So, MANTRA (OM) did a nosedive the likes of which would make your stock portfolio weep quietly in the corner. Investors? Left clutching their bags, wondering if they accidentally joined a bad comedy instead of crypto.

We got a bunch of so-called “experts” to poke around the wreckage and boil down the five glaringly obvious reasons this thing went kablooey. And yep, there are some strategies if you want to live to invest another day.

MANTRA (OM) Crash: The Crystal Clear Signs Everyone Missed Because Ego

On April 13, BeInCrypto dropped the bomb that OM plummeted 90%. Investors started whispering about pump-and-dump, and honestly? The red flags were waving like they wanted to be noticed.

But nobody cared. Because optimism, right?

1. MANTRA Tokenomics—or how to confuse everyone in one move

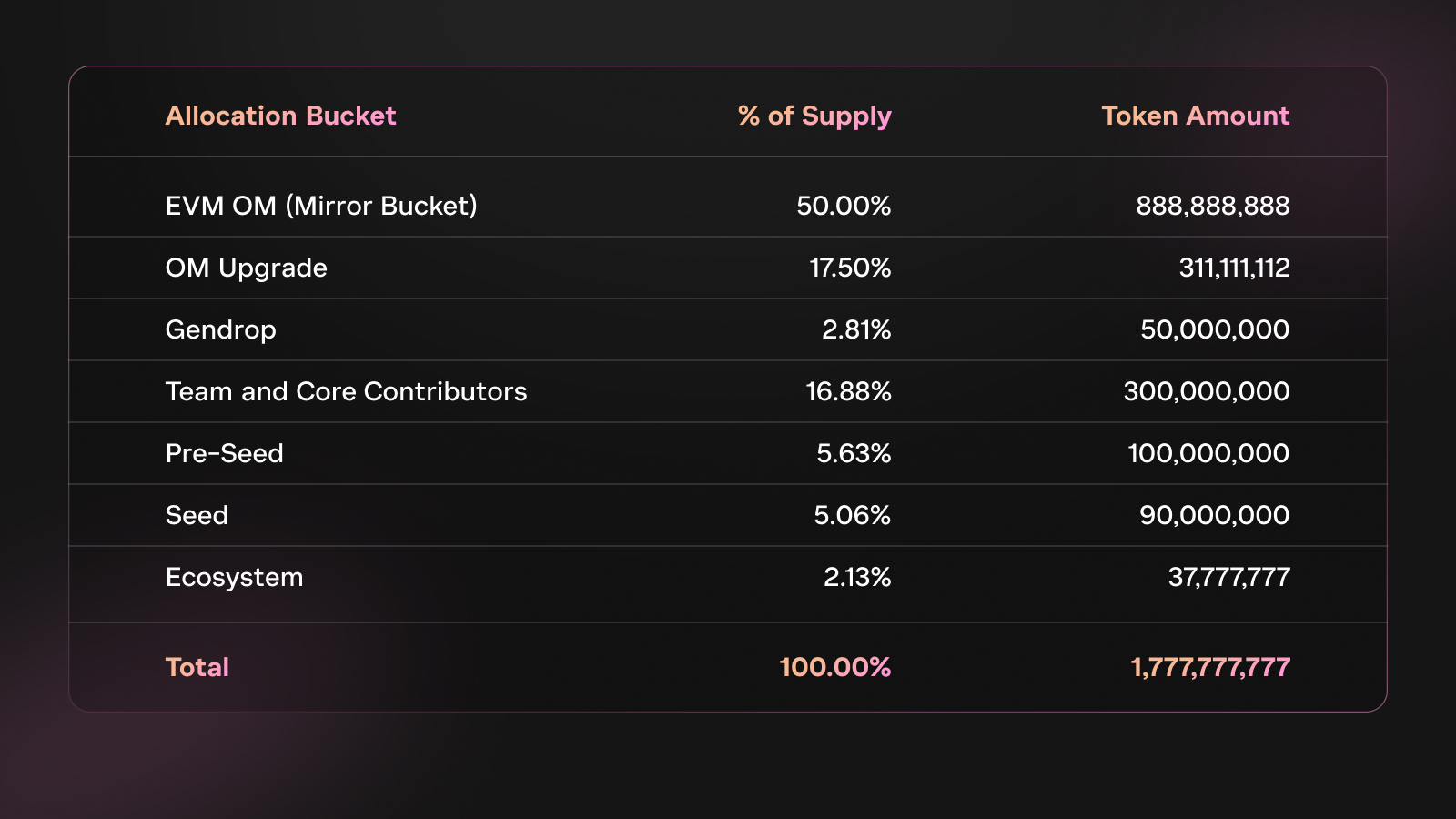

In 2024, OM flipped the script, changing tokenomics after a community vote (yeah, a vote!) and went from ERC20 to their own “native L1 staking thing.” Plus, they threw out the token cap like it was last season’s pants.

The supply ballooned to 1.7 billion tokens. That’s right—more tokens than your phone’s storage can handle.

Jean Rausis from SMARDEX summed it up perfectly:

“They doubled supply, went inflationary, insulated insiders with complex vesting, and hyped it like a Vegas show. Price manipulation? Oh yeah.”

And hold on—90% of the tokens were with the team. Because what says “decentralized” better than one group pulling all the strings? Phil from Cork basically called it:

“Team control over supply and governance equals red flag city. Manipulation central.”

Pro Tip:

Phil says don’t freak out if a few whales hold a lot, but maybe find out who those whales are, if they’re locked up, and whether they’re actually planning to play nice. Ming Wu chimes in:

“Bubble maps! They’re like creepy neighbor’s binoculars but for your tokens, helping spot potential trouble.”

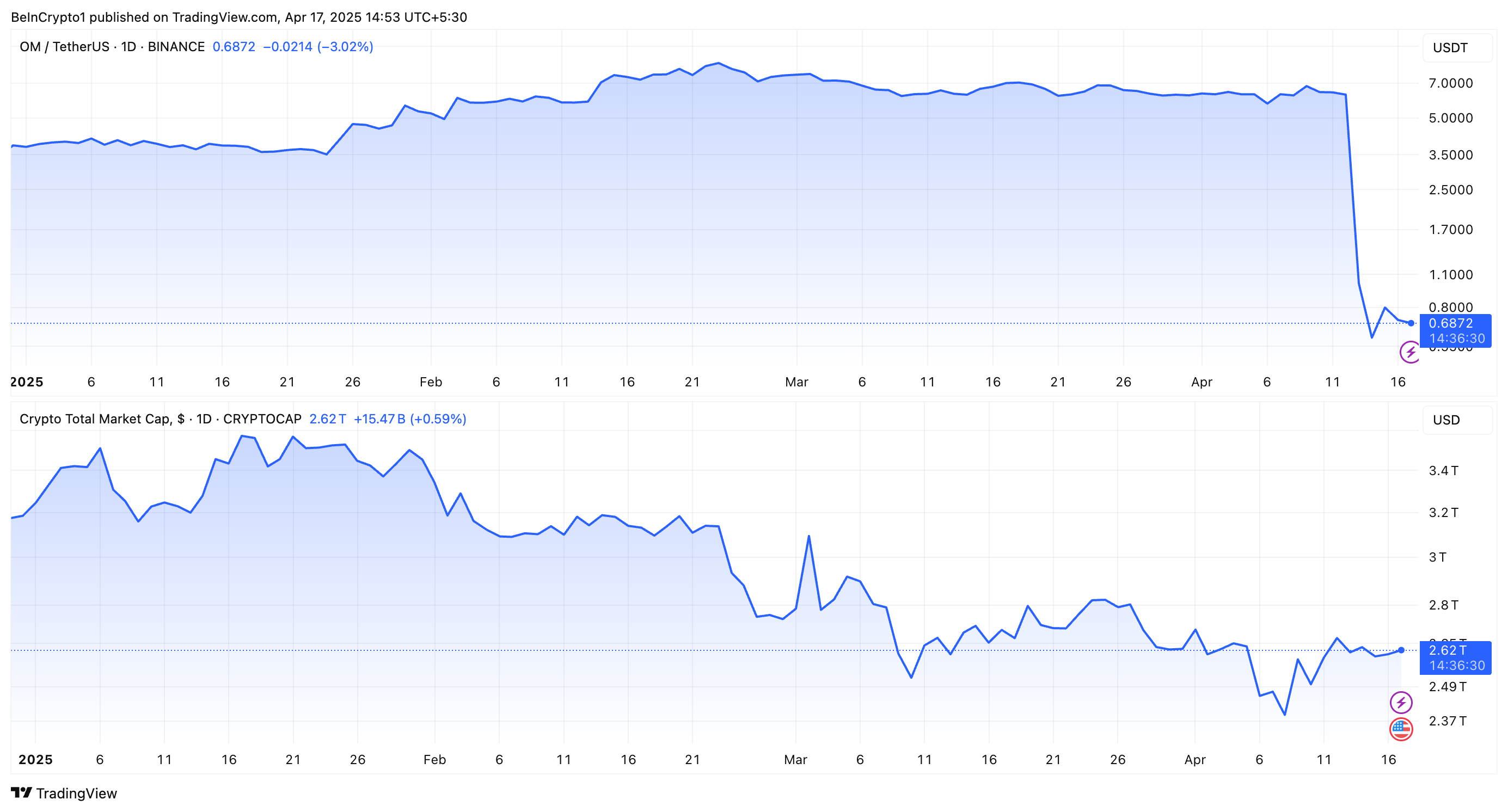

2. OM Price Action: The market was tanking but OM was moonwalking?

While practically everything else was bleeding in 2025, OM’s price was oddly upbeat—doing the pump-flatten-pump-flatten dance like a drunk guy at a wedding.

Jean: “The price was pumping like it just drank 5 espressos while the market was crashing. Anyone sane should have screamed ‘Wait, what?’”

Still, unless you’re a chart-reading wizard, this shenanigan was easy to miss. *Sighs* So many lost millions, so little laughter.

How not to be that guy:

Eric He talks diversification and stop-losses like a responsible adult, suggesting spreading your bets and cutting losses fast.

“Diversify or dive—automate stop-losses around 10-20% below your buy price because crying later isn’t sexy.”

Ming Wu says use futures to hedge: basically a financial safety net that isn’t made of duct tape.

“Perpetual futures are like crypto insurance. Get some.”

3. Project Fundamentals: When your numbers tell a sad joke

The Fully Diluted Valuation (FDV) was $9.5 billion, but their total locked value? A cringe-worthy $13 million. That’s like saying you’re a millionaire but you only have $13 in your wallet.

Forest Bai: “That gap? It screams ‘Something’s fishy.’ And no, not the good kind.”

The airdrop? More like an airdrizzle—a mess of delays, rule changes, and bots partying while real supporters got left outside.

Phil: “Favoring insiders sucks. It’s like inviting only your cousins to Thanksgiving and banning everyone else.”

Oh, and some shady past with gambling platforms? Yeah, that too.

Smart Moves:

Check who’s running the show. Look at roadmaps, community buzz, and if things feel thinner than your grandma’s soup, maybe run.

Ming Wu: “Look for fake growth tricks—airdrop hype isn’t real engagement. Don’t get played.”

4. Whale Watching: The O.M.G. moment

Before the plunge, whales (big token holders) dumped millions of OM tokens into exchanges. Like, who just leaves the door open when a stampede’s coming?

Forest Bai: “$227 million tokens dropped before crash? Red flag level: Novice kite flyer in hurricane.”

CryptoQuant: “Transfers into exchanges spiked way above norm—like a warning siren nobody turned up the volume on.”

To be less clueless:

- Chain Sleuthing: Use Arkham or Nansen—because stalking whales beats stalking exes.

- Set Alerts: Etherscan and Glassnode can scream ‘Watch out!’ at you.

- Track Exchange Flows: Know when the big fish are unloading their bags.

- Check Lockups: Dune Analytics shows if insiders are quietly sneaking out with tokens early.

Eric: “If the order book depth is less than $500K for 1% of your token, you’re basically building on quicksand.”

5. Centralized Exchange Circus

MANTRA’s CEO blamed CEXs for wrecking the party with forced closures—something about “reckless” timing and “negligence.” Binance said, “Hold my beer, it’s cross-exchange liquidations.”

Experts aren’t buying the excuse cake wholeheartedly. Forest Bai and Eric He pointed to thin liquidity and cascading sell-offs like dominoes on espresso shots.

Eric: “$74.7 million wiped in 24 hours. Ouch doesn’t cover it.”

Ming Wu calls the CEO’s story “an excuse” worthy of a bad sitcom script, pointing to rising short positions during the crash.

Your gameplan:

Forest Bai: “Don’t get greedy with leverage, pick transparent platforms, watch for liquidation risks, and keep your keys—literally.”

Eric adds: “Use tools like ATR and Bollinger Bands to know when the crypto rollercoaster is about to go off the rails. Trading at midnight UTC? Why are you like this?”

So, the MANTRA (OM) crash is the kinda crypto horror show you use to scare novice investors straight. If you take away one thing: snoop on tokenomics, track token movement like a hawk, and for heaven’s sake, diversify like your next meal depends on it—because it kinda does.

Remember, in crypto, it’s not just about the gains; it’s about not losing your shirt while chasing moonshots. 🌙🚀

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- ATHENA: Blood Twins Hero Tier List

- Clash Royale Furnace Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

2025-04-19 23:05