Five reliable harbingers of the US economic realm may whisper their ominous tales, tightening their grip on the feeble sentiment of Bitcoin (BTC) this week, while the crypto market dances joyfully on the precipice of despair.

The influence of American economic events resembles the swift hand of fate, shaping Bitcoin into a puppet of fear and hope. Traders and investors find themselves at the mercy of these treacherous data points, for they wield great power over their fortunes.

US Economic Data To Watch This Week

Amidst the lamentations of a crypto Black Monday, these economic revelations shall serve as the guiding stars for those navigating the stormy seas of Bitcoin and its less fortunate altcoins.

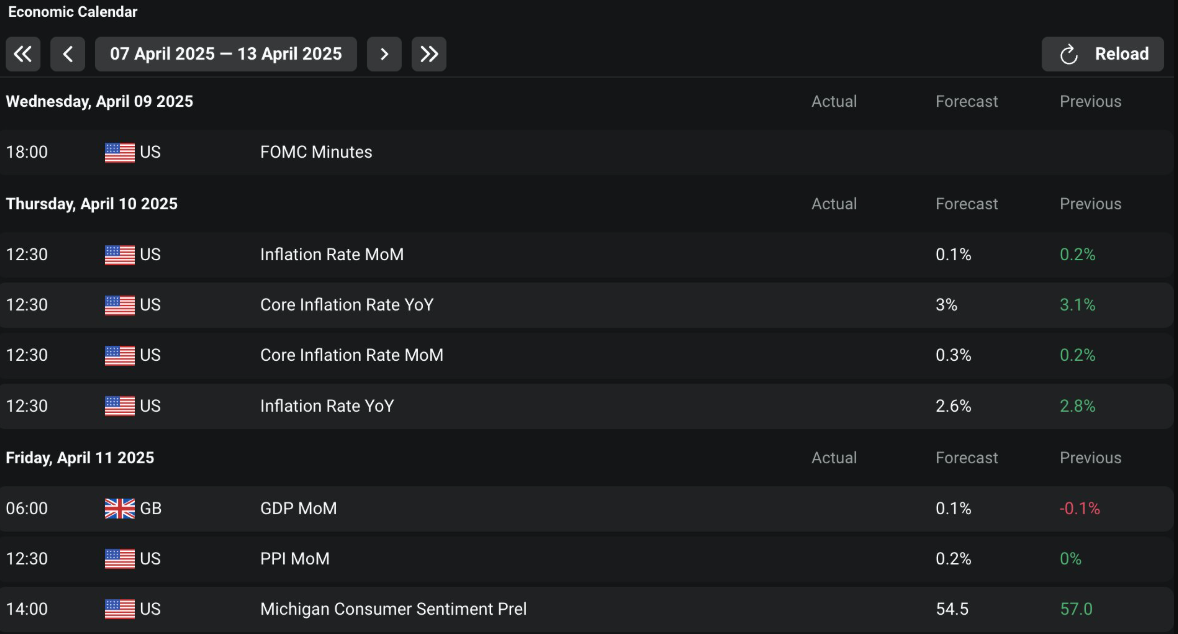

March FOMC Minutes

Ah, the hallowed minutes of the Federal Open Market Committee (FOMC) shall grace our presence on Wednesday, opening a window into the mystical workings of the Federal Reserve’s (Fed) monetary polices, much like a well-placed mirror in a darkened room.

These precious minutes detail spirited discussions—oh, the fervor!—concerning interest rates, inflation, and the plight of economic growth, all of which dance delicately with the sentiments of a world hungry for stability. Should the tone be hawkish, the pursuit of safety may ensnare investors like moths to the flame of bonds, casting Bitcoin into the shadows of doubt along with a boldly strutting dollar.

Yet, rejoice! Should the winds blow favorably with a dovish outlook, whispers of rate cuts may stoke an appetite for risk and unleash a torrent of capital into the once-dreaded embrace of crypto. What a delightful irony, that a cheaper pathway to investment ignites dreams of audacious riches!

Let us peer into the abyss, for crypto traders will be ever-watchful, seeking crumbs of wisdom about the Fed’s stance on inflation. Recent indicators have been rather dull, failing to ignite any passionate re-acceleration—a true testament to mediocrity!

Federal Chair Jerome Powell may yet reaffirm his previous musings, warning against the heady folly of premature rate cuts, but new signals could emerge that would toss Bitcoin into exhilarating turmoil, a sight to behold.

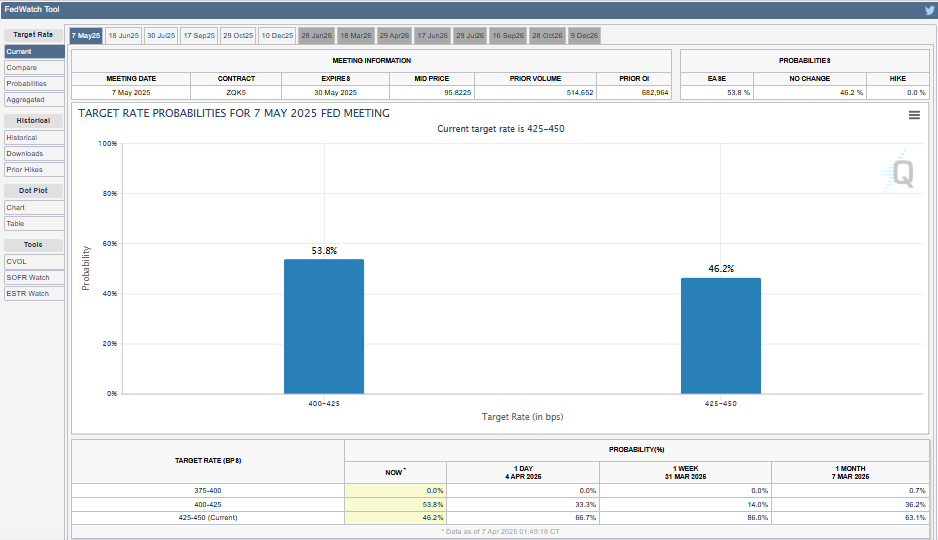

Prepare thyself! Traders and investors must steel themselves for a tempest of price swings, particularly if the minutes choose to play coy and deviate from what the gallant heroes at CME FedWatch have anticipated.

In an unexpected twist, JPMorgan emerges as the early prophet of recession, speaking ominously of the dread that follows Trump’s tariffs. With foresight, they proclaim that the Fed may be compelled to loosen their iron grip on rates before their next grand meeting, scheduled for the epoch of May 6-7, 2025.

Despite these tiresome proclamations of doom, the crypto maelstrom continues unabated, without so much as a whisper of emergency meetings to calm the tumult within April, as per the Fed’s delightful calendar. Thus, all eyes turn toward that fateful May date, where change may be afoot.

“The next FOMC meeting beckons in the first week of May! Can the weary investors wait? Can the good citizens of the US endure? How high does the specter of inflation loom? Can we summon an urgent rate cut meeting? Until our neighbors to the east embrace crypto, BTC languishes in the ebb and flow of US liquidity,” one particularly astute observer mused.

Initial Jobless Claims

Further casting their shadow, beyond the March FOMC minutes, the next herald to watch shall be the Initial Jobless Claims—a report that emerges every Thursday, offering a glimpse into the delicate health of the labor market, much like peering through a weathered window on a stormy night.

Measuring the fickle nature of unemployment filings, a lower count may proclaim a thriving economy, while a higher tally serves as a harbinger of weakness. In our beloved crypto realm, a robust labor market (as evidenced by lower claims) may dampen Bitcoin’s allure, compelling investors to better-nurtured equities.

However, as fear for a recession creeps closer like an unwelcome guest, rising claims may cause deliberations at the Fed’s table about rate cuts. Historically, such a prospect provides a generous feast for crypto, with lower rates sprinkling liquidity like fairy dust upon parched ground.

The market can hardly contain its anticipation for claims to surpass the previous week’s count of 219,000, for such a revelation would bolster Bitcoin, positioning it as a hedge against the storm of economic uncertainty.

Yet—oh, what irony!—while recent trends showcase a delightful decline in claims, the lingering specter of ongoing issues for job seekers plagues the land.

The volatility of crypto may get a most exhilarating rise, especially as Thursday unfurls its mysteries, with CPI data twirling into view thereafter.

“US Core Inflation Rate and CPI (Thu10) plus Initial Jobless Claims (Thu10)—they are the titans that shall move markets, influencing USD, bond yields, and Fed expectations amidst the tumult of tariffs,” quipped a keen observer.

US CPI

The eminent Consumer Price Index (CPI), to be released on Thursday, shall serve as yet another critical piece of the puzzle for those entrenched in the crypto battleground. This data reveals inflation’s capricious nature by measuring fluctuations in the prices of goods and services.

A CPI that surges above expectations can herald a sustained inflationary wave, compelling the Fed to maintain their stance or even ascend rates with reckless abandon, further inflating the dollar’s stature and squeezing crypto prices downwards as appetite for risk dissolves.

In a recent showing, inflation barely cooled to a tantalizing 2.8% in February. Should March’s CPI breach the anticipated 2.6% annual rise, the prospects for Bitcoin could dim, compelling investors to flock to safer havens against this tempest of uncertainty.

Conversely, if fortune smiles and CPI falls beneath expectations, the comforting whispers of rate cuts may herald a brighter outlook for crypto, crafting it as a cherished store of value amidst the gentle easing of monetary policy.

As crypto traders navigate this realm, the core CPI (excluding the tumultuous duo of food and energy) shall draw their gaze, wielding the power to sway the Fed’s decisions.

With Bitcoin’s recent faltering performance struggling beneath the $75,000 line, this pivotal data may dictate the digital revolution’s next course of flight. Indeed, volatility beckons like a tempter, compelling participants to brace themselves for the market’s whims, freshly reminded of the FOMC minutes’ lingering shadows.

US PPI

On Friday, the Producer Price Index (PPI) shall take center stage, tracking inflation in the realm of wholesale trade. It promises to unravel the tale of production costs—oh, what secrets may it hold for crypto market denizens!

A rise in PPI signals increasing input costs, impacting the very lifeblood of crypto mining, which threatens miners’ profitability while constricting Bitcoin’s supply growth like a tightening noose.

Should March’s PPI ascend significantly beyond the modest 3.3% year-over-year, it might foreshadow inflation beginning to brew in earnest, exerting pressure on the Fed to act, which in turn could weigh down crypto prices amid tightening liquidity. Oh, what a delightful dance of financial intrigue!

Conversely, a gentler PPI may soothe inflationary fears, fanning the flames of a bullish crypto outlook—especially when paired with comfort-laden signals from the Fed on Wednesday.

Wise investors ought to heed PPI’s prophetic status as a leading indicator for CPI. A startling contradiction between PPI and the upcoming CPI may bewilder markets, cultivating turmoil and unpredictability.

“A monumental week looms, replete with FOMC minutes, CPI, and PPI—an arena for epic battles over rate cut bets,” interjected the analytical minds at Deribit.

With Bitcoin’s fortunes intricately tied to dollar strength, astute participants shall pay heed to PPI’s revelations regarding Fed expectations. A stable reading may engender calm, but unexpected surprises could send sentiments reeling like a ship in a tempest.

Consumer Sentiment

Ah! The University of Michigan’s Consumer Sentiment Index, to be unveiled on Friday, reflects the very heartbeat of the populace’s optimistic or despondent state of mind. A high reading may conjure widespread optimism, perhaps inciting a flurry of spending and risk-taking, thereby lifting Bitcoin as investors seek treasures among growth assets.

However, should this index falter below expectations, hovering around 54.5, it could herald anxious whispers of inflation weighing heavy upon the populace’s heart, a revelation that may duty-bound investors toward the sanctuary of safety, consequently pressing the crypto giants down into the murky depths.

This index oftentimes embodies inflation expectations so vividly, that Bitcoin’s narrative as a hedge could flourish should consumer apprehension of rising prices burgeon.

Thus, these events collectively shape the current sentiments swirling around the crypto marketplace, weaving together the intricate threads of monetary policy, economic wellness, and the hopes and fears that govern investor psychology.

Participants must remain agile, blending their observations of data with the caprices of the market to establish strategies informed by both logic and whimsy, all while executing their own research with enthusiastic diligence.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Best Arena 9 Decks in Clast Royale

- World Eternal Online promo codes and how to use them (September 2025)

- Country star who vanished from the spotlight 25 years ago resurfaces with viral Jessie James Decker duet

- ‘SNL’ host Finn Wolfhard has a ‘Stranger Things’ reunion and spoofs ‘Heated Rivalry’

- JJK’s Worst Character Already Created 2026’s Most Viral Anime Moment, & McDonald’s Is Cashing In

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- Kingdoms of Desire turns the Three Kingdoms era into an idle RPG power fantasy, now globally available

- M7 Pass Event Guide: All you need to know

2025-04-07 14:58