Ah, the winds of change are blowing through the land of cryptocurrency, my friends 🌟. As of Saturday afternoon, the price of Bitcoin has been holding steady at a respectable $108,100. But, as we all know, the devil is in the details 😏. It appears that the big holders, those whales who were once the kings of the sea, have been quietly shipping out a massive load of coins 🚢.

According to reports, these whales have sold over 500,000 BTC in the past 12 months 🤯. That’s a stash worth a whopping $50 billion 💸. And who’s been buying it all up? Institutions, of course 📈. It’s a huge shift in who really owns Bitcoin, and it’s happening quietly, without much fanfare 🤫.

The Torch Has Been Passed

As Bloomberg’s review of 10x Research data shows, wallets holding between 1,000–10,000 BTC have seen their balances slip from over 4.5 million coins in January 2023 to about 4.47 million in July 2025 📊. Meanwhile, addresses with 100–1,000 BTC have jumped from nearly 4 million to 4.77 million 🚀. It’s a clear sign that the big players are trimming back, while medium-size holders, often funds or wealthy clients, are building their stacks 💪.

Institutions Take the Reins

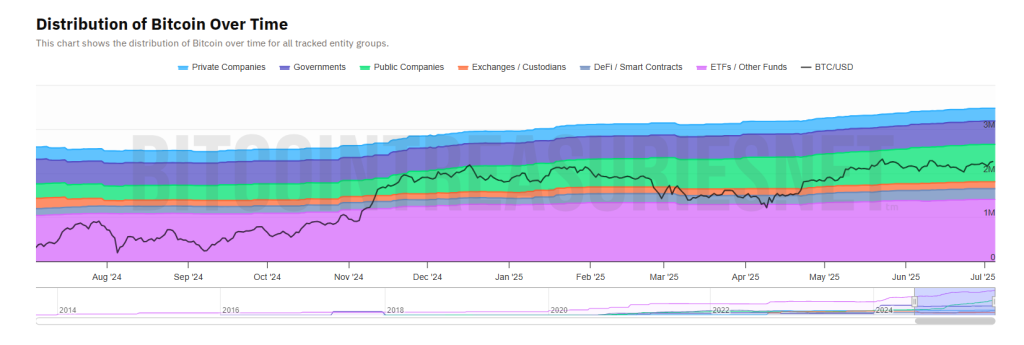

Funds, ETFs, and corporate treasuries have been scooping up almost every coin dropped by whales 🤑. Data from Bitcoin Treasuries shows that private companies have boosted their holdings from 279,374 BTC in July 2024 to 290,883 BTC today 📈. Public firms have climbed from 325,400 BTC to 848,600 BTC, and ETFs have led the charge, raising their balance from 1,039,000 BTC to 1,405,480 BTC 🚀.

In total, these groups have added 899,198 BTC—about $96 billion—over the past year 🤯. That buying power has helped keep the market in balance as whales step back 🌈.

And what does this shift in on-chain holdings mean? It means that new types of investors are moving in 🚪. Medium-sized wallets are growing, while the largest ones shrink 📉. It’s a trend that suggests a changing of the guard, a new era in the world of Bitcoin 🔮.

Edward Chin, co-founder of Parataxis Capital, says that in-kind transfers let coins move from anonymous holders to regulated firms without public trades 🤫. This quiet pipeline boosts on-chain activity and brings more oversight to big Bitcoin trades 👮.

Volatility Hits a Two-Year Low

As institutional flows rise, price swings have dulled 😴. The Deribit 30-day volatility gauge sits at its lowest level in two years 📊. Jeff Dorman, CIO at Arca, compares today’s Bitcoin to a steady dividend payer that might deliver annual gains in the 10–20% range 📈.

That’s a far cry from the 1,400% surge seen in 2017 🚀. But for long-term savers, steadier returns look more attractive than wild rallies 🤔.

Meanwhile, Fred Thiel, CEO of miner MARA Holdings, says his company still holds every coin it mines 💎. But he warns that if whale selling picks up again and institutional appetite fades, prices could lurch lower ⚠️.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Best Hero Card Decks in Clash Royale

- Clash Royale Furnace Evolution best decks guide

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Witch Evolution best decks guide

2025-07-06 10:24