The market, like a weary traveler clutching a half-empty bottle of optimism, stumbles toward recovery. Buyers, perhaps emboldened by a caffeine-fueled epiphany, dare to re-enter the fray after a bloodbath of liquidations that left wallets weeping into their keyboards. 🖥️💧

Volatility still dances like a feral cat on a hot stove, but derivatives whisper that sellers are slowing their tango with doom. Could this be the moment UNI gathers its courage to tackle the $8 wall? Only time will tell-or maybe a few more crypto bros losing sleep. 🤷♂️

Open Interest Data Suggests Deleveraging and Market Reset

UNI/USD clings to $6.61, a 1.34% rebound on the hourly chart, as if the token just remembered it had a will to live. Open interest, that fickle lover, dropped from $149M to $148M, hinting at a mass exodus of over-leveraged traders. One wonders if they’re now buying into the “buy the dip” myth, or just buying bread to survive. 🍞

This derivatives slump, like a deflated party balloon, signals the end of reckless speculation. Will it birth a new era of calm? Or just a lull before the next storm? The market, ever the drama queen, remains unpredictable. 🌪️

Open interest’s pause is a sigh of relief for the derivatives crowd, who’ve likely been binge-watching Netflix instead of trading. If UNI stays above $6.50, maybe the bulls will finally stop looking like deer in headlights. The path to $7 and $8? Let’s just say it’s less “March to Freedom” and more “stumble through a minefield.” 🧗♂️💣

Market Data Highlights Shaky but Improving Market Sentiment

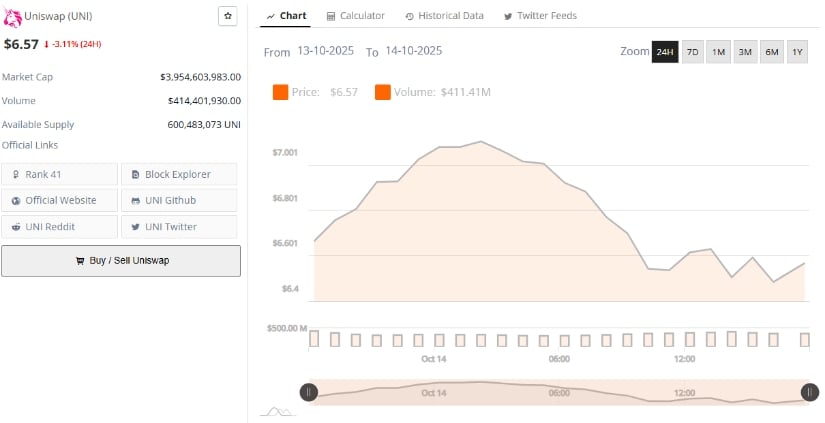

BraveNewCoin reports UNI at $6.57, down 3.11% in 24 hours, with a $3.95B market cap. Ranked 41st, it’s the DeFi king of a kingdom with a leaky roof. Liquidity? Thin as a diet soda. But hey, at least it’s not last on the list-yet. 🏆😅

The token’s $6-$7.2 range is a tug-of-war between hope and despair. Sellers are losing steam, but buyers? They’re still waiting for a sign. Maybe a divine one from the Oracle of Crypto, or just a meme that goes viral. 📉✨

If buying volume picks up and volatility takes a nap, UNI might finally stop playing “floor is lava.” Staying above $6.50? That’s the difference between a comeback and another sad TikTok trend. 🎤

Technical Indicators Confirm Gradual Buyer Re-Entry

UNI/USDT trades at $6.564, down 6.91% today, after a rollercoaster ride from $8 to $6.384. Technical indicators suggest buyers are sneaking back in like thieves in the night. Chaikin Money Flow at 0.18? That’s the sound of someone whispering, “This is a bargain.” 🛍️💸

The MACD histogram, stuck at -0.080, is a bearish ghost clinging to life. But even ghosts can get bored. If these indicators turn neutral, sellers might finally hand over the keys to the kingdom. Until then, $6.50 is the line in the sand-and let’s hope no one gets sandy. 🏜️

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Witch Evolution best decks guide

2025-10-15 00:56