Ah, the illustrious President Trump, a maestro of the marketplace, is set to unfurl his grandiose new round of reciprocal tariffs on April 2nd—an apparent ode to fiscal liberation, or perhaps just another day in his mercurial ballet of bombast.

In his latest theatrical venture, Trump, with the flair of a showman, announces this momentous occasion as “Liberation Day” for the beleaguered American economy—a title bursting with a curious blend of bravado and naïveté, wouldn’t you agree? 🎭

The previous escapades with tariffs had previously caused ripples in the crypto pool, leading to panicked liquidations, or as we might jest, the swimming club’s unfortunate slip ‘n slide. Thus, the forthcoming April 2nd gambit may well ripple through the digital currency waters once more.

Behold the Unveiling of Trump’s Tariff Dramaturgy

It appears our unpredictable playwright may delay some of his bombastic tariffs—those targeted at sectors he labels as dangerously overripe for plundering, such as autos, semiconductors, and pharmaceuticals. What a plot twist! 🎢

Instead of a cacophony of indiscriminate taxation, our economic bard may choose to sing solely to countries boasting the grandest trade surpluses—those infamous 10-15, a motley collection that some have whimsically dubbed the “Dirty 15.” Will they wash their hands of this affair? Only time shall tell! 🧼

But, delightfully, the script isn’t set in stone just yet. Flexibility is Trump’s true middle name, following the method in which he often rewrites political history.

“I may bestow upon a plethora of nations what one might call breaks, reciprocal brakes if you will, perhaps even an unusually tenderhearted touch. You see, dear compatriots, we’ve lavished niceties on countless lands for an eternity. I proclaim April 2nd is Liberation Day!” he proudly declared—oh, the poetic irony! 🎉

Should he choose to temper the iron fist of tariffs, the burden on both the stock and crypto markets might ease, at least momentarily. A little breathing room never hurt anyone, right?

As we’ve witnessed time and again, when tariffs are the fiery harbingers of doom, markets tend to plummet in despair. Conversely, when the tariffs wear a gentler guise—or perhaps take a cheeky detour—prices often stabilize or even blossom like spring flowers after a refreshing rain.

Pondering the Crypto Future Amid Tariff Tango

The impending April 2nd proclamation could tango with the crypto market in several intriguing ways, hinging delicately on the aggressiveness or moderation of the announced policy. Let’s embark on this speculative promenade, shall we?

In the Event of Aggressive Tariffs (High Duties, a Shakespearean Tragedy)

- Risk sentiment plummets: Our fragile equity and bond markets might react akin to royalty faced with a usurper’s blade. This gloom, like an unwanted ghost, may haunt crypto, which remains an acquainted parlor in the risk-on mansion.

- Bitcoin and Ethereum might ebb away, akin to a summer breeze fading into autumn’s chill as traders fortify against the encroaching specter of dwindling global growth and inflated trepidation.

- A hasty capital exodus into the comforting embrace of USD or mere cash could precipitate short-term outflows from speculative realms such as the whimsical world of altcoins.

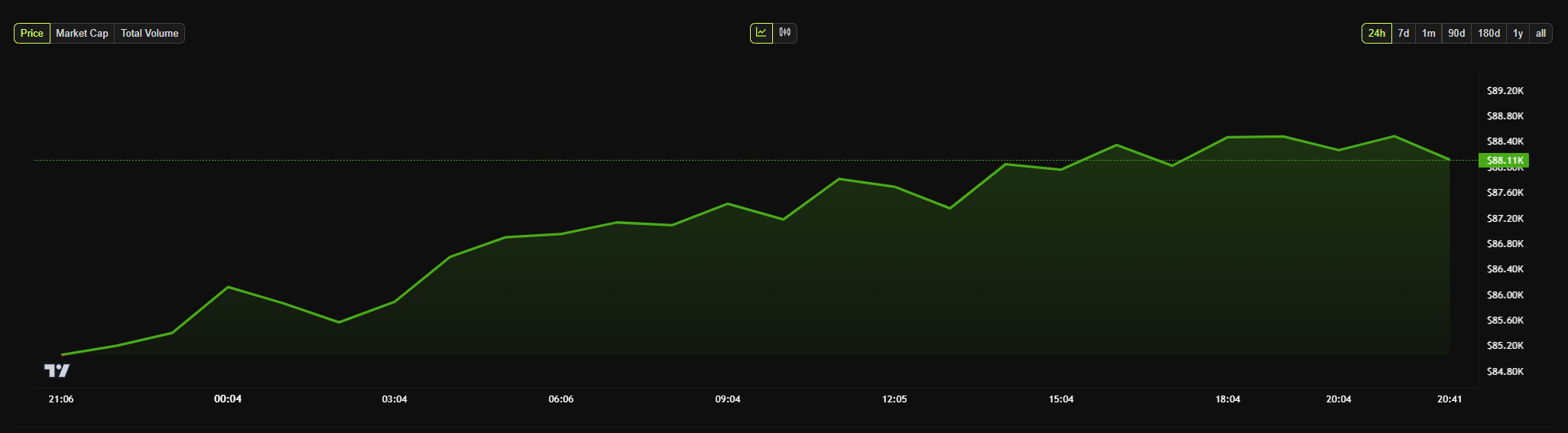

Take heed, dear reader! When Trump affirmed his steep tariffs in a past episode, Bitcoin tumbles did ensue, descending below $90,000 amid palpable market anxieties. A déjà vu may very well materialize!

In the Event of Narrowed Tariffs (Delays That Could Bring Elation)

- A likely market relief rally: Should Trump’s minstrels declare a reprieve on auto/chip/pharma tariffs, focusing solely on a few select nations burdened with heavy trade barriers, one might witness investor anxiety dissipate like morning mist.

- This, perchance, would ignite a temporary resurgence in crypto prices, especially if gallant equity markets follow suit like a well-disciplined corps de ballet.

- Clarity promotes tranquility: If uncertainty wanes, the markets—including the rebellious seekercamp of crypto—tend to offer a bountiful reward for such elegance.

Cast your mind back, dear audience, to when Trump playfully hinted at flexibilities; Bitcoin, in gleeful response, fearlessly rebounded to the enchanting heights of $88,000 once more. One could reasonably surmise that a carefully curated tariff approach might summon forth a similar resurgence.

Alas, the crypto realm has become a highly sensitive organism, utterly enthralled by the broader economic signals. Tariffs act as harbingers of fear, preaching visions of slowed global trade and ominous inflation—a delightful cocktail for our risk-averse investors. And yet, while our digital currencies remain unshackled from direct trade flows, they are inextricably woven with the larger tapestry of liquidity and investor sentiment. 🥂

Read More

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Best Arena 9 Decks in Clast Royale

- Clash Royale Witch Evolution best decks guide

- Clash Royale Best Arena 14 Decks

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Decoding Judicial Reasoning: A New Dataset for Studying Legal Formalism

2025-03-24 23:52