Bitcoin (BTC) has been wallowing below the $90,000 mark since March 7, a sad and lonely journey in the land of shifting market sentiments.

Oh, the irony! While the Ichimoku Cloud and EMA lines insist the trend remains bearish, they whisper of a potential reversal, a glimmer of hope in this crypto desert.

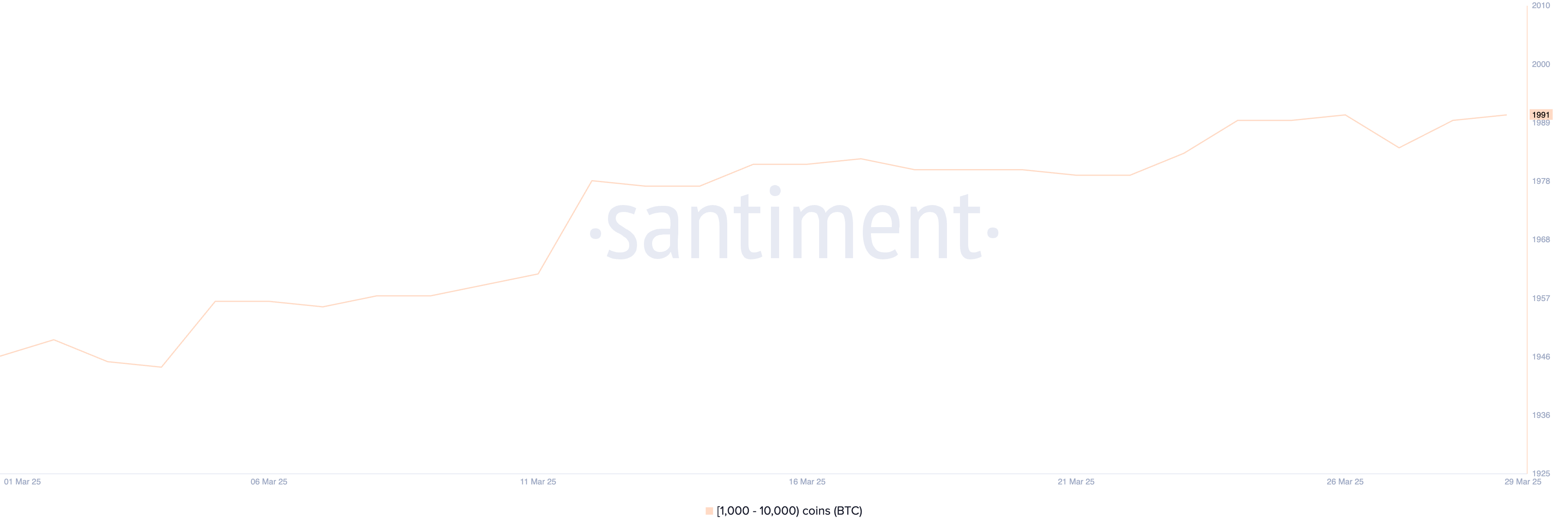

The number of Bitcoin whales—those majestic creatures holding at least 1,000 BTC—has been steadily climbing like a sloth on a steep hill. On March 22, there were 1,980 such addresses, and now, presto! The number has climbed to 1,991.

A mere 11? Ah, but in the world of whales, this is a significant leap, a sign of large-scale accumulation, especially considering it’s the highest count in over three months.

These whales, towering giants in the crypto sea, often dictate the price tides with their vast holdings. More whales accumulating than distributing can signal rising confidence, reduced selling pressure, and a hint of bullish sentiment.

With the whale count hitting a multi-month high, it suggests that the big players are positioning themselves for a potential upward move. The crypto market, dear reader, is where patience and strategy meet.

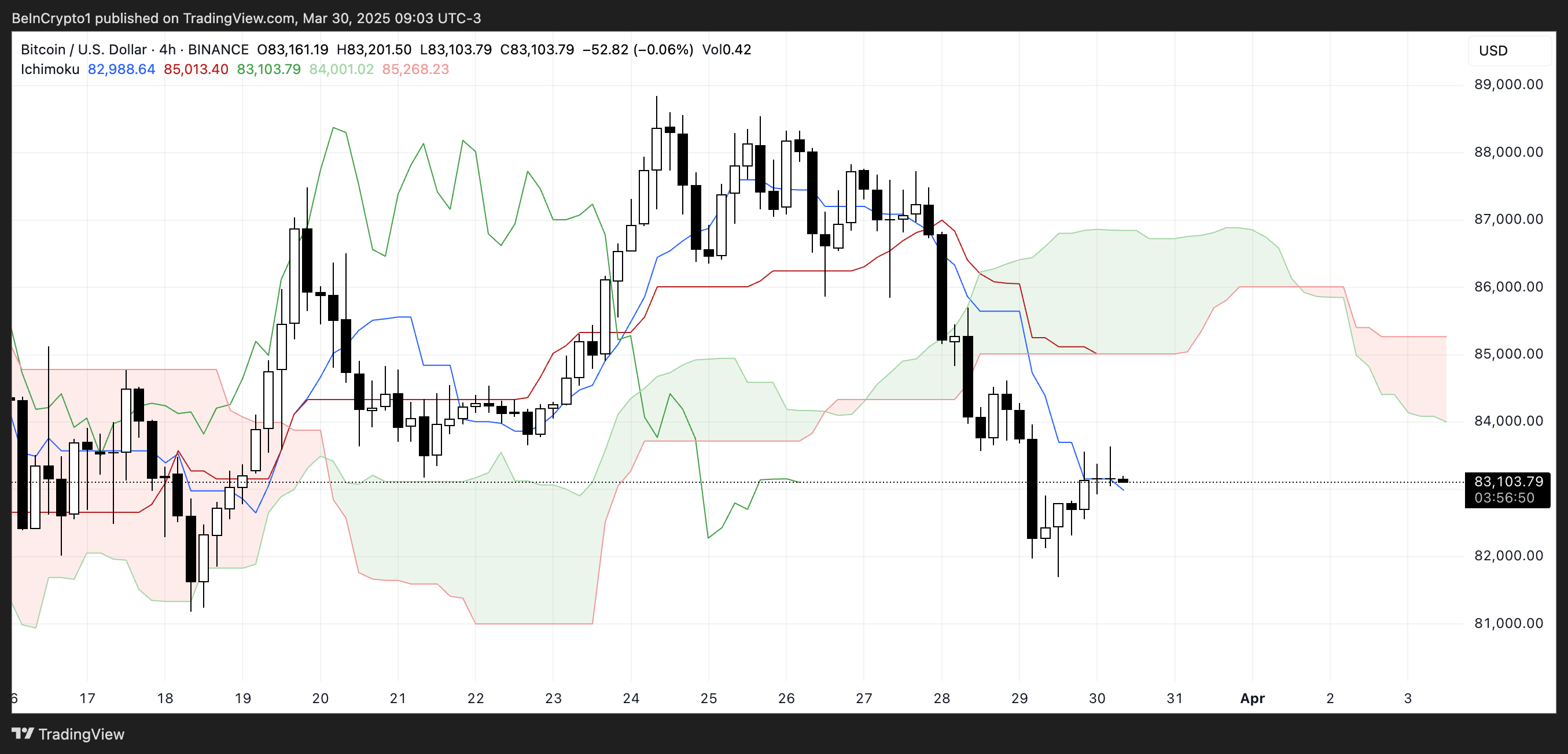

BTC Ichimoku Cloud Shows Challenges Ahead

The Ichimoku Cloud chart for Bitcoin paints a picture of price consolidation just below the Kijun-sen (red line) after a strong downward dive.

The Tenkan-sen (blue line) remains below the Kijun-sen, a clear sign of short-term bearish momentum. The price is trying to stabilize, but a decisive shift in trend is yet to be seen.

The Lagging Span (green line) trails below both the price and the cloud, reinforcing the bearish outlook from a historical perspective.

The Kumo (cloud) ahead is bearish, with the Senkou Span A (green cloud boundary) below the Senkou Span B (red cloud boundary), and the cloud itself projecting downward. This suggests resistance overhead and limited bullish momentum unless price breaks through the cloud decisively.

However, the thin structure of the current cloud hints at possible vulnerability. If buyers step in with strength, there could be a window for a reversal. But for now, caution is the word, as the prevailing trend remains bearish.

Can Bitcoin Rise To Test $88,000 Soon?

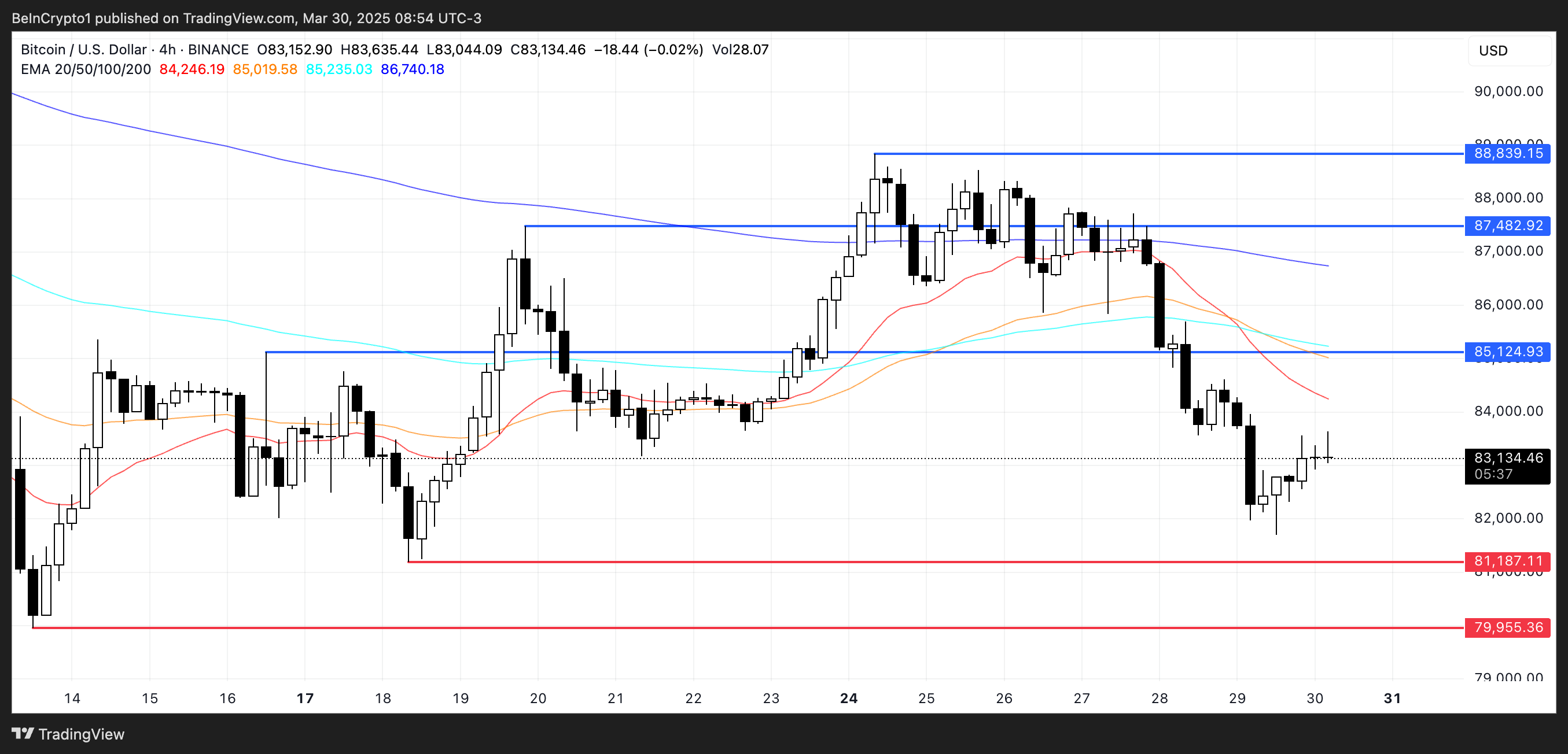

The EMA lines continue to indicate a downtrend, with short-term moving averages below the longer-term ones. Bearish momentum is the reigning champion for now.

However, if buyers regain control and establish an uptrend, Bitcoin price may climb toward the next key resistance levels. The first challenge is the resistance near $85,124. If broken, this could open the path to $87,482 and potentially $88,839, assuming bullish momentum strengthens and sustains.

On the flip side, failure to build upward momentum would reinforce the current bearish structure. In that case, Bitcoin could revisit the support level around $81,187. A breakdown below this point would further validate the downtrend, potentially dragging the price down to $79,955.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-03-30 15:56