Dear darlings, this week our beloved Bitcoin has played footsie within the modest confines of $83,268 to $85,917, with a coy flirtation down to $74,434 on April 6—scandalous, I know! Some rather gloomy sorts opine that the bullish parade has trotted offstage. Should the pinnacle have graced Trump’s grand entrance as the 47th U.S. President, well, one wonders if Bitcoin’s encore might be a nosedive encore. Oh, the drama! 🎭

Bitcoin’s Soiree Between $83K and $86K as the Great Peak Gossip Persists

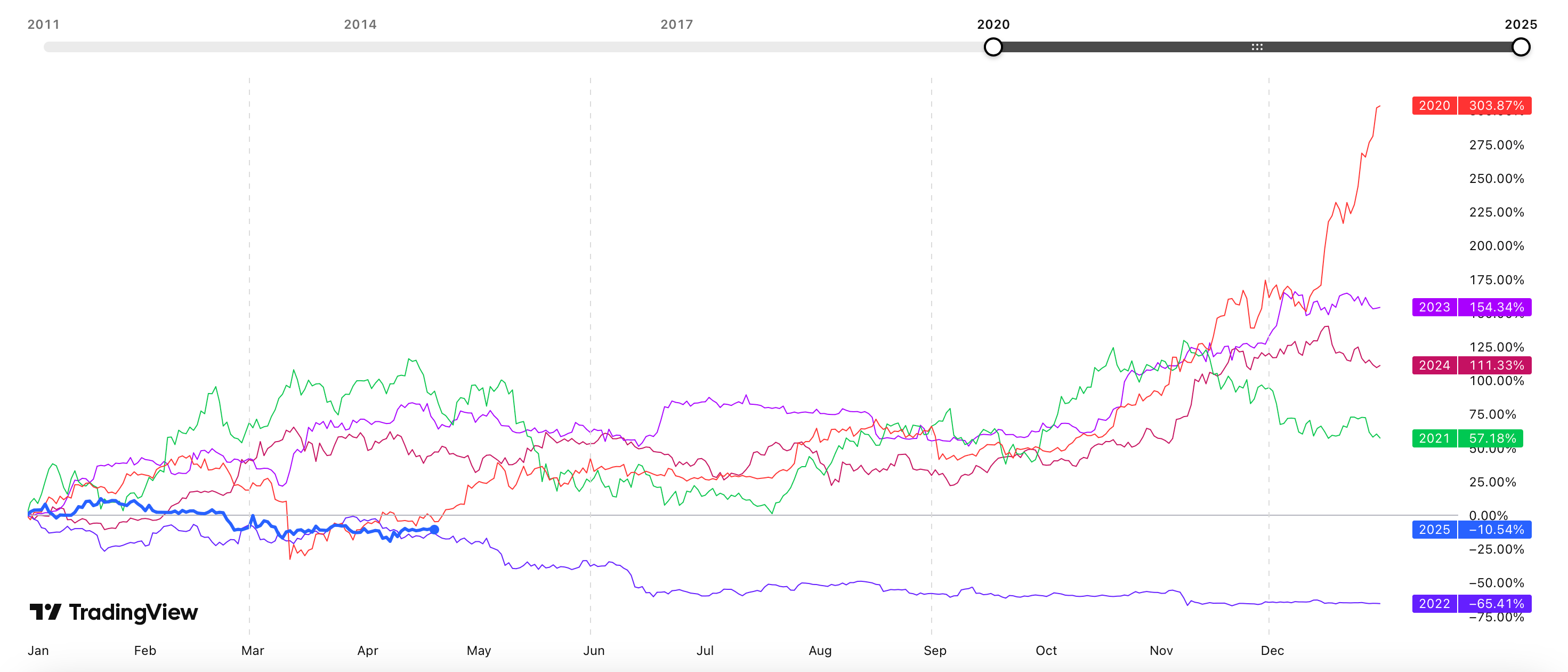

Nearly three months ago, on January 20, 2025, our star performer Bitcoin sashayed to its dizzying record high of $109,356 per glittering coin. Since then, murmurs of a bear market have rustled through the parlors (quite the party poopers), claiming the climax was set that very day. Should these naysayers be right, brace for a gloomy intermission lasting from ten to thirteen months—a soufflé that might rise again between February 19 and May 19, 2026. Patience, my dear, patience.

Assuming the bear market wraps up with all the grace of a curtain call within that timeframe—though history has a cheeky habit of overstaying its welcome, as it did post-2021’s bull run—Bitcoin (BTC) has been known to pirouette downward by 78% to 84% from its former dizzying highs. A bit of arithmetic suggests an 80% plummet would land us at a mere $21,871 (a bargain basement sale!), whereas a gentler 70% dip rests around $32,806—still enough to make one clutch their pearls, if not their wallets.

Now, a 60% retreat from our January 20 spectacle equals approximately $43,742, which in bear territory is practically a cordial nod. Meanwhile, our often less sensible friends, the altcoins, have historically taken swan dives of 70% or more, some plummeting past 90%—especially the ones lacking charm or those pesky ‘communities’. Take Ethereum (or ETH, to those on intimate terms), which tiptoed to $4,111 in mid-December 2024, and now flirts with an 80% nosedive close to $822—a tragicomedy of losses indeed. At present, ETH has already shed 66.36%, really making a melodramatic exit since December 15.

As Bitcoin braces for what may be an extended downturn, investors find themselves clutching their monocles and peering keenly at support levels and market signals. History, that stern schoolmistress, advises recovery might be months hence, testing the mettle and manners of all involved. Analysts cheekily suggest that risk management and portfolio diversity—fancy words for ‘don’t put all your eggs in one crypto basket’—are the keys to survival. The coming acts promise to reveal if Bitcoin’s spirit shall endure, or if the curtain falls on a deeper gloom shadowing digital fortunes and strategies. 🎩🐻

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- Best Hero Card Decks in Clash Royale

2025-04-20 19:57