Hyperliquid is like that overachieving kid in the blockchain class—running its own decentralized exchange while others are still figuring out how to spell “crypto.” It’s basically the speed demon of layer-one blockchains, boasting a decentralized exchange where perpetual futures trade like it’s happy hour every hour. Move over, centralized exchanges—there’s a new sheriff in town, and it doesn’t take coffee breaks.

What sets Hyperliquid apart? It has an order book—yes, an actual order book, not some mysterious liquidity pool thingamajig that makes you feel like you’re guessing in the dark. Also, it runs on Arbitrum, which means transactions zip by faster than you can say “metamask,” at dirt-cheap fees, because who wants to pay more than the cost of a mediocre latte to move their money?

Now, the Hyperliquid bridge might sound like a fancy tourist attraction, but really, it’s just the bridge connecting your precious USDC to the world of Hyperliquid. Spoiler: without it, you’re just shouting into the void.

How to Push Your USDC onto Hyperliquid (Bridge Style)

The very first brain cell you’ll need to fire up is learning how to bridge USDC over to Hyperliquid, because every trading pair there demands payment in USDC, no exceptions. Two roads diverged in a blockchain wood: centralized or decentralized. Spoiler alert: either requires some tinkering with your crypto wallet—MetaMask is the usual suspect—to keep your life interesting.

Before you start daydreaming about your Arbitrum wallet address, yes you do need one, and yes, it’s best if it’s already awake and activated. Pick your DeFi wallet like you’d pick a favorite pizza topping—go multi-chain or go home.

The “I Want to Do Things Myself (and Possibly Make Mistakes)” Method

The decentralized path to moving USDC reads like a mildly tedious scavenger hunt, best tackled using deBridge, the almost-magical service that promises to move your assets across chains almost instantly, which sounds suspiciously like blockchain witchcraft.

Step 1: Stumble your way to the deBridge website.

Step 2: With the grace of a caffeinated squirrel, select your source chain—that’s where your money is currently lounging—and your destination, Arbitrum, naturally, since Hyperliquid calls it home.

Step 3: Connect that MetaMask wallet like it’s the final piece to your digital puzzle.

Step 4: Enter the amount of USDC you want to teleport and triple-check everything because, y’know, crypto never forgets your mistakes.

Step 5: Slam that confirm button and wait a few minutes. If you blink, you might miss it.

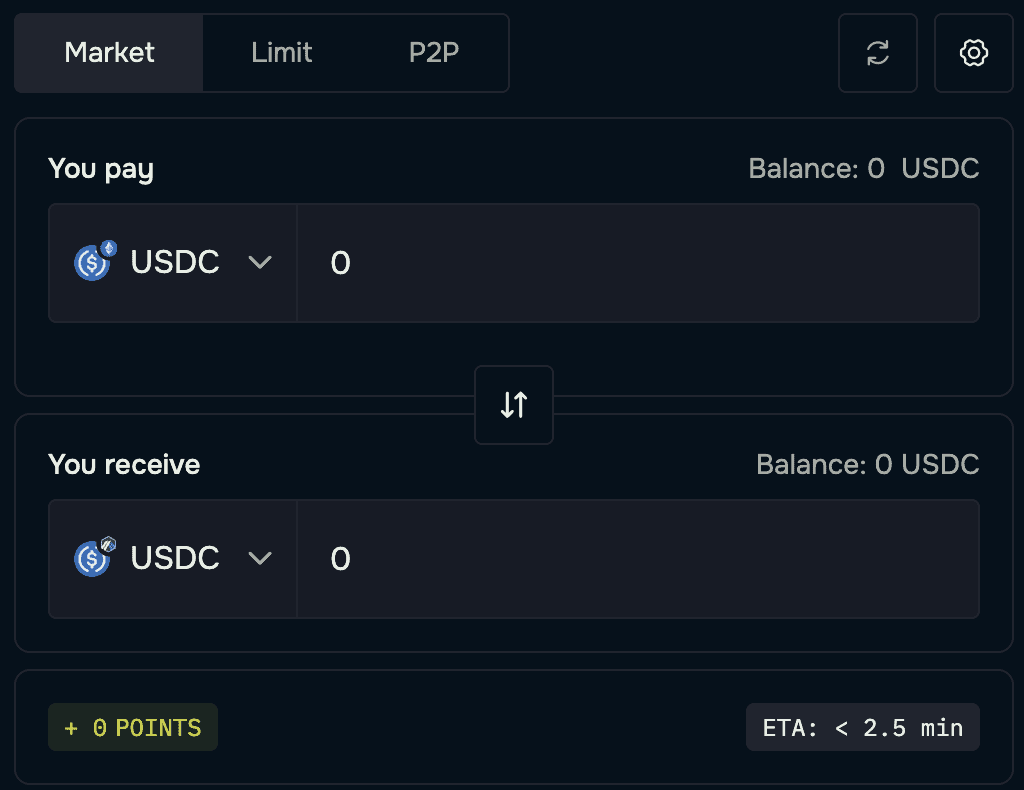

Step 6: Open Hyperliquid, connect your wallet, hit “Deposit” (top right, in case your eyesight is as bad as your crypto luck), and pour in your freshly arrived USDC like it’s the syrup on your blockchain pancakes.

The “I’m Lazy and Already Have Binance” Method

If you already have your USDC chilling on Binance or some other big-name exchange, congrats, your life is about to get a smidgen easier. Withdraw your funds, paste in your Arbitrum wallet address (no, don’t forget that – it’s crucial), confirm, and just like magic, your USDC will pop into your Arbitrum wallet.

From there, return to Step 6 above to complete your grand entrance into the Hyperliquid trading floor.

Bits and Bobs About Hyperliquid Bridge

Depositing: Not for the Penny-Pinchers

Validators (fancy title for the blockchain security folks) sign off on your deposits once two-thirds of them say, “Yep, that looks legit.” Then, your USDC shows up like a guest you actually invited. But fair warning, don’t even think about sending less than 5 USDC—you’ll lose that money faster than you lose socks in a laundry vortex.

Withdrawing: Like Leaving a Party Without a Scene

When it’s time to take your USDC back, you only need to sign on Hyperliquid’s end. No Ethereum gas fees! The validators handle the rest, and your money arrives in your Arbitrum wallet in about 3-4 minutes. There’s a modest 1 USDC withdrawal gas fee to keep the validators happy, which means your funds aren’t just disappearing into the void like your last online dating match.

If drama ensues, there’s a dispute period where the bridge gets locked tighter than grandma’s cookie jar. Two-thirds of validators have to agree before anything moves—call it blockchain democracy or just a tedious safety net.

Where to Learn More (If You’re Into Homework)

- Official Hyperliquid bridge docs (the bedtime reading of champions)

- Flow charts for deposits and withdrawals, guaranteed to make your head spin (in a good way)

- The exhaustive, no-nonsense Hyperliquid review by CryptoPotato, a name just as crunchy as the content

So next time you wonder how to toss your USDC into the Hyperliquid pool without drowning in jargon or fees, just think of this guide as your blockchain lifeguard. But hey, don’t blame me if you accidentally drop your funds—Sedaris style means I’m here for laughs, not financial advice! 🚀💸

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- How to find the Roaming Oak Tree in Heartopia

- Country star who vanished from the spotlight 25 years ago resurfaces with viral Jessie James Decker duet

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- M7 Pass Event Guide: All you need to know

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- Kingdoms of Desire turns the Three Kingdoms era into an idle RPG power fantasy, now globally available

2025-04-18 09:14