In news that may encourage miners everywhere to start hoarding lucky socks, Bitcoin miners managed to come up $40 million short in April compared to March—marking four straight months of ever-thinning wallets and much gnashing of ASIC teeth.

April’s Revenue? About as Stable as a Wobbly Ladder

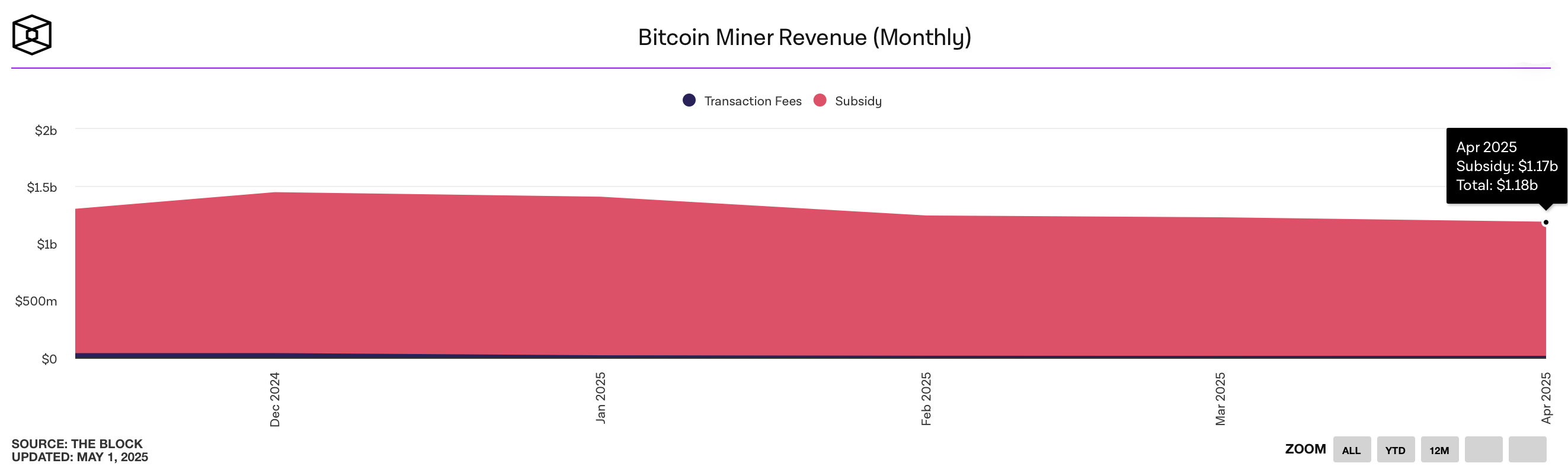

Sure, the drop wasn’t the kind that makes you leap out of your chair and look for a parachute. But a contraction is still a contraction—even if it’s wearing a polite hat. In April, those brave (or stubborn) souls known as bitcoin miners made off with $1.18 billion in total revenue—block subsidies and transaction fees bundled together like a suspiciously light fruitcake, according to data unearthed by theblock.co. The fees alone accounted for a mere $15.65 million (yes, consider buying that second coffee). For comparison, March’s piggy bank had $1.22 billion in it, so April’s piggy really needs a good meal and probably a holiday. 🐷

Curiously, despite everything getting soggier, April managed to wring out a little more in transaction fees: $15.65 million versus March’s $15.11 million. Perhaps the blockchain gods just wanted miners to have one nice thing. This all unfolded while the BTC price puffed itself up like a rooster and hashprice—the “you might get rich, honest” rate per PH/s—actually ticked upward.

Hashprice on April 1: $46.88.

Hashprice by May 1: $50.26.

That’s right, miners were almost able to afford real food. Nearly.

But—there’s always a but, isn’t there?—network difficulty currently lounges at a record 123.23 trillion, occasionally glancing at hopeful miners and muttering, “Not today.” With block times slowing down to the pace of a municipal committee meeting, rumor has it the upcoming difficulty tweak on May 4, 2025, will drop the challenge by 5.47%. Fingers crossed. Or maybe toes, because miners are running out of fingers.

So what’s propping this all up like a wobbly bookshelf? Barely, it’s price appreciation. The long and short of it: miners are clinging to efficiency like a wizard to his pointy hat, with monthly earnings shrinking but not yet vanishing entirely. Market equilibrium is now a delicate tightrope walk. Those who can’t balance? Well, let’s just say there’s always cat-sitting. 🐈⬛💸

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Clash Royale Furnace Evolution best decks guide

- M7 Pass Event Guide: All you need to know

- Clash of Clans January 2026: List of Weekly Events, Challenges, and Rewards

- Best Arena 9 Decks in Clast Royale

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Witch Evolution best decks guide

2025-05-01 23:30