Ah, the grand theater of finance! In a most dramatic twist, the illustrious shares of AI chipmakers, those titans known as Nvidia and AMD, have plummeted like a lead balloon, all thanks to the U.S. government’s latest export restrictions on AI chips to the enigmatic land of China. Nvidia, in a fit of despair, has proclaimed a staggering $5.5 billion financial catastrophe looming in its first fiscal quarter, as the ban effectively seals the fate of the H20 chip in one of its most ravenous markets. Who knew chips could be so spicy? 🌶️

As the news spread like wildfire, semiconductor stocks found themselves in a downward spiral, dragging along the likes of AMD, Micron Technology, Broadcom, and ASML, all of whom experienced price drops that would make even the most stoic investor weep. In just three months, the semiconductor sector has seen a market value decline of $2 trillion—yes, trillion!—due to the ever-looming specter of trade conflicts and regulatory risks. It’s like a soap opera, but with more numbers and fewer dramatic pauses.

According to the ever-astute Kobeissi Letter, China, with a shrug of indifference, has acknowledged these restrictions while its goods are being slapped with a 245% tariff from the U.S. But fear not! They’ve decided to play the numbers game like a child ignoring broccoli on their plate. China vows to fight until the bitter end of this tariff war, armed with nothing but determination and a calculator. 🥦✊

In this chaotic carnival, Adam Kobeissi has observed a most peculiar phenomenon: investors, both bullish and bearish, are feeling as uneasy as a cat in a room full of rocking chairs. He quips, “An over-reliance on tariff-related headlines has created a fragile market environment, where both sides are exposed to abrupt, often disproportionate price swings. Even headlines with questionable credibility are driving trillions of dollars in market cap in either direction. Until this sentiment dissipates, volatility will remain.” Sounds like a financial rollercoaster, doesn’t it? 🎢

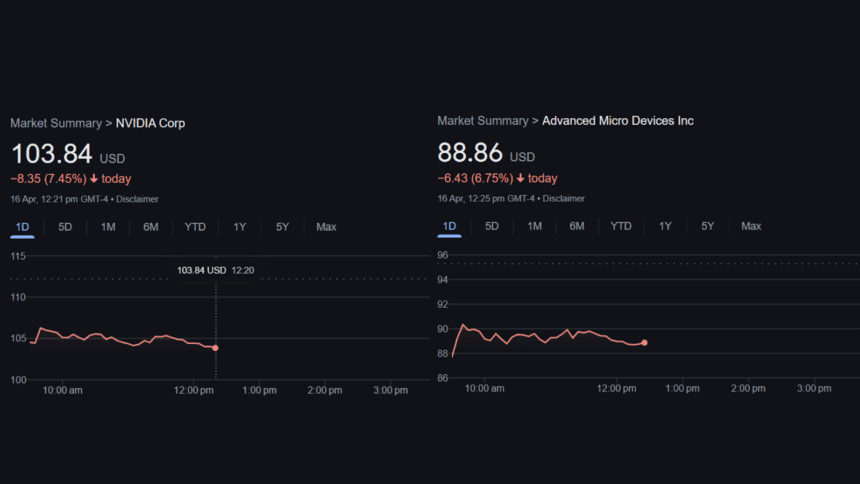

As of this very moment, Nvidia’s stock price has taken a nosedive of 7.46%, while AMD is not far behind, down by 6.97%. The bears are having a field day! 🐻

In a twist of fate, the renowned crypto analyst, Ali Martinez, has declared that this chip ban in China might just be the golden ticket for NVIDIA, hinting at a potential retest of the 200-week moving average at $55. He suggests it’s a splendid buying opportunity for long-term investors. Because who doesn’t love a good gamble? 🎰

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- ATHENA: Blood Twins Hero Tier List

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Witch Evolution best decks guide

2025-04-16 20:23