In the tranquil hours of the night, on the 15th of July, a creature of the deep, a Bitcoin whale, long thought to be in a state of eternal slumber, awoke and stirred the waters of the crypto ocean. This ancient being, having acquired its treasure in the early days of the network, reemerged and transferred 9,000 BTC, a sum worth over $1 billion, to the shores of Galaxy Digital, a well-known digital asset management firm.

The sudden movement of such a vast fortune caused a ripple in the market, and Bitcoin, like a ship caught in a storm, dipped from the lofty heights of $123,000 to the more modest $116,900, according to the chronicles of CoinMarketCap.

Chaos Amid a 9,000 BTC Transfer

The first to sound the alarm was the vigilant Spot On Chain, a platform dedicated to the study of blockchain movements. The transfer, it was whispered, was part of an over-the-counter (OTC) deal, a transaction so large it could only be conducted in the shadows of the market.

🚨The whale just moved 8.5K $BTC (~$1B) to Galaxy Digital 15 minutes ago. It is likely an OTC deal.

This is his first cash-out in 14.3 years.

Wallet Link:

— Spot On Chain (@spotonchain) July 15, 2025

Despite the significant outflow, the whale’s vast hoard still held around 11,000 BTC, a treasure worth roughly $1.3 billion. The market buzzed with speculation, wondering if this was the beginning of the end or merely a prelude to a greater storm.

Earlier in the day, the wallet had already made a grand gesture, moving 20,000 BTC, a sum worth a staggering $2.4 billion, to a new address. These coins, purchased at the humble price of $2 per BTC, had grown into a mountain of wealth, a testament to the power of patience and the rewards of early adoption.

The wallet first resurfaced on July 4, after 14 years of inactivity, initiating the transfer of 80,000 BTC across several transactions. Conor Grogan, the head of product at Coinbase, ventured a theory that some of these reactivated funds might be linked to compromised private keys, a notion that added a layer of intrigue to the already mysterious affair.

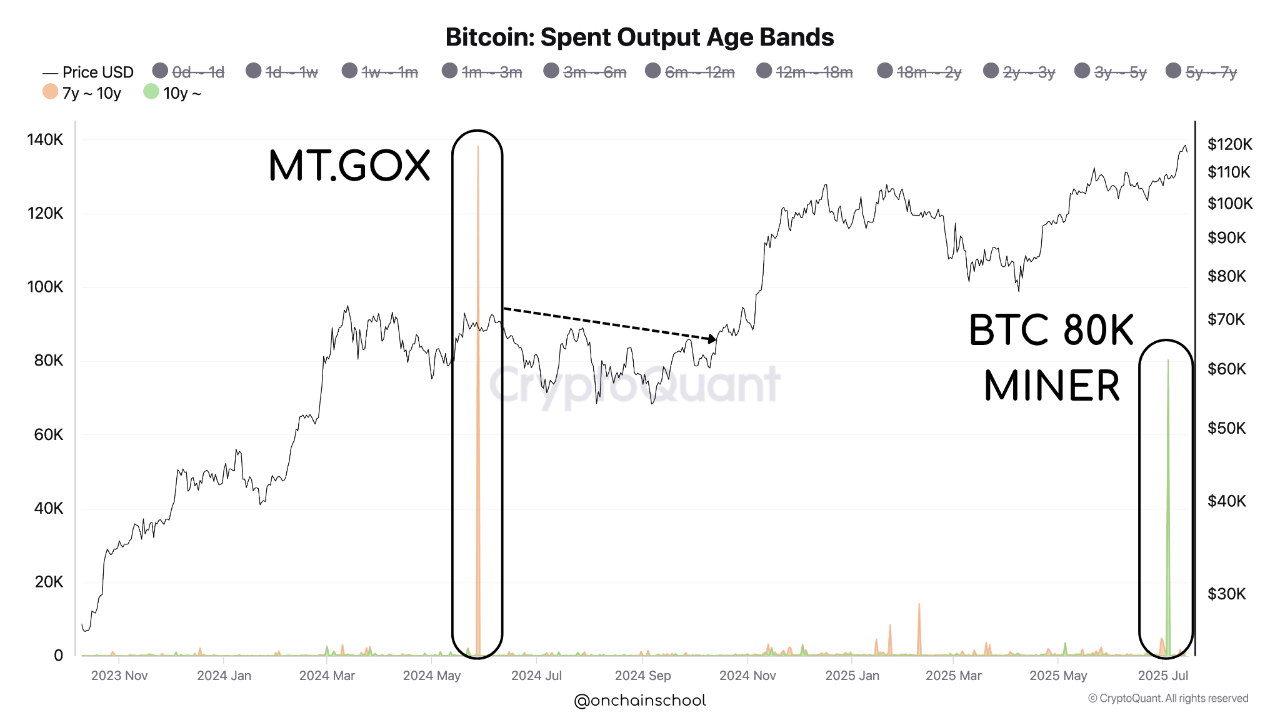

OnChainSchool, in a subsequent update, revealed that of the 80,000 BTC that this wallet had held for the past years, it had sold 20,000 BTC worth $2.33 billion. The transfers, it seemed, were not a strategic repositioning but a “strategic liquidation,” a phrase that echoed through the halls of the crypto community.

Bitcoin Whale Wallet Sells 20K BTC | Source: CryptoQuant

So far, only a portion of the total 80,000 BTC has been sold. As Bitcoin hovers below the $117K price level, investors are left to ponder if more pain is to follow, or if this is merely a tempest in a teapot.

Should Bulls Be Worried?

According to the sages at Bitfinex, new Bitcoin buyers, particularly those in the “Shrimp,” “Crab,” and “Fish” categories (those holding less than 100 BTC), are accumulating Bitcoin at a pace that far outstrips the post-halving supply rate.

“Demand from this segment alone is more than enough to absorb all new supply,” Bitfinex stated in a recent market report, adding:

“This cohort-level accumulation trend supports the broader bullish narrative that new buyers entering the Bitcoin market are price-agnostic buyers and are relentlessly accumulating with limited intervals.”

The small buyers are adding approximately 19,300 BTC per month, while the monthly issuance stands at just 13,400 BTC following the April 2024 halving. Thus, the market, it seems, is not without its defenders, and the bulls, though momentarily shaken, may yet find the strength to weather the storm.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- Country star who vanished from the spotlight 25 years ago resurfaces with viral Jessie James Decker duet

- ‘SNL’ host Finn Wolfhard has a ‘Stranger Things’ reunion and spoofs ‘Heated Rivalry’

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- JJK’s Worst Character Already Created 2026’s Most Viral Anime Moment, & McDonald’s Is Cashing In

- M7 Pass Event Guide: All you need to know

- Kingdoms of Desire turns the Three Kingdoms era into an idle RPG power fantasy, now globally available

2025-07-15 17:13