Well, strap in, folks, because the Uniswap rollercoaster has taken a rather dramatic dip lately. After what felt like an eternity of sideways shuffling and bullish back-patting in 2024, our dear UNI decided to go on a discount spree, slipping below key support levels faster than a politician’s promises. Liquidations? Oh, they had a field day. But fear not, for the coin has bounced back near $6, suggesting the sellers might finally be taking a coffee break. ☕️

Open Interest Shrinks Faster Than My Bank Account After Payday 💸📉

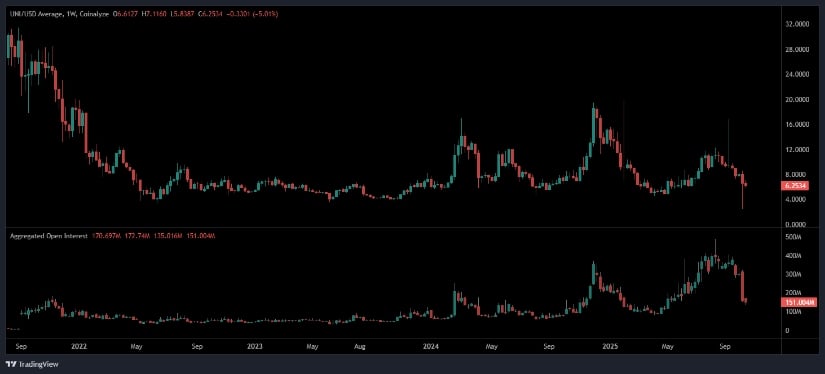

At the time of writing, UNI/USD was hovering around $6.25, nursing a 5.01% weekly hangover. The long-term chart looks like it’s lost its keys to the $8-$10 consolidation zone, leading to a downward sprint that would make Usain Bolt proud. The volatility? Intense. The leverage? Reduced. It’s like the market decided to go on a detox after a wild party. 🥳→🥒

Derivatives data tells us open interest has plummeted from a whopping 400 million to a mere 151 million. That’s right, speculative traders are packing their bags faster than tourists at a rain-soaked beach. This contraction is the market’s way of saying, “Let’s all take a deep breath and reset.” 🌬️

A lower open interest usually means fewer forced liquidations and more organic price movement. But don’t get too excited-buyers need to step up their game before we can declare a momentum shift. It’s like waiting for your friend to finally commit to plans. Will they? Won’t they? 🤷♂️

Market Data: The Calm After the Storm? 🌧️→🌤️

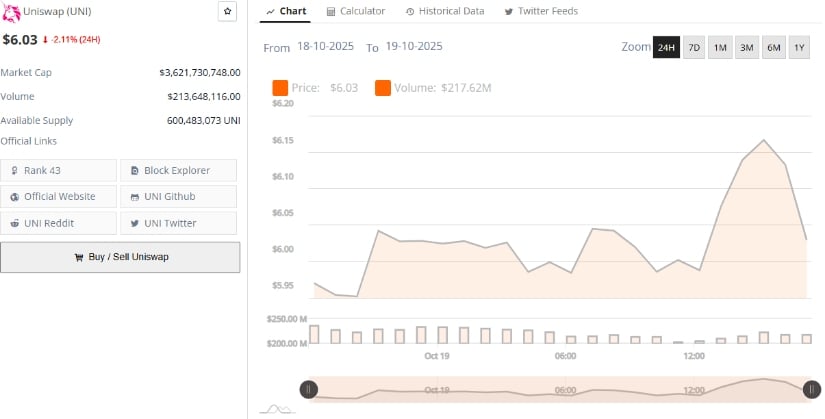

According to BraveNewCoin, Uniswap is trading at $6.03, down 2.11% intraday, with a market cap of $3.62 billion and a 24-hour trading volume of $213.6 million. Circulating supply? 600.48 million tokens, ranking it 43rd globally. Not too shabby, but not exactly a victory lap either. 🏆→🤷♀️

Volume recovery is as muted as a librarian’s sneeze, suggesting traders are tiptoeing back into the market like it’s a minefield. This cautious sentiment mirrors the broader DeFi ecosystem, where liquidity is tighter than a pair of skinny jeans after Thanksgiving. 🦃→👖

Uniswap remains the lifeblood of its decentralized exchange, doubling as a governance token for protocol upgrades and treasury management. But right now, technical sentiment is calling the shots, with traders eyeing the $6.00 to $7.00 range like it’s the last slice of pizza. 🍕

Technical Indicators: $9 or Bust? 🚀💰

UNI/USDT is trading around $6.30, up 4.58% intraday, as buyers defend the $6 zone like it’s the last castle in a medieval siege. Bollinger Bands show the lower band at $5.38, the basis line at $7.19, and the upper band at $9.00-a clear roadmap for near-term movement. The coin’s rebound from the lower band hints at a bottoming process, with the next stop likely at $7.19. 🚉

Momentum indicators are cautiously optimistic. The RSI is at 37.88, just above its moving average of 37.22, signaling a breather from oversold territory but still below the neutral 50 mark. Sellers are losing steam, but bulls aren’t quite ready to charge. It’s like a game of chicken, but with charts. 🐔💼

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Witch Evolution best decks guide

- Best Hero Card Decks in Clash Royale

2025-10-20 00:43