So SUI’s been doing that thing where the new kid at school gets all the attention and Solana is left clutching its backpack, wondering if it’s still cool. SUI has swanned in, gathered $14.7 million in institutional love notes, while Solana’s outflows hit $13.9 million, which is the crypto equivalent of “It’s not you, it’s me.” 🕺💸

Is this a fleeting romance, or are the Big Kids (institutions, not your neighbour with three Bored Apes) genuinely eyeing SUI as their new commitment? Suspense!

SUI: New Popular Kid on the Playground

//beincrypto.com/wp-content/uploads/2025/05/Screenshot-2025-05-01-154912.png”/>

It’s juicy because Solana’s been the teachers’ fave for ages, and suddenly SUI rolls up, throws down some numbers, and grabs everyone’s eyeballs. Diversification is the word—because heaven forbid anyone commits to just one blockchain like it’s a monogamous relationship.

Juan Pellicer from IntoTheBlock agrees, but more eloquently. And with fewer snack breaks.

“Institutions are diversifying rather than replacing Solana with SUI. Some capital has shifted, with cues that 60% of Solana’s outflows moving to SUI, drawn by its growth potential and newer technology. Yet, Solana’s $73 billion market cap, established ecosystem, and strong ETF momentum keep it a mainstay, complementing SUI’s role in diversified institutional portfolios,” Pellicer told BeInCrypto.

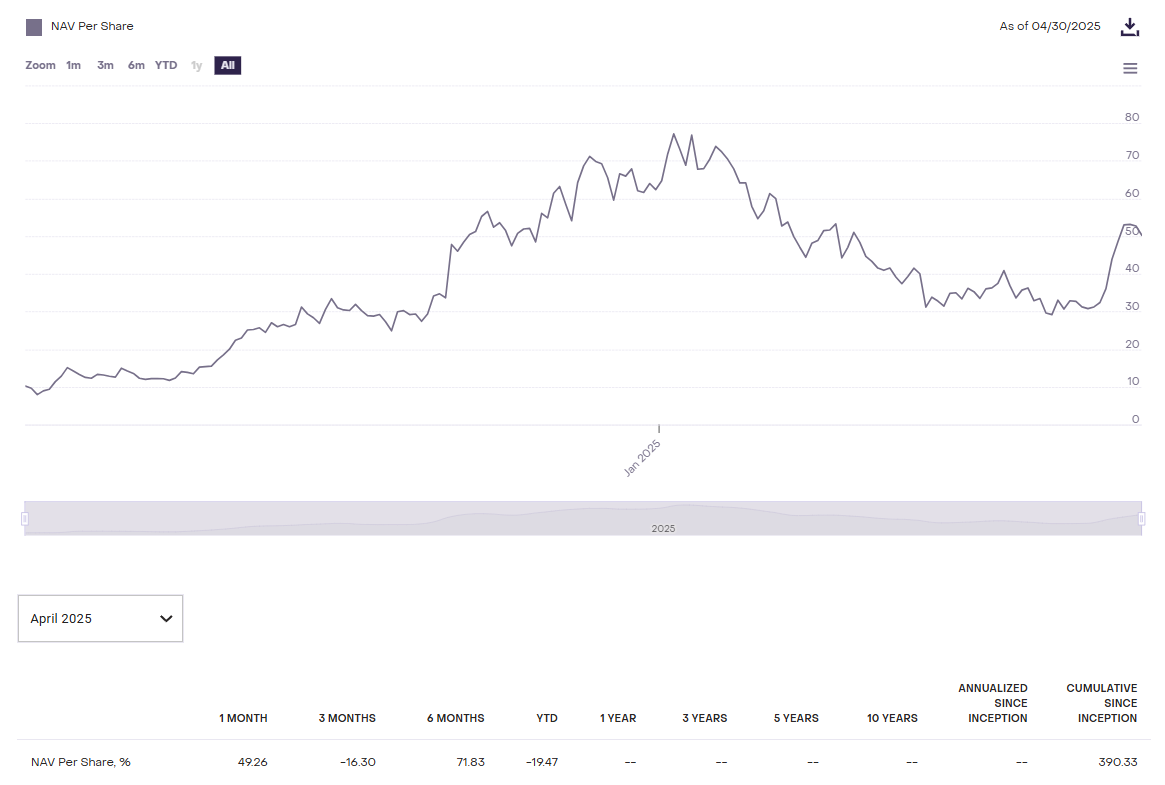

Meanwhile, over in the magical world of Grayscale Trusts, SUIFUND danced its way to a 71.8% NAV increase over six months. Solana? Just sort of vibed, didn’t move at all—still at the punch bowl.

This difference in demand is like watching two people at the same party, but only one is double-fisting canapés and making new friends.

Oh, and in a plot twist, CBOE waved a piece of paper at the SEC for a SUI ETF. Pellicer’s take: “Yeah, maybe—like waiting for a new season of ‘Fleabag’—but probably only after Solana gets its time in the spotlight, what with its $73 billion market cap and ‘Fidelity Likes Me’ bumper sticker.” SUI’s shiny-new status and those pesky past allegations mean there’s still some waiting ahead—though, hey, if the SEC is feeling frisky, you never know.

“A SUI ETF is less likely to be approved before a Solana ETF. Solana’s June 2024 filings, $73 billion market cap, and support from major firms like Fidelity prioritize it for mid-2025 decisions. SUI’s March 2025 filing and smaller market presence face delays due to its newer status and past allegations, though a pro-crypto SEC may enable approval earlier than expected.”

SUI and Solana: The Awkward Price Performance Tango

Both tokens took a tumble for most of the year—SUI slid 14%, Solana 19%. But then April happened and SUI shot up 56.6% (as if it accidentally put rocket fuel in its kombucha). Solana, meanwhile, rallied 21%, casually jogging behind going, “Wait up, I know those people too!”

But let’s not forget size matters—Solana’s market cap rally in April alone is equal to SUI’s entire market cap. (Solana tried not to look smug about it. Failed.) So, SUI’s growth is spicy, but Solana still owns the grown-up table at Thanksgiving.

SUI’s April supernova does point to new friendships forming—probably helped by its scalable chains and some tasty partnerships. Expect more fireworks in Q2 and Q3 if it keeps up this pace, but let’s not put Solana’s photo off the family mantle just yet. SUI’s still got a long way before it’s the new institutional darling. For now, they’re both hiring PR teams and pretending not to check each other’s Instagram stories. 🙃🚀

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- M7 Pass Event Guide: All you need to know

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- Clash Royale Witch Evolution best decks guide

2025-05-01 20:03