The desert of Bitcoin mining, scorched and dusty, finds some prospectors eyeing a richer, greener valley—AI and high-performance computing. Those miners, blessed with the right tools and a keen mind, might just strike gold by turning their rigs toward this new frontier.

As the beast of AI hunger grows, demanding more power and cooler shade, miners sitting on grids with plenty of juice and chill might well become the sheriffs in this booming, buzzing town of data centers, according to the town criers at Galaxy Digital. They claim these green pastures offer steadier water than the wild river of cryptos.

The wise men behind the research reckon veterans with a knack for building AI and HPC empires hold a “tremendous opportunity” to add a heap of value to their homesteads. It’s the kind of promise wrapped in long contracts and cash flows as predictable as a sunrise—none of the hair-raising rollercoasters that crypto often delivers. Galaxy calls it “predictable and high margin cash flow streams,” the kind of stability rarer than a cool breeze on a baking summer afternoon.

“Not only is revenue more predictable than Bitcoin mining, it’s also uncorrelated to crypto markets, which smooths revenue profiles of companies with high exposure to the volatile crypto markets. In Bitcoin bear markets, this can enhance financial stability, allowing miners to continue to raise cash through equity or debt without incurring excessive dilution or interest burden.”

—Galaxy Digital

Money talks, and these data centers are listening. With a lease signed by a reputable soul, operators can summon vast sums—billions, in fact—to build their fortresses of silicon and cooling fans. Just last quarter, $18 billion marched onto the field, ready for construction.

Take a look at the numbers behind the smoke: Bitcoin miners usually trade between six to twelve times their earnings. Yet the biggest kid on the block in data centers scoops valuations twenty to twenty-five times higher. It’s a whole new game with fatter chips on the table.

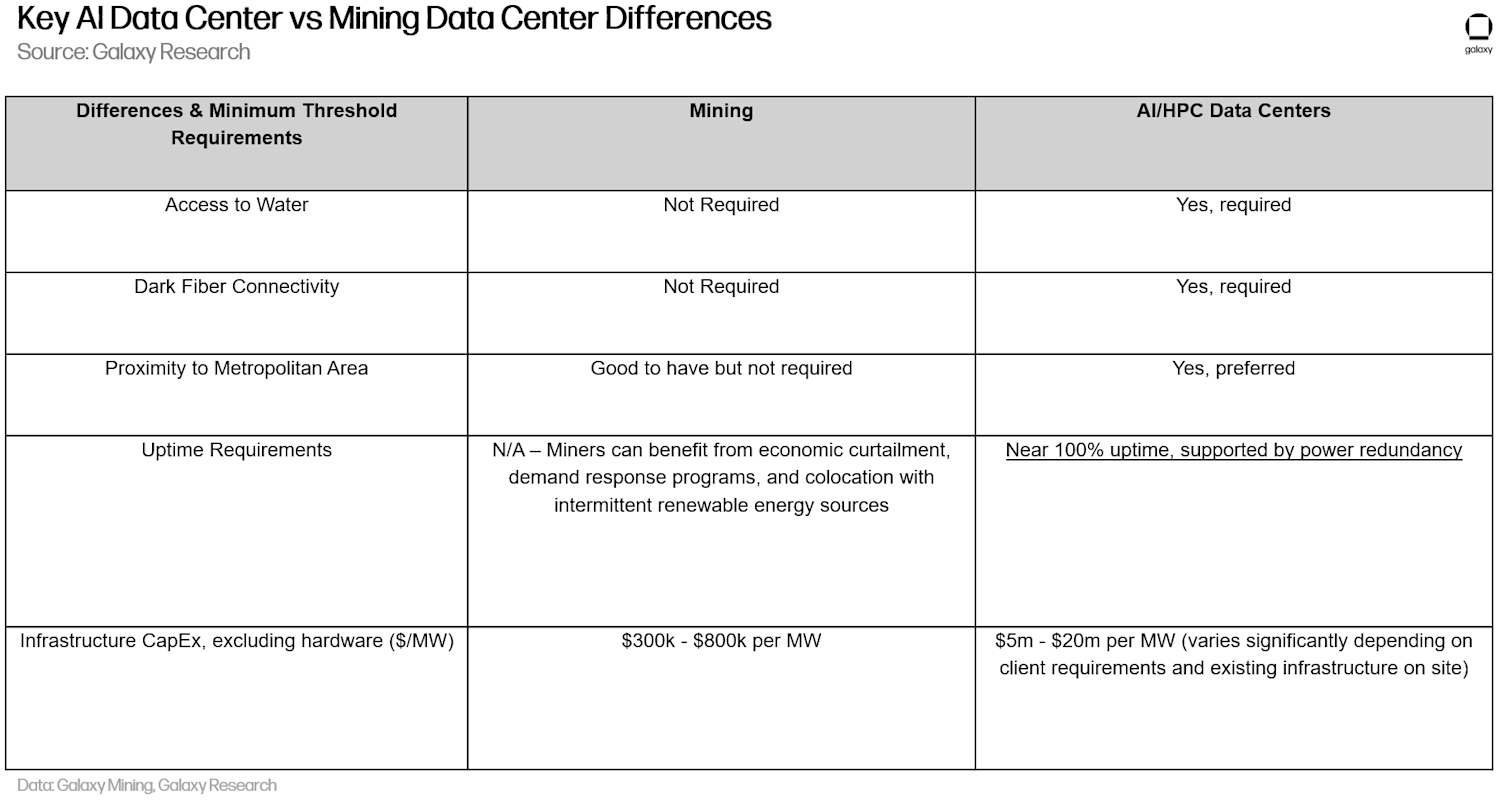

But before you pack your bags, not every dusty mining site fits the bill for this AI gold rush. Mike Novogratz’s Galaxy Digital reminds us some rigs shine only in the crypto sun, not the high-performance moon.

With American data center space set to double by 2030, those savvy enough to hitch their wagons to this rising star might just become the new giants stalking the plain—minus the drama, plus a little more predictability.

So, miners, ready to swap those wild crypto rollercoasters for the steady hum of AI? Sometimes, trading chaos for calm just makes cents. 😉

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-04-29 12:36