What to know:

By Francisco Rodrigues (All times ET unless indicated otherwise)

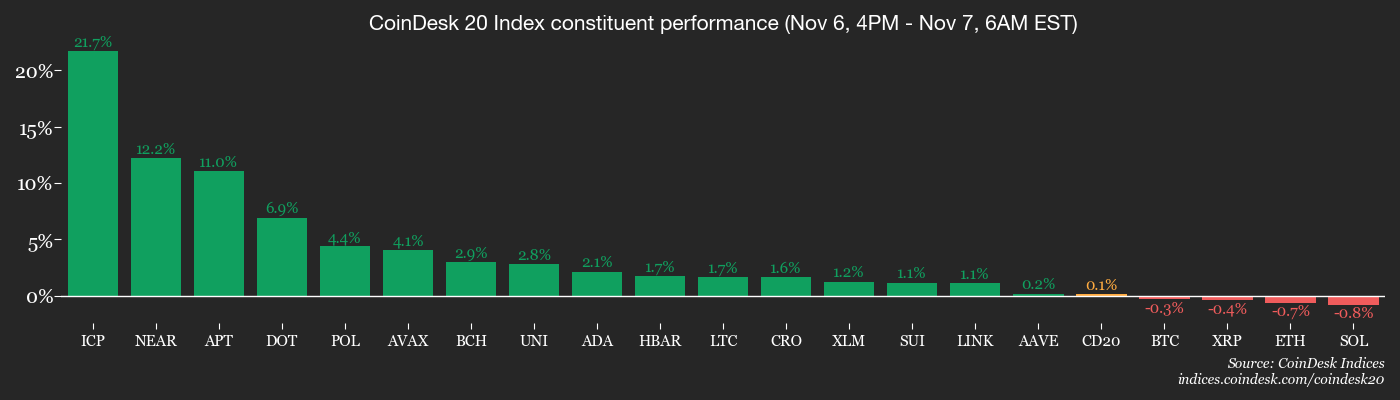

Bitcoin, that most mercurial of digital monarchs, has taken a tumble in the last 24 hours, with the CoinDesk 20 (CD20) index retreating 2.17%, caught in the whirlwind of global market chaos. One might say it’s as if the crypto crowd decided to play musical chairs with the economy’s fate.

The broader retreat began with a sell-off in tech-heavy equity indices like the Nasdaq 100, which is down 3.4% this week. According to a report from Citi, bitcoin’s drop below its 55-day moving average is often an early warning sign that risk appetite in equity markets is starting to fade. A rather dramatic curtain call for optimism, wouldn’t you say?

Historically, when bitcoin holds above that threshold, tech stocks tend to perform better, Citi said. The recent crypto drop is largely due to tighter liquidity conditions. A veritable game of musical bank reserves, it seems.

The U.S. Treasury’s recent cash rebuild and a drop in bank reserves, estimated around $500 billion since July, have made risk assets less attractive. One must wonder if the Treasury is hosting a tea party for the cautious.

While Treasury balances are nearing a point where tightening could pause, according to the report, the market hasn’t yet seen meaningful signs of a turnaround. A glimmer of hope, perhaps, but don’t hold your breath!

Meanwhile, AI-related stocks slumped as investors question evaluations and aggressive spending on data centers. That skepticism has spilled into crypto, weighing on the bitcoin price. A most uninviting ball for the digital elite.

Jasper de Maere, an OTC strategist at Wintermute, said bitcoin options positioning remains concentrated between $102,000 and $105,000, with limited upside unless volatility picks up. A tightrope walk for the bold, perhaps?

Ether options flows are anchored in the $3,000-$3,400 range, with traders using options strategies that favor protection rather than bullish bets. Stay alert! Or not-proceed with caution and a stiff upper lip.

What to Watch

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”.

- Crypto

- Nothing scheduled. A most disappointing affair.

- Macro

- Nov. 7, 7 a.m.: Federal Reserve Vice Chair Philip N. Jefferson is giving a speech on “AI and the Economy.” Watch live. A riveting tale of algorithms and coffee breaks.

- Nov. 7, 8 a.m.: Brazil Sept. PPI YoY (Prev. 0.48%), MoM (Prev. -0.2%).

- Nov. 7, 8 a.m.: Mexico Oct. inflation rate. Headline YoY Est. 3.56%, MoM Est. 0.36%. Core YoY Est. 4.27%, MoM Est. 0.28%.

- Nov. 7, 8:30 a.m.: Canada Oct. Unemployment Rate Est. 7.1%.

- Nov. 7, 11 a.m.: Michigan Consumer Sentiment Nov. (Preliminary) Est. 53.2.

- Nov. 7, 3 p.m.: Federal Reserve Governor Stephen I. Miran is delivering a speech on “Stablecoins and Monetary Policy.” Watch live. A masterclass in jargon.

- Earnings (Estimates based on FactSet data)

- Nothing scheduled. A most splendid void.

Token Events

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”.

Conferences

For a more comprehensive list of events this week, see CoinDesk’s “Crypto Week Ahead”.

- Day 5 of 5: Hong Kong FinTech Week

Market Movements

- BTC is down 0.16% from 4 p.m. ET Thursday at $100,913.00 (24hrs: -2.64%)

- ETH is down 0.73% at $3,300.94 (24hrs: -3.71%)

- CoinDesk 20 is unchanged at 3,197.23 (24hrs: -2.74%)

- Ether CESR Composite Staking Rate is down 12 bps at 2.94%

- BTC funding rate is at 0.0055% (6.0148% annualized) on Binance

- DXY is unchanged at 99.76

- Gold futures are up 0.57% at $4,013.70

- Silver futures are up 1.44% at $48.64

- Nikkei 225 closed down 1.19% at 50,276.37

- Hang Seng closed down 0.92% at 26,241.83

- FTSE is down 0.54% at 9,682.80

- Euro Stoxx 50 is down 0.49% at 5,583.84

- DJIA closed on Thursday down 0.84% at 46,912.30

- S&P 500 closed down 1.12% at 6,720.32

- Nasdaq Composite closed down 1.9% at 23,053.99

- S&P/TSX Composite closed down 0.78% at 29,868.59

- S&P 40 Latin America closed down 0.15% at 3,050.45

- U.S. 10-Year Treasury rate is up 1.3 bps at 4.106%

- E-mini S&P 500 futures are down 0.42% at 6,719.00

- E-mini Nasdaq-100 futures are down 0.56% at 25,102.00

- E-mini Dow Jones Industrial Average Index are down 0.33% at 46,874.00

Bitcoin Stats

- BTC Dominance: 60.45% (-0.15%)

- Ether to bitcoin ratio: 0.03233 (-1.13%)

- Hashrate (seven-day moving average): 1,091 EH/s

- Hashprice (spot): $40.64

- Total Fees: 3.33 BTC / $340,917

- CME Futures Open Interest: 135,765 BTC

- BTC priced in gold: 23.7 oz

- BTC vs gold market cap: 6.69%

Technical Analysis

- The Altcoin Market Cap (Excluding Top 10) / BTC Ratio is testing weekly support (around $0.113 – $0.116). A most precarious tightrope.

- If bitcoin confirms a weekly close below the critical $107,000 support, as expected, this alt/BTC support level is also likely to be broken in the short term, signaling a flow back to BTC and more pain for the altcoin market. A dance of despair, perhaps?

Crypto Equities

- Coinbase Global (COIN): closed on Thursday at $295.22 (-7.54%), -0.6% at $297

- Circle Internet (CRCL): closed at $100.01 (-11.52%), +0.69% at $100.70

- Galaxy Digital (GLXY): closed at $30.38 (-3.37%), +0.39% at $30.50

- Bullish (BLSH): closed at $44.59 (-7.72%), -0.31% at $44.45

- MARA Holdings (MARA): closed at $15.96 (-6.83%), -0.5% at $15.88

- Riot Platforms (RIOT): closed at $17.34 (-8.59%), -0.58% at $17.24

- Core Scientific (CORZ): closed at $20.59 (-5.55%)

- CleanSpark (CLSK): closed at $15.4 (-7.12%), +0.13% at $15.42

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $56.55 (-9.05%), +0.8% at $57

- Exodus Movement (EXOD): closed at $21.45 (-7.7%), +9.14% at $23.41

Crypto Treasury Companies

- Strategy (MSTR): closed at $237.2 (-6.98%), -0.54% at $235.91

- Semler Scientific (SMLR): closed at $27.42 (-4.59%)

- SharpLink Gaming (SBET): closed at $11.17 (-7.91%), -0.18% at $11.15

- Upexi (UPXI): closed at $3.31 (-9.93%), +2.42% at $3.39

- Lite Strategy (LITS): closed at $1.84 (-0.54%)

ETF Flows

Spot BTC ETFs

- Daily net flows: $239.9 million

- Cumulative net flows: $60.5 billion

- Total BTC holdings ~1.34 million

Spot ETH ETFs

- Daily net flows: $12.5 million

- Cumulative net flows: $13.93 billion

- Total ETH holdings ~6.57 million

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Best Hero Card Decks in Clash Royale

- Clash Royale Furnace Evolution best decks guide

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- Clash Royale Witch Evolution best decks guide

2025-11-07 15:43