Discover How U.S. Data Could Make or Break Bitcoin—And Keep You Awake at Night! 🚀💰

After last week’s thrilling adventure with the CPI and PPI—those two mighty indicators that command the Federal Reserve’s every move—investors, traders, and those who simply enjoy watching numbers dance now turn their weary eyes to this week’s parade of economic data, with a particular fondness for how it might influence the fickle world of crypto. Yes, the markets are like temperamental lovers—sometimes they bloom, sometimes they blast your portfolios to smithereens, all under the watchful gaze of macro events.

The digital gold rush continues unabated, with Bitcoin and its shivering brethren eyeing four key U.S. economic indicators this week, each vying to sway their fortunes—and yours. Meanwhile, the markets will keep a keen watch on these numbers, as if life itself depended on it. Because, in truth, it does.

Top U.S. Economic Indicators That Might Make or Break Your Bitcoin Dreams (or Nightmares)

Prepare yourself. The upcoming economic data promises to be entertaining, possibly terrifying, and certainly unpredictable. Just as a clown might juggle knives, the market will juggle hopes, fears, and dollar signs.

Initial Jobless Claims: The Weekly Ticket to Unemployment Panic 🎭

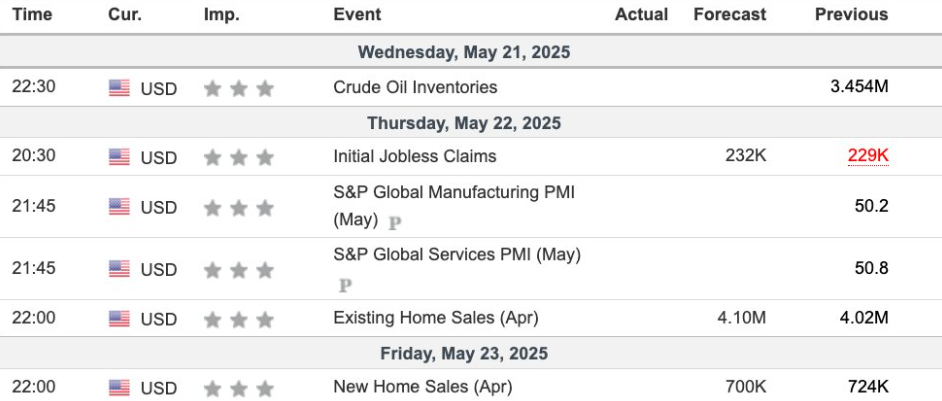

This report, the weekly tally of folks filing for unemployment benefits—or, as I like to call it, the “How Broke Are We This Week?” indicator—serves as a mirror reflecting the health of our labor market. Investors and traders watch it as if it’s a crystal ball, predicting whether the Fed will be kind or cruel to the financial world.

“…A core labor market indicator that could shift market expectations on Fed policy,” noted an indicator expert in a post. Because who doesn’t love market predictions based on people losing their jobs? 😂

The consensus forecast points to 232,000 claims, up from 229,000—an alarming increase, suggesting economic weakness. If true, consider crypto as your tiny safe harbor amidst economic chaos. Conversely, fewer claims than 229,000 might mean the economy is too robust for Bitcoin’s liking, potentially strengthening the dollar and sending risk assets crashing like a sitcom slapstick fall.

This number drops on Thursday, much like your hopes for a peaceful markets evening—watch out for volatility! And yes, this influences the mighty USD and the Fed’s next move, because in finance, everything is interconnected, much like soap operas.

Services PMI: The Monthly Report Card for Service Sectors 📈

Released by S&P Global, this indicator measures how well America’s transport, finance, and hospitality sectors are doing—think of it as the report card your aunt might give you if she cared about your career in Uber driving or fancy restaurants.

If the number rises above 50, the economy’s doing well—kind of like when your neighbor’s lawn suddenly looks better after a lawnmower frenzy. But if it dips below 50, it’s time to panic or maybe just make a funny meme about it. Last month’s 50.8? Think of it as a gentle, cautious thumbs-up. May’s forecast? Same at 50.8—unless the numbers surprise us, which they often do, like a plot twist in a novel nobody asked for.

Expect Thursday’s release to create fireworks—volatility, surprises, maybe even some crying. Bitcoin will decide whether to dance or hide under the bed.

Manufacturing PMI: The Industrial Mood Ring of the U.S. 🏭

This is the factory report card, measuring activity in America’s factories. Think of it as a thermometer stuck deep in the industrial heart—above 50 means “Things are growing,” below suggests “Uh oh, trouble’s brewing.”

Tariffs have made this indicator more dramatic than a Shakespearean tragedy, with recent numbers showing supply chain disruptions and economic strain. Crypto traders want to see it dive below 50.0—because, like a rebellious teenager, they prefer chaos to stability. Last forecast? Near 49.8—so if it’s lower, expect Bitcoin to erupt like a fireworks display, owing to the deepening economic gloom.

“PMI data for April 2025 shows manufacturing contracting (PMI 50.2) and services slowing (PMI 50.8), signaling tariff impacts and domestic demand weakness,” a wise man on X (Twitter) wisely tweeted.

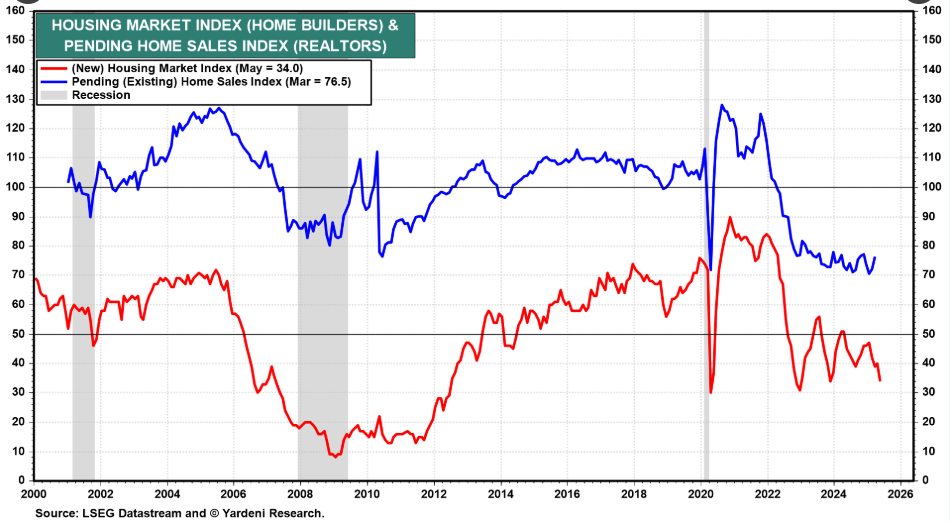

Existing Home Sales: The Real Estate Soap Opera 🏡

The Nation’s Realtors—those wizards of the housing market—report the sales of pre-owned homes each month. And it turns out, fewer sales might mean more crypto. Recently, estimates suggest 700,000 homes sold in April, down from March’s 724,000—oh, the drama! This decline hints at an economic slowdown, prompting investors to seek refuge in cryptocurrencies, which are apparently more resilient than a house on quicksand.

If the housing market remains bleak, Bitcoin’s appeal as a hedge grows—kind of like insurance against your bad decisions.

//beincrypto.com/wp-content/uploads/2025/05/COIN_2025-05-13_14-56-56-2.png” alt=”Crypto Price Chart”/>

As of now, Bitcoin is trading at $102,820, down by a mere 0.5%—perhaps just a bad hair day for the markets.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Best Hero Card Decks in Clash Royale

- Best Arena 9 Decks in Clast Royale

- Dawn Watch: Survival gift codes and how to use them (October 2025)

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Witch Evolution best decks guide

- ATHENA: Blood Twins Hero Tier List

- Wuthering Waves Mornye Build Guide

2025-05-19 15:19