Oh dear, oh dear! The cryptocurrency merry-go-round, which had spun wildly at the end of 2024, hit a shocking snag in the first quarter of 2025, sending everyone tumbling—much like a clown on roller skates! 🎢 The usual suspects—trade wars and a grumpy user sentiment—brought the whole carnival down faster than a soggy pie! 🥧

The Rise of Our Lovely Little BTC Friend

Just when we all thought Bitcoin was strutting around like the king of the jungle, it skidded right off the path and dropped nearly 12% by March! 😱 That’s like finding out your favorite candy is now made of broccoli! It ended the month at around $93,500, which sounds grand, but is it? When you compare it to its grand peak of over $109,000 on inauguration day—talk about a slap! 👋 March felt more like a bad dream, and everyone’s been waking up in a panic!

And poor Ethereum! It plummeted down by a whopping 45%. That’s enough to break a heart—or a piggy bank! 🐷 Meanwhile, Solana decided to join the party with a dramatic 34% fall—swoon! The entire gang of altcoins looked like they took a trip off a cliff, while Bitcoin, bless its heart, managed to claw its way up to a cozy 62.8% dominance. And traditional stock markets were just as miserable as a rainy day, with the S&P 500 and Nasdaq suffering their own dreadful tales.

As the gloomy Q1 unfolded, onlookers blamed the looming trade wars like kids blaming the dog for their missing homework. Economists were shouting warnings louder than a foghorn, fearing what might come if President Trump actually went through with his tariffs. Two scoops of chaos on the side, please! 🍦

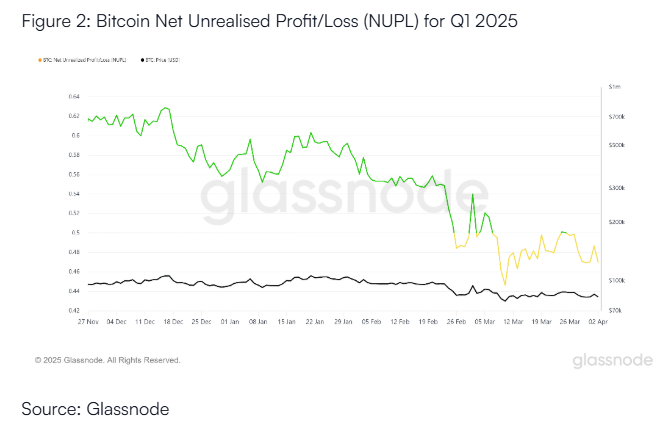

Then came along an analysis by AMINA, which focused on that grumpy user sentiment. According to them, the market’s mood was mirrored by the net unrealized profit/loss (NUPL). Higher numbers meant everyone was swimming in unrealized gains, but lower numbers? Yikes! It’s like finding your wallet empty and your ice cream melted! 🍦➡️🥵

Look at that chart—it went down, down, down like a rollercoaster that forgot to stop! 🎠 It plummeted to its 2025 low on March 10. How exhilarating! Or not. Nobody was feeling excited when unrealized losses outpaced the gains by 24%. It was like getting a kick in the shins at a dance party! 💃😵💫

As if that wasn’t bad enough, there was a noticeable decline in larger entities accumulating BTC. The “buying mood” was practically non-existent—like finding a unicorn at a yard sale. The average score for accumulation sat around 0.1—barely a flutter! So, it seems, dear friends, that the market was about as eager to stack Bitcoin as a cat is to take a swim. 😼

All in all, it seems our BTC buddy just wasn’t feeling up to the task of stacking more Bitcoin. The whole quarter felt like a soggy sandwich, with everyone hoping for sunny picnics instead. 🥪🌤️

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-04-09 08:58