The land of UNI has been plowing forward like a stubborn mule in a dust storm, its price stubbornly clinging to a falling wedge—a pattern that even a blindfolded bull could recognize as bullish. The token now rests at $10.73, a modest sum for those who’ve seen the highs of $12.83, but a springboard for the dreamers eyeing $13.00 like a mirage in the desert.

Analysts, with their charts and coffee-stained spreadsheets, whisper of a 12% rally if the wedge breaks. But let’s be honest—this market’s been playing a game of hot potato with its own momentum. The volume bars have flipped from red to green like a traffic light in a hurry, and the bulls are up to their old tricks again. If UNI cracks $11.00, the bears better start polishing their shovels.

The Wedge: A Valley of Hope and Desperation

On the 1-hour chart, UNI has been trapped in a falling wedge—two converging cliffs that even a mountain goat would think twice about scaling. Analyst @CryptoJoeReal, a man with a chart and a dream, insists the price bounced off the lower boundary like a rubber band snapping back. The breakout target? A modest $11.83, which sounds like a lot until you remember that $13 is the promised land.

Volume has been rising like a tide, and the green bars are a welcome sight for those who’ve been swimming in red. Buyers are stacking bricks, one dollar at a time, hoping to build a fortress above $10.50. If they can hold that line, the bulls might just have enough steam to reach $11.40 and beyond. But let’s not get ahead of ourselves—this is crypto, after all. Nothing’s ever simple.

Intraday Drama: A Bull’s Gambit

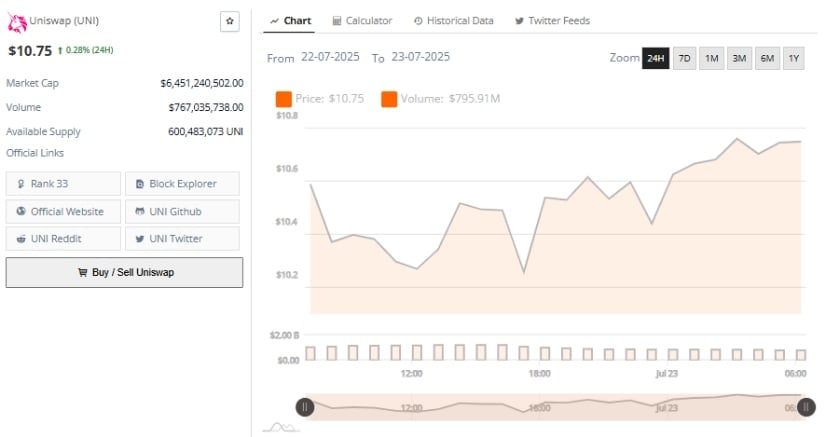

Over the past 24 hours, UNI has danced between $10.20 and $10.75 like a cat on a hot tin roof. The price action tells a story of higher lows and higher highs—a narrative as old as time, but one that’s always worth retelling. The 24-hour volume has hit $795.91 million, a number that sounds impressive until you realize it’s just 3% more than yesterday. Still, it’s enough to make the bears grumble and the bulls chuckle.

With a market cap of $6.45 billion, UNI isn’t exactly the king of the hill, but it’s got enough grit to hold its own. If the price stays above $10.50 and the volume keeps humming, the bulls might just have the stamina to test $11.80. But let’s not forget—this is a game of inches, and one slip could send the whole house of cards tumbling.

Technical Indicators: The Bull’s Best Friends

The daily chart tells a tale of resilience. UNI’s rallied from mid-June, hit a high of $12.83, and then took a breather. The support around $10.50 is holding like a fortress, and the bulls are licking their wounds, waiting for the moment to strike. The MACD is a happy camper, with the line above the signal line and a histogram that’s still in the green. But the bars are narrowing like a desert well running dry—caution is in order.

The Chaikin Money Flow is at +0.09, a number that sounds insignificant until you realize it’s the first time it’s been positive in weeks. If the bulls can keep the momentum going and the volume stays strong, UNI might just have enough gas to hit $13.00. But let’s not get carried away—this market’s as unpredictable as a California wildfire. The bears are grumbling, but the bulls are whispering sweet nothings of $13.00. Who will win? Only time will tell. 🐄 vs. 🐆

Read More

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- Clash Royale Witch Evolution best decks guide

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Best Arena 9 Decks in Clast Royale

- Clash of Clans Meltdown Mayhem December 2025 Event: Overview, Rewards, and more

- Cookie Run: Kingdom Beast Raid ‘Key to the Heart’ Guide and Tips

- JoJo’s Bizarre Adventure: Ora Ora Overdrive unites iconic characters in a sim RPG, launching on mobile this fall

- Best Builds for Undertaker in Elden Ring Nightreign Forsaken Hollows

- Clash of Clans Clan Rush December 2025 Event: Overview, How to Play, Rewards, and more

2025-07-23 20:49