Markets

What to know:

- USD.AI is a new stablecoin protocol that converts idle crypto liquidity into loans for AI data centers, backed by NVIDIA GPUs.

- The protocol uses a system of tokenized NFTs, curators, and queue extractable value to manage loans and liquidity.

- USD.AI aims to bridge on-chain capital with real-world AI infrastructure, offering yields between 13% and 17%.

Ah, DeFi – where stablecoins are working harder than a caffeine-addicted intern, earning Treasury yields like they’re going out of style. Meanwhile, the little guys in AI, who are desperately trying to squeeze funds for their shiny new GPUs, are left crying into their data sets.

Enter USD.AI. Not a superhero (but it does wear a snazzy blockchain cape). This protocol wants to turn idle crypto liquidity into loans for AI machines, because why let all that idle crypto just sit there when it could be financing the future of humanity’s robot overlords?

According to a shiny Dune Dashboard, this protocol is already sitting on a cool $345 million in circulation. What do they do with that money? They back their synthetic dollars with short-term credit tied to NVIDIA GPUs. Yes, those magical chips that run AI in their expensive little homes – the data centers.

And what do those GPUs do? Oh, just generate some revenue by selling compute time for model training and inference. Nothing fancy, just keeping the AI train running while those repayments chip away at the debt. Lenders aren’t getting rich off emissions, though. Oh no, they earn their yield by watching their borrowers pay up.

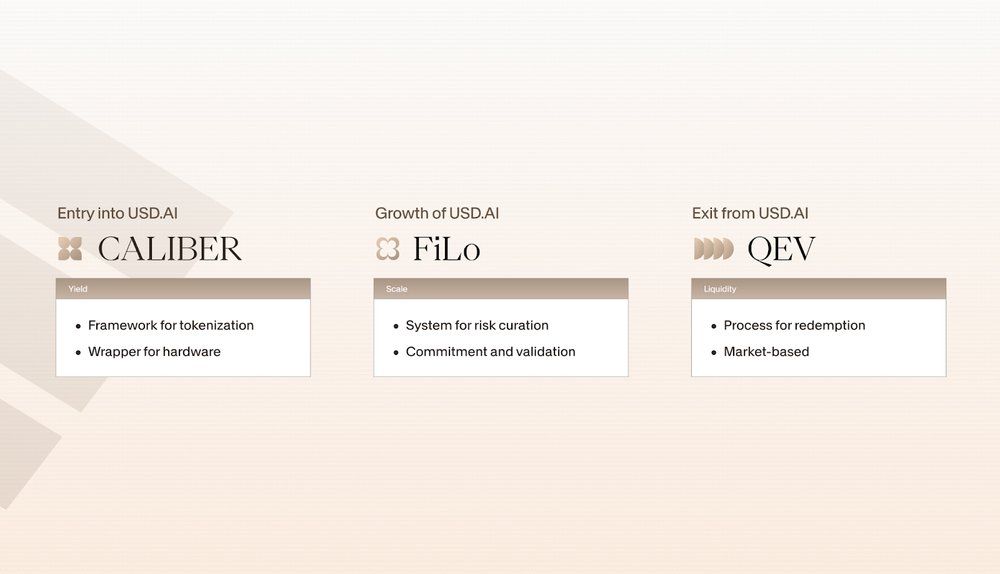

Now, let’s talk structure. USD.AI’s whole setup is like a three-piece puzzle, where each piece needs to work in harmony (or at least pretend to). First up: CALIBER. This is the legal and technical bridge between your humble GPU and its on-chain twin. Each GPU gets a VIP pass into an insured data center, where it’s documented under U.S. commercial law (fancy, right?), then turned into an NFT. Yes, NFTs are now in finance – get over it.

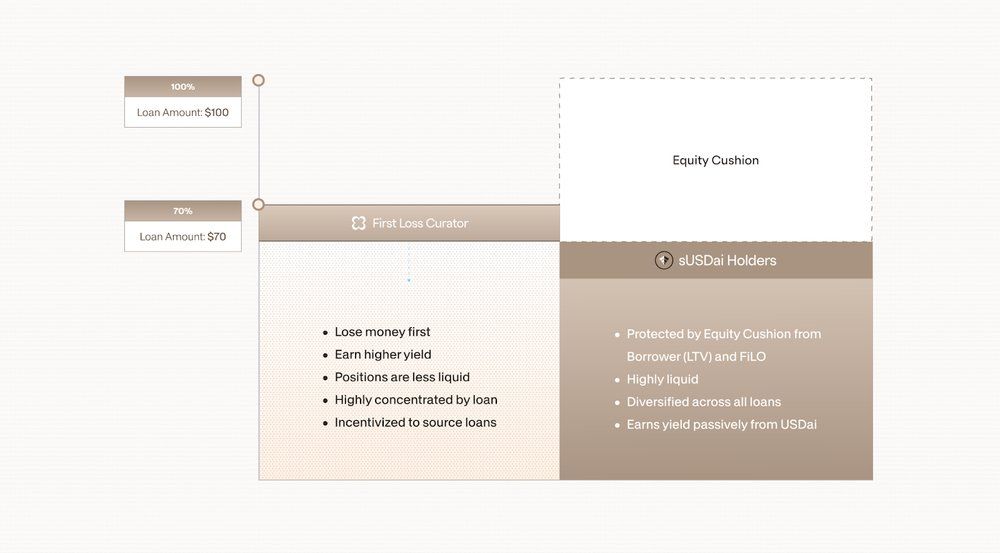

These tokenized receipts? They’re collateral for loans. Yes, real, physical collateral. It’s like a mortgage for a GPU, but with fewer house parties. Now, the next part of the puzzle is the FiLo Curator. These fine folks manage GPU loans and take on some personal risk, meaning they absorb defaults before the lenders are left crying over their non-fungible tokens.

What’s their incentive? Well, they only profit when their borrowers perform. They’re like the unsung heroes of the DeFi world, except with a healthy dose of “please don’t default.” And finally, the last piece of the puzzle is QEV – Queue Extractable Value. Sounds fancy, doesn’t it? It’s the mechanism that manages liquidity and ensures no one’s getting paid immediately. Those who can wait for their repayments get rewarded, and those who can’t? They’ll pay a premium to jump the line. Patience is rewarded, but only if you’ve got the stomach for it.

Right now, if you stake your sUSDai, you’re looking at yields ranging between 13% and 17%. Not bad, especially since it’s not all tied up in weird crypto tricks or leverage loops.

USD.AI’s creators are talking big dreams here, envisioning a future where decentralized infrastructure finance (InfraFi) becomes the norm, extending to everything from renewable energy to computing networks. But for now, it’s all about whether GPU leasing (yes, a literal rental for hardware) can keep up with AI’s insatiable thirst for compute power. If it does, USD.AI could become DeFi’s first real bridge to the machinery behind the AI revolution.

In the meantime, don’t get too comfy. The future is unpredictable, and if the AI overlords decide to take a nap, so might your yield.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- Best Arena 9 Decks in Clast Royale

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-10-24 14:24