BC leg has been extending since November—probably planning a grand finale in April 2025.

If everything aligns (fingers crossed), the CD leg will push LINK up to $30.92, roughly 125% higher than its current sad state. Basically, it’s the market’s version of “not today, bear!”

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Best Hero Card Decks in Clash Royale

- Clash Royale Witch Evolution best decks guide

- Clash Royale Furnace Evolution best decks guide

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-06-02 19:49