Right. So, apparently, someone – and let’s be clear, “someone” is usually a collection of someones with incredibly questionable life choices – has been subtly offloading a rather significant number of Lighter (LIT) tokens. We’re talking $7.18 million worth of subtly offloaded tokens. Which, when you think about it, is roughly the cost of a small planet. Or a very large number of cups of tea. Priorities, people.

This unfolding drama follows some rather insistent poking around in the blockchain, revealing a pattern of sales that has the DeFi community twitching nervously. It’s all a bit…untidy. A bit like trying to explain quantum physics to a goldfish. Particularly concerning is that this all stems from the ‘Token Generation Event’ (TGE). A TGE. As if giving something a fancy acronym makes it less inherently suspicious. 🙄

Coordinated Deposits and Suspicious Patterns: Or, Why Nobody Trusts Anyone

Five wallets, seemingly interwoven by a nefarious cosmic design (or, you know, a spreadsheet), received a generous dollop of LIT tokens – approximately 4% of the entire circulating supply. Which, in case you’re wondering, is enough to cause a moderate degree of bother. They then, quite predictably, started selling those tokens. Which, again, is a bit like discovering water is wet.

Analysts – those people who spend their lives staring at numbers and murmuring darkly – suspect a deliberate strategy, not just random market fluctuations. One can only imagine them, hunched over their screens, muttering things like “The algorithm… it’s taunting us…”

Blockchain researcher MLM (a name that suggests a secret society of cryptographers) first pointed out this little kerfuffle, noting that someone deposited around $5 million USDC into Lighter’s liquidity protocol (LLP) around April 2025. Don’t ask why someone would do that. Seriously, don’t.

This money was then neatly divided amongst five wallets, who promptly received nearly 10 million LIT tokens (~$26 million at the time). Talk about a lucky dip. Or a carefully orchestrated heist. Potato, potahto.

Here are the wallets, in case you were hoping to send them a strongly worded email:

- 0x30cD78B301192736b3D6F27Bdad2f56414Eb6164

- 0x9A6D9826742f1E0893E141fe48defc5D61866caD

- 0x7c5d228B0EB24Ad293E0894c072718430B07Dfe3

- 0xc0562d68b7C2B770ED942D28b71Bc5Aa0209bbee

- 0xfdBf615eC707cA29F8F19B7955EA2719036044bf

The even distribution – 1% of the total LIT supply, 4% of circulating tokens – is, shall we say, striking. It grants the entity a rather uncomfortable amount of influence. The sort of influence that can buy a lot of… well, anything. Probably spaceships.

And as if that wasn’t enough, the wallets also made an extra $1-2 million from LLP yield, because why not? 🤷♀️ Let’s just add more fuel to the fire, shall we?

$7.18 Million in Sales: A Collective Intake of Breath

Since the aforementioned TGE, these linked wallets have flogged 2,760,232.88 LIT tokens, totaling roughly $7.18 million. The general consensus? This looks suspiciously like someone deliberately liquidating their holdings, rather than a spontaneous outburst of market enthusiasm. Who knew?

– ZachXBT (@zachxbt) January 1, 2026

ZachXBT, a blockchain investigator known for his insightful and disturbingly accurate commentary, suggested that this might be a case of opportunistic insider behavior. Shocking! Meanwhile, someone called Henrik expressed the anxieties of the entire LIT community.

“If this is correct, that’s a serious concern for every $LIT holder, especially given the lack of transparent communication from the Lighter team,” wrote Henrik.

This, of course, highlights the central problem: the Lighter team is…silent. Like a mime at a rock concert. Investors are clamoring for information regarding token allocation, vesting schedules, and distribution mechanisms. But silence, as they say, can be golden. Or, in this case, a rather ominous shade of grey.

Without clarity, it’s difficult to discern between legitimate market activity and potentially dodgy insider selling. Which, let’s be honest, is rarely a good sign.

This whole debacle comes at a critical moment for DeFi, riddled with the inherent instability of crypto airdrops and token distributions. Airdrops – designed to shower early adopters with digital confetti – can, unintentionally, allow a single entity to amass disproportionate rewards. It’s like trying to win a raffle by buying all the tickets. A bit unfair, really.

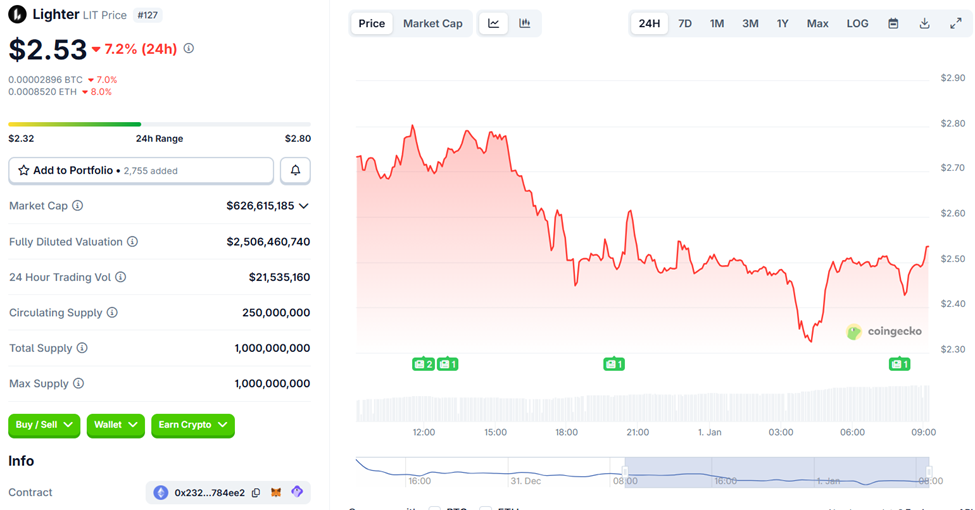

The sales are already knocking the token price down (it’s currently down over 7%, trading at $2.53 as of… well, now), and generally stirring up a rather unpleasant mood. In short, things could be worse. But not by much. 🙄

And if those wallets decide to offload the remaining 7 million LIT… well, let’s just say it won’t be a joyful occasion.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Clash Royale Furnace Evolution best decks guide

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Best Hero Card Decks in Clash Royale

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Best Arena 9 Decks in Clast Royale

- Clash Royale Witch Evolution best decks guide

- Dawn Watch: Survival gift codes and how to use them (October 2025)

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2026-01-01 09:42