In the quiet depths of the modern marketplace, where fortunes rise and fall like the waves upon a restless sea, there lies a creature known as Bitcoin. Once a revolutionary spark in the minds of men, now it ambles along the horizon, teetering between the precipice of ascension and the abyss of despair. And yet, despite the ominous signs—those dark clouds of negative momentum—there whispers a strange promise: that it shall soon ascend again.

Lo, a herald from the land of Swissblock has declared that this digital titan, despite the heavy cloak of negativity, prepares to burst forth like a knight in shining armor to take the heights once more. They say that Bitcoin merely must flip its course, turn its back on despair, and rally—just a flick of the mirror, a shift in wind, and the altcoins will dance in eager anticipation, leaping upward in joyful rebellion.

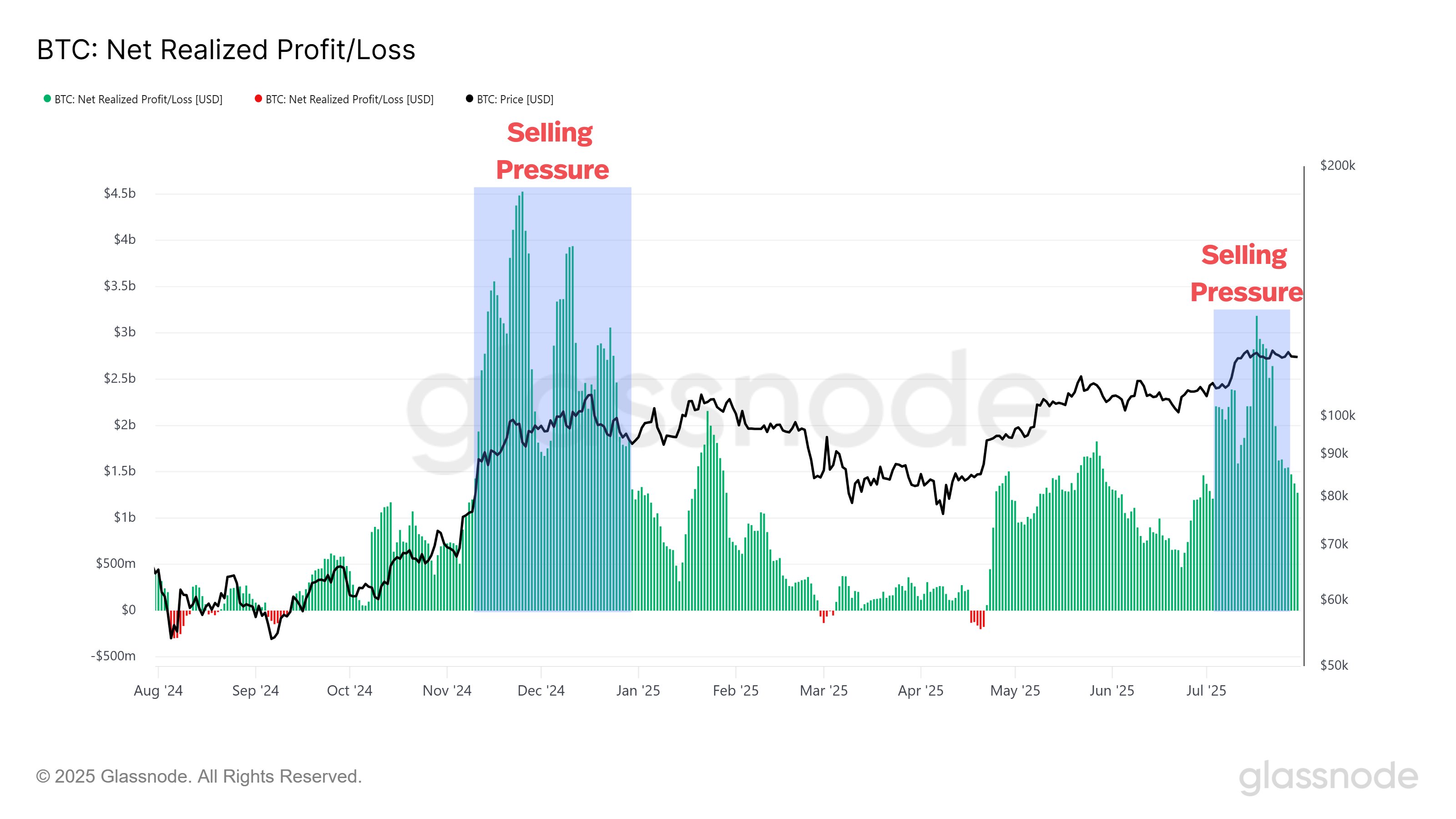

“Profit-taking is fading, and selling pressure is being absorbed,” they declare, as if whispering secrets to the faithful. “Bitcoin’s hope of breakout is real—if only it can ignite the flame of momentum. While it drags sideways, analysts watch for the moment it flips—after which Ethereum and those lesser coins will likely explode with the enthusiasm of a child on Christmas morning.”

Given the grand tale of market cycles, Swissblock insists that our noble crypto champion was poised to break free before the ambitions were thwarted by the greed of those greedy enough to take profits. The moment of triumph seemed near, but alas, it was dashed—momentum failed, stalling because investors, like bored monarchs, sought to pocket their gains.

“What’s the tale this time? Momentum has failed to ignite. Bitcoin tried, oh yes, but the rally hit a wall above $118,000—only to stumble backward, turning negative once more,” they lament. “Profits are being taken, but not as fiercely as during the storm of late 2024. July saw many a greedy hand clutching realized gains, shading the rally into a cautious lull. It’s cooling, not capitulating; a pause, a breath before the next leap.”

Yet, amidst this chaos, the wise at Swissblock observe that the audience still longs for the digital treasure, with nearly all the holders basking in modest green—2% of the supply not included. The paradox—so tempting—is that these profits, all tendered and green, beckon the sellers as if they were Sirens luring sailors to wreck.

“Ninety-six percent of Bitcoin’s supply is in profit,” they say with a wink. “A double-edged sword, indeed! The stalwart holders stand firm, but the allure of unrealized gains tempts many to unload, like a dog chasing its tail. Until demand rekindles, every bounce might just be a supply signpost. The trend holds—yet the rhythm needs a reset.”

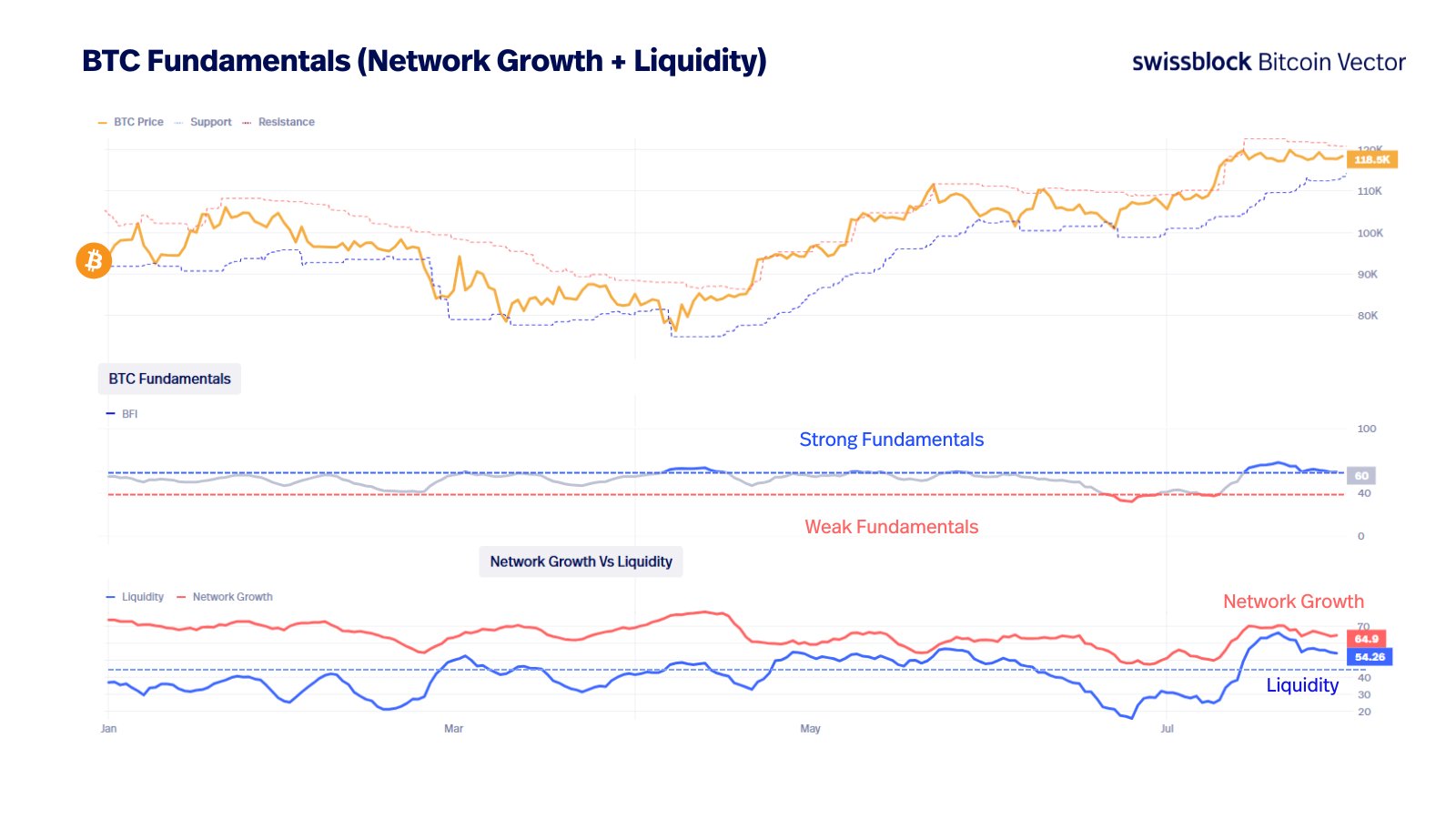

As the wise men conclude, the fundamentals paint a picture of stability—healthy, even (or so they claim)—like an old oak whose branches sway gently in the wind. Their verdict: Bitcoin must dance a slow waltz of sideways motion, gathering strength for the inevitable, perhaps triumphant, leap.

“The Bitcoin Fundamentals Index stands at a neutral 60, the network growth slows as if contemplating whether to grow or die, liquidity recovers like a patient recovering from a fever. We are in a period of gentle consolidation—waiting for the moment of conviction to strike.”

And so, dear reader, while Bitcoin today prances around the $114,747 mark—a modest 3% fall in this day’s parade—it continues its silent, unpredictable journey. Perhaps soon, it will burst forth once more, or perhaps it will simply chuckle at us all. The only certainty is that this story, as old as time, remains unwritten; and the players are ever hopeful, ever wary, and always just a little amused.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-08-01 23:12