Oh, the quiet stirrings in the financial world! Wells Fargo, that venerable institution, has more than quadrupled its holdings in BlackRock’s Bitcoin ETF, IBIT, in the second quarter of 2025. Imagine the whispers in the marble halls of Wall Street! 🏛️💼

But wait, there’s more! Sovereign wealth funds in Abu Dhabi, those enigmatic masters of the financial universe, continue to hold some of the largest institutional Bitcoin ETF positions known to man. 🌍💎

Wells Fargo’s $160 Million Bet: A Tale of Boldness and Bravery

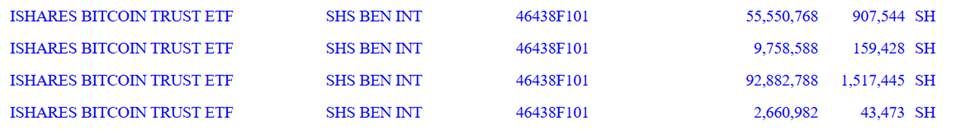

According to a new SEC filing, the fourth-largest US bank by assets, Wells Fargo, revealed that it held over $160 million worth of shares in the iShares Bitcoin Trust (IBIT) as of June 30. Can you believe it? From a mere $26 million at the end of the first quarter, the bank’s holdings have soared like a phoenix from the ashes! 🌟🔥

Wells Fargo and Bank of America’s (BofA) Merrill unit began offering spot Bitcoin ETFs to brokerage clients in their wealth management divisions in February 2024, barely a month after the financial instrument was approved in the US. One can only imagine the boardroom discussions, filled with the scent of fine cigars and the clinking of crystal glasses. 🥂🎉

“Bank of America Corp.’s Merrill arm and Wells Fargo & Co.’s brokerage unit are offering access to ETFs that invest directly in Bitcoin, reflecting mainstream firms’ increasing acceptance of the products,” Bloomberg reported, as if announcing the arrival of a new season in the grand opera of finance. 🎵OperaGlasses

The banks offer the approved ETFs to some wealth management clients with brokerage accounts who request the products. Thus, Wells Fargo’s Q2 filings suggest the bank has gone beyond merely opening the door to client demand. It is now making a direct institutional allocation on its own books, a move that would make even the most seasoned market veteran raise an eyebrow. 🕵️♂️🧐

A Diverse Feast of Bitcoin Funds

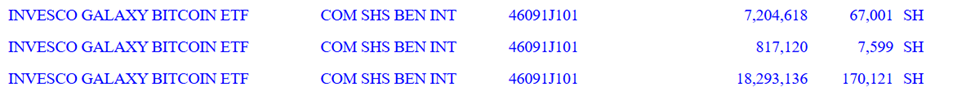

Meanwhile, Wells Fargo’s Bitcoin exposure extends beyond BlackRock’s flagship product, IBIT. The bank also increased its stake in the Invesco Galaxy Bitcoin ETF (BTCO) from $2.5 million to approximately $26 million over the same quarter. Its Grayscale Bitcoin Mini Trust (BTC) holdings grew modestly, from about $23,000 to $31,500. Meanwhile, its Grayscale Bitcoin Trust (GBTC) position rose from $146,000 to over $192,000. A veritable smorgasbord of investments, if you will! 🍽️🍽️

Wells Fargo also reported smaller positions in Bitcoin ETFs managed by Cathie Wood’s ARK Invest/21Shares, Bitwise, CoinShares/Valkyrie, Fidelity, and VanEck. The bank has even diversified with allocations to spot Ethereum ETFs. It’s as if they’re trying to cover every base, just in case the crypto world decides to throw a curveball. 🏏⚾️

The moves indicate a broadening of the bank’s crypto-linked investment exposure, reflecting institutional interest in Bitcoin as an asset class and the growing acceptance of ETFs as the preferred access point. A true testament to the times we live in! 📜⏰

Abu Dhabi’s Steadfast $681 Million Bitcoin ETF Holdings

Elsewhere, Abu Dhabi’s sovereign wealth funds remain steadfast in their substantial Bitcoin ETF positions. SEC filings show that Mubadala, one of the world’s largest state-owned investment firms, held 8.7 million IBIT shares valued at $534 million as of June 30. One can almost hear the distant echo of ancient wisdom guiding these decisions. 📜📜

13F Update: Abu Dhabi HODLs its BTC

In its latest SEC filing, Abu Dhabi’s sovereign wealth fund continued to HODL its BTC exposure, now worth $534,177,956 as of 6/30/25.

SEC filing:

– Juan Leon (@singularity7x) August 14, 2025

Al Warda Investments, managed by the Abu Dhabi Investment Council, reported 2.4 million IBIT shares worth $147 million during the same period. Together, these holdings total $681 million, unchanged since May. “Diamond hands at a nation-state level,” remarked Cas Abbe, an analyst and web3 growth manager, as if he were a sage from another era. 🧐🔮

“Diamond hands at a nation-state level,” remarked Cas Abbe, an analyst and web3 growth manager.

The latest disclosures highlight the widening range of major institutional players, from US banking giants to Middle Eastern sovereign wealth funds, making calculated moves into Bitcoin ETFs. Wells Fargo’s aggressive Q2 accumulation stands out, signaling a bet on price appreciation, a strategic hedge, or a reflection of growing client demand. Meanwhile, Abu Dhabi’s unshaken positions suggest a long-term, conviction-driven approach in what is increasingly seen as a strategic asset on the global stage. A truly fascinating spectacle, worthy of the greatest playwrights and poets! 🎭📚

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- M7 Pass Event Guide: All you need to know

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- Clash Royale Witch Evolution best decks guide

2025-08-15 13:13