On a Wednesday as gray as a Moscow sky (April 30), the perpetual march of bitcoin and ether ETFs ground to a halt, pausing for a collective sigh—or was it a dramatic fainting spell? Bitcoin ETFs, always the theatrical ones, parted with $56 million, while their ether siblings surrendered a modest $2.36 million, interrupting their bold procession of daily victories.

Bitcoin ETFs Find Their Weakness, Drop $56M and Break Their 8-Day Vodka Binge—Ether Joins the Hangover

Wednesday’s celebration ended not with a bang but the slow, inevitable creak of an office chair. Investors in bitcoin and ether ETFs considered the meaning of life—or at least the meaning of consecutive inflow streaks—when the numbers reversed, toppling the crypto market’s fragile optimism like a countryside fence in the spring thaw.

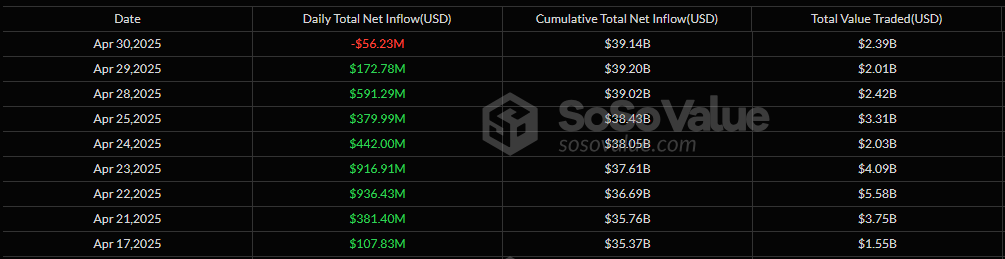

Take Bitcoin ETFs: After eight days of relentless joy, they finally couldn’t keep their poker face. Fidelity’s FBTC, always eager to impress, dashed out the door with $137.49 million in tow. Not to be outdone, Ark 21shares’ ARKB slunk out with $130.79 million, while Grayscale’s GBTC and Bitwise’s BITB scurried behind, each clutching their own little train cases ($31.96 million and $23.02 million, respectively). One could practically hear the doors slamming in the corridor.

Poor Blackrock’s IBIT heroically welcomed $267.02 million—like a lonely aunt trying to keep spirits high at the family reunion with an extra cherry pie—but the effort was lost on the group. The whole trading hall rumbled with $2.39 billion in volume, only to find net assets gently drooping to $108.58 billion, like a wilted tulip in April.

Ether ETFs, having enjoyed a four-day nap in the sun, met reality at the door. They put on their bravest faces but still watched $2.36 million stroll away. Grayscale’s ETHE, with melodramatic flair, lost $7.13 million, Bitwise’s ETHW misplaced $1.02 million down the back of the sofa, and Fidelity’s FETH did its best with a $5.08 million head pat—alas, not quite enough to turn the tide.

Total trading activity in ether ETFs clocked in at a polite $176.42 million, and net assets adjusted themselves to $6.17 billion, trying not to make eye contact with anyone in the hallway.

Is this the end or just a mood swing? Only the idle clouds know. For now, relentless ETF inflows have been gently but firmly shown the door. Curtain falls. 🕯️🥲

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- M7 Pass Event Guide: All you need to know

- Clash Royale Furnace Evolution best decks guide

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash of Clans January 2026: List of Weekly Events, Challenges, and Rewards

- Best Hero Card Decks in Clash Royale

2025-05-01 21:57