Well now, it seems Bitcoin hath stumbled, much like a drunken sailor on a moonlit night, finding itself in a sorry state beneath that fabled $85,000 mark—oh, how it teeters and totters! For two months running, it’s been limping along without a whit of luck to lift it above this craggy hurdle.

There were moments, sure, when it appeared to raise its weary head for a breath of fresh air, yet the esteemed cryptocurrency has preferred to lounge about like a cat in the sun, leaving its once jubilant long-term holders (LTHs) clutching their pearls and cursing their fate. What a glorious time it was when profits flowed—now they’re watching those gains dwindle like a mirage in the desert.

The Reluctant Investors Gather ‘Round

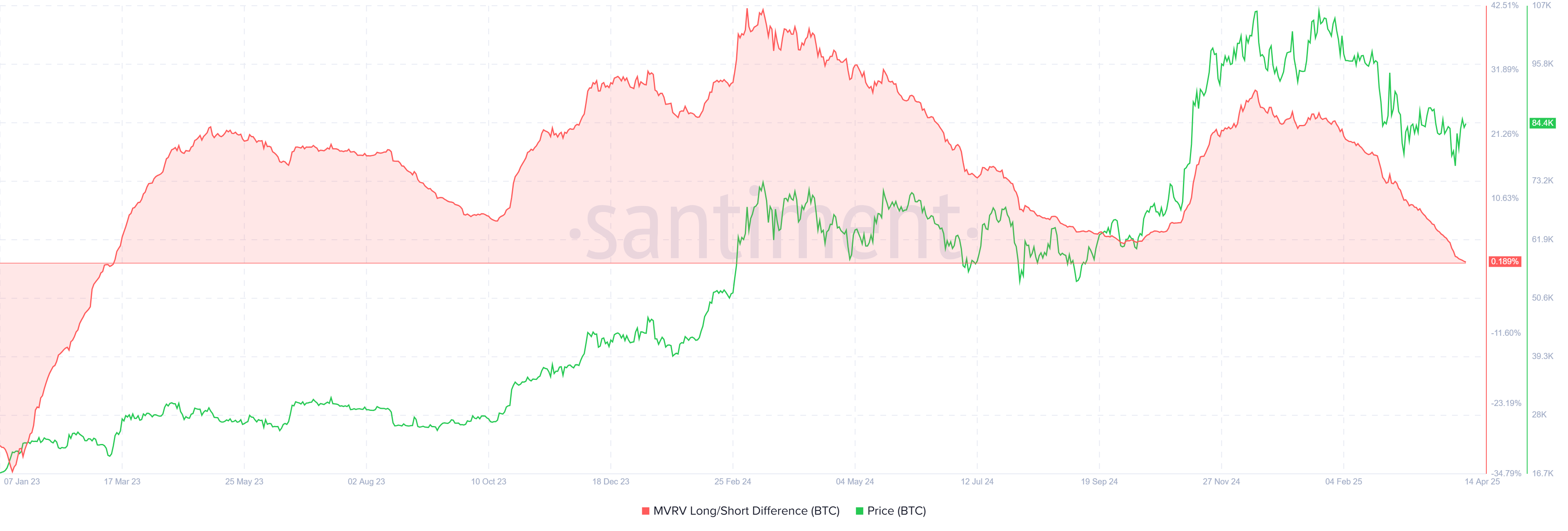

By jove! The MVRV Long/Short Difference, a curious contraption that tells us how the wind blows in the market, hath struck a most alarming note for our dear LTHs. It’s dropped lower than a snake’s belly in a wagon rut, indicating that these once-hopeful souls are now grappling with profits that resemble a shadow of their former selves since March 2023. The winds of fortune do not gust favorably these days, my friends.

As the price of Bitcoin remains trapped like a fish in a barrel, our short-term holders (STHs) are reveling in this chaos, taking advantage of every little twitch in price while the LTHs, burdened by diminishing returns, shy away from committing further capital—lost in a fog of trepidation.

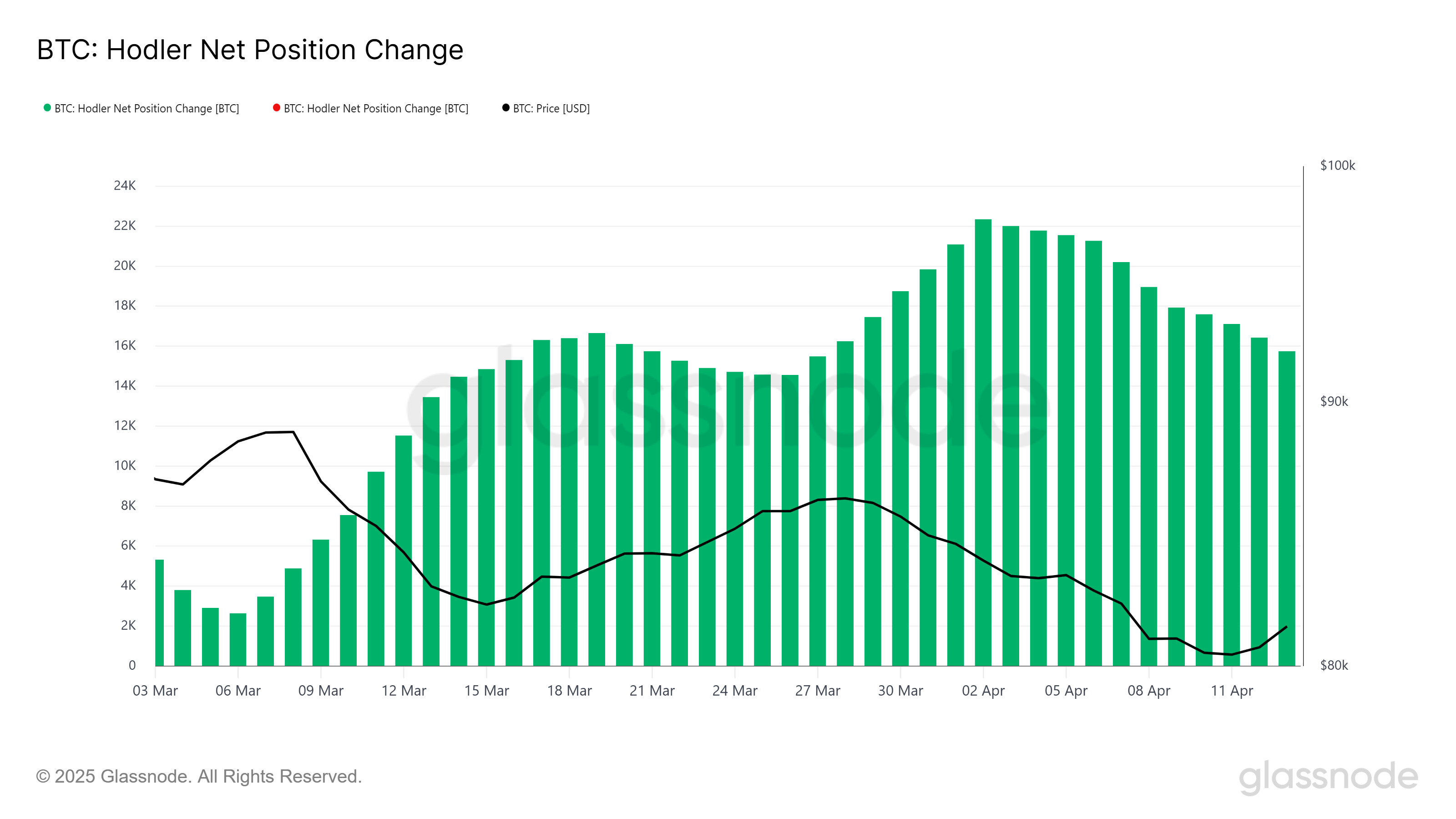

Lo and behold! The very momentum of Bitcoin, as measured by a bevy of technical indicators, presents a gloomy countenance indeed. The HODLer net position change reveals that our long-term guests have been selling off their treasures like misers at a yard sale, surrendering over 6,596 BTC—worth more than the combined treasures of a small pirate fleet—over the past fortnight.

While this figure may seem but a drop in the ocean, the troubling shift from optimism to caution among the LTHs is as clear as the noonday sun. Without conviction, the great ship of Bitcoin may find itself adrift at sea, struggling to find its bearings in the stormy market, and the current doldrums could stifle activity further, exacerbating the malaise.

Ah, The Price, How It Dwindles!

At present, Bitcoin finds itself trading at $84,421—rather precarious, hovering just above the vital support level of $82,619, like a cat on a fence. If it cannot scale that lofty $85,000 barrier, the pressure might just compel it to breach the thresholds of despair. Should it falter below $82,619, prayers may be sent for its spirited bounce off of the next psychological cliff at $80,000—if one could be so bold!

If the bearish winds continue howling, we might indeed see Bitcoin descend further, with $78,841 looming as a sinister specter. Losing this would be akin to losing one’s trousers mid-dance, confirming the market’s ongoing woes and solidifying the pessimistic fog hanging about.

But lo! Should Bitcoin rise up and seize the $85,000 mark as a bastion of strength, it might just spark a revival worthy of a grand tale, steering its course toward $86,848. A sustained climb above that troubled resistance would cast away the current shipwreck of skepticism and chart a hopeful course toward $89,800, restoring confidence amongst the beleaguered investors, much like a well-timed punchline in the midst of a dull affair.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Best Arena 9 Decks in Clast Royale

- ATHENA: Blood Twins Hero Tier List

- Clash Royale Furnace Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- How To Watch Tell Me Lies Season 3 Online And Stream The Hit Hulu Drama From Anywhere

2025-04-14 09:56