What to know:

- A decidedly rowdy U.S. 10-year yield pranced merrily to 4.22% in the midst of market pandemonium—apparently unconcerned that the world was shrieking “Knock it off!” due to trade skirmishes, currency capers, and geopolitical fisticuffs. 🤺

- Ole S. Hansen, that clever banana at Saxo Bank, spotted the jump in long-dated Treasuries and muttered about hidden gremlins lurking behind the drapes.

- Jim Bianco responded with a jaunty wave of the hand, insisting foreign chaps weren’t ditching the debt, tracing it instead to an inflation-fueled domestic exodus and a dollar bounding around like a puppy in springtime.

On Monday, markets wiggled like jelly in a tempest. One moment they were happily nibbling crumpets, the next they were engaging in a delightful meltdown reminiscent of the COVID crash of March 2020. With the U.S. and China quarreling like two alley cats over tariffs, no one seems to be blinking, let alone backing down. 😼

Stocks tottered. Commodities soared and sank. Even our dear friend Bitcoin got in on the act, tossing about 10% in the air like it was confetti. Yet the real star of this cosmic circus is the U.S. 10-year Treasury yield. People call it the “risk-free” interest rate—though on days like this, one has to wonder if that was a terribly misguided nickname. The Trump administration fancies giving it a haircut, all the better to refinance heaps of national debt, no doubt.

In a daring display of gravity, yields dipped from 4.8% to 3.9% last week, aided by Mr. Trump slapping tariffs on every import that so much as looked at him funny. Ordinarily, bond prices prefer to go up, pulling yields down, at the slightest whiff of global mayhem. But in true contrarian form, they spun around on Monday and did the exact opposite—rocketing higher to 4.22% whilst waving a jaunty handkerchief. 🎩

This unruly spectacle wasn’t limited to the U.S. Across the pond, the U.K. had a jump in yields so wild it threatened to give everyone flashbacks to the Liz Truss pension pickle of 2022—further proof that global markets sometimes band together in one big cosmic pratfall. Confidence in sovereign debt and currencies took a drubbing, like a set of musty old rugs.

Ole S. Hansen at Saxobank declared the surge in long-dated Treasuries smelled like trouble brewing. Quoth he: “U.S. Treasuries suffered a massive sell-off yesterday, with long yields rising the most since that ghastly pandemic kerfuffle—a possible sign of large holders, such as foreign types, selling and repatriating their pennies. The 30-year yield catapulted from near 4.30% to a breezy 4.65%, while the 10-year leapt back to 4.17% from 3.85%. Dreadful stuff!”

Meanwhile, Jim Bianco—ringmaster of Bianco Research—popped up to say, “Fiddlesticks! Foreigners aren’t selling Treasuries to pester Trump,” pointing instead to the rather perky Dollar Index, which bounded up 2.2% over three days like a terrier after a squirrel. 🐿️

“If our chums in distant lands were truly flogging Treasuries to make a point,” he observed, “they’d have swapped dollars for another currency. Yet the dollar soared, not sank. So the money likely motored into the States, not away. That suggests a domestic meltdown, driven by dread of inflation.”

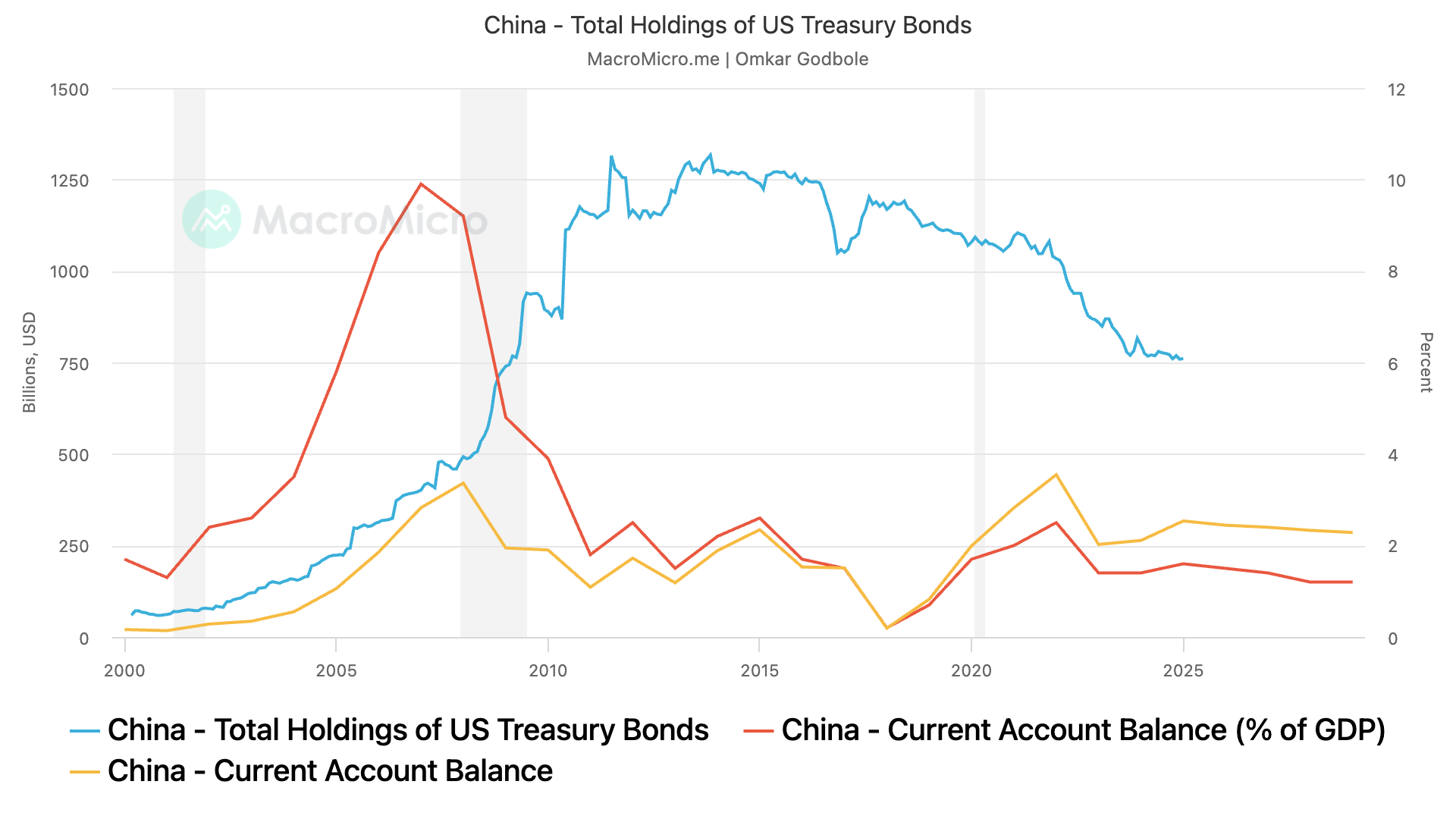

And so the world wags on, with rumors swirling that China has offloaded $50 billion in Treasuries. Though unverified, they do tickle the imagination. As of January 2025, the venerable Middle Kingdom still jingled with about $761 billion in Uncle Sam’s IOUs, second only to Japan.

Some say the 10-year and 30-year yield leaps are all down to China being in a right sulk. But the evidence is slim, since China’s official stash is stuffed largely with shorter-term bills and agency bonds (rather than the long-duration larks that are apparently misbehaving). Despite the notion that China might brandish Treasuries as a cudgel in the trade war, economic wags like Michael Pettis note that giving up U.S. bonds for vengeance would be a tad like throwing out your crumpets to spite your teapot—too messy and not terribly effective.

In short, dear reader, the grand dance of yields continues apace. China’s been steadily trimming its holdings since 2013, not for mischief but because of its current account surpluses. Will this kerfuffle blow over with nary a ruffle, or is it just the beginning of a grand comedic farce in the realm of global finance? One rather suspects we’re all in for a jolly good show. 🍿

Michael Pettis, author of “The Great Rebalancing,” has long opined that China can’t just weaponize its U.S. Treasury stash to serve up financial vengeance. It’s all dreadfully linked to that surplus lark, so they’re simply not at liberty to brandish it like an umbrella on a rainy day.

Thus, we find ourselves in quite the fix, with yields bobbing about like unruly ducks. But fret not. After all, in the delightful world of finance, there’s always another twist right around the corner—or, as Aunt Agatha might say, “Just when you think you’ve sorted the dratted thing, it leaps out and nips you in the ankle.” 🦆

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Best Arena 9 Decks in Clast Royale

- ATHENA: Blood Twins Hero Tier List

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Furnace Evolution best decks guide

- What If Spider-Man Was a Pirate?

2025-04-08 12:14