What to know:

- So, there’s a tidal wave of bitcoin treasury companies out there, all trying to hoard as much bitcoin as possible. It’s like a digital gold rush, but with fewer pickaxes and more spreadsheets.

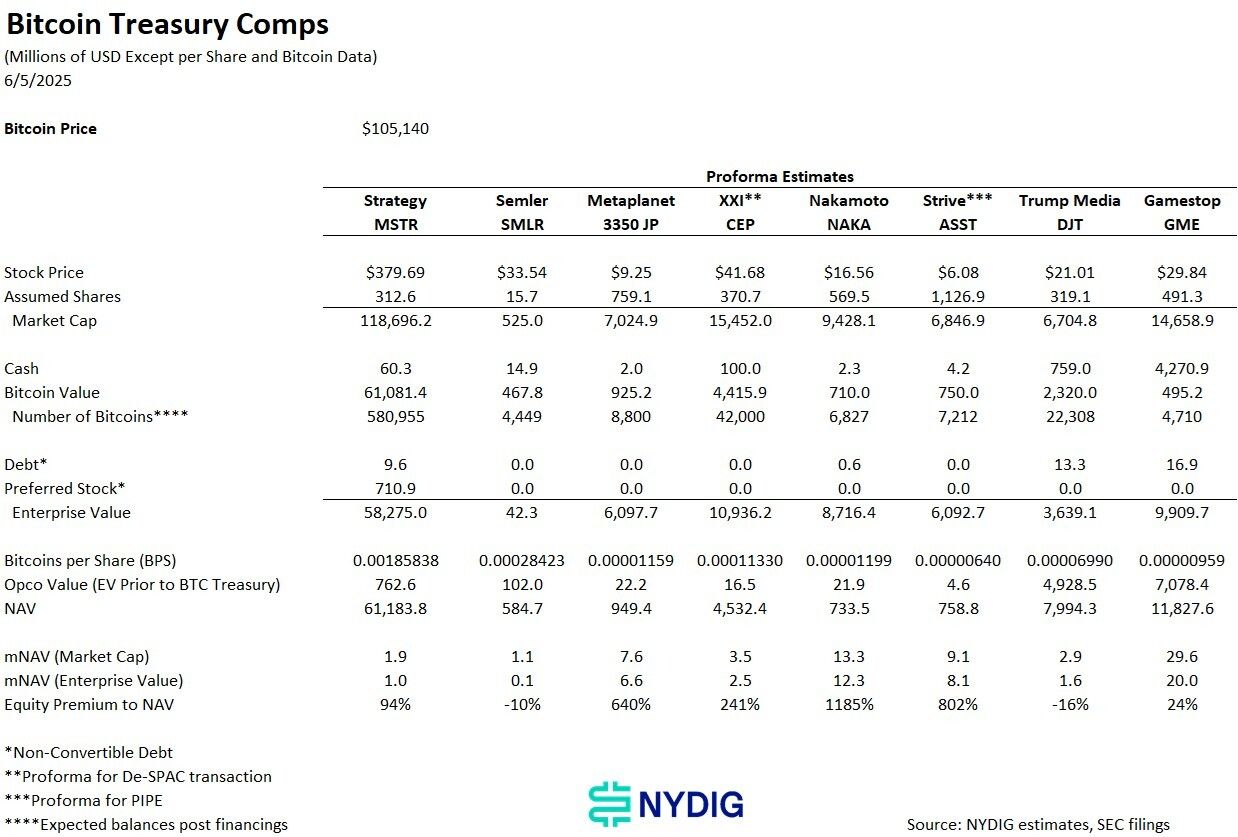

- Now, while mNAV is the go-to metric for valuation, NYDIG’s head honcho of research thinks it’s about as useful as a chocolate teapot on its own. He suggests mixing it up with a cocktail of other metrics for a proper analysis. 🍹

Picture this: a tsunami of bitcoin treasury companies—yes, firms that are practically married to bitcoin—are crashing onto the market like they’re auditioning for a reality show. 📺

Since they’re all basically following Strategy’s (MSTR) playbook, the big question is: how do we even begin to value these companies? It’s like trying to compare apples to… well, more apples, but some are shiny and some are a bit bruised.

“The most important metric for a bitcoin treasury is the premium it trades at relative to its underlying net assets, including any operating company,” Greg Cipolaro, the bitcoin guru at NYDIG, wrote in a report that’s probably more riveting than your average thriller novel.

In layman’s terms, this means you add up the company’s bitcoin, cash, and all that jazz, then subtract any debts. It’s like figuring out how much money you have after your friend borrows $20 and never pays you back. “It’s this premium that allows these companies to convert stock for bitcoins, effectively acting as a money changer converting shares for bitcoins,” Cipolaro said. Because who doesn’t want to be a money changer, right?

One of the most popular metrics, mNAV, is like the report card for a company’s valuation against its net asset value—basically, their bitcoin stash. If mNAV is above 1.0, it’s like getting a gold star; below 1.0? Well, that’s just sad. 😢

But hold your horses! mNAV alone is “woefully deficient” for analyzing these firms, according to Cipolaro. The report throws in other metrics like NAV, mNAV by market cap, and equity premium to NAV to paint a more colorful picture. Think of it as adding sprinkles to your ice cream—necessary for a complete experience!

Now, here’s the kicker: Semler Scientific (SMLR) and Trump Media (DJT) have the lowest equity premium to NAV of the eight companies measured, sitting at -10% and -16% respectively. It’s like they’re the wallflowers at the bitcoin party, even though they have an mNAV above 1.1. Awkward! 😬

And guess what? Both SMLR and DJT are barely budging on this fine Monday, even as bitcoin climbs to $108,500 from Friday’s $105,000. Meanwhile, MSTR is strutting its stuff with a nearly 5% increase. Talk about a rollercoaster ride! 🎢

Read More

- Clash Royale Best Boss Bandit Champion decks

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Best Hero Card Decks in Clash Royale

- Clash Royale Furnace Evolution best decks guide

- Best Arena 9 Decks in Clast Royale

- Dawn Watch: Survival gift codes and how to use them (October 2025)

- Clash Royale Witch Evolution best decks guide

- Wuthering Waves Mornye Build Guide

- ATHENA: Blood Twins Hero Tier List

2025-06-09 22:42